Taxes, Fiscal Policy, and Inflation

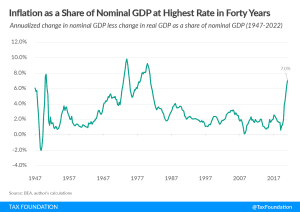

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

While hoping for inflation’s continued decline, policymakers should finish the job and index the tax code to prepare for future bouts of high inflation and as a contingency in case it takes longer to defeat elevated inflation than expected.

4 min read

Inflation is often called a hidden tax, but in many states it yields a far more literal tax increase as tax brackets fail to adjust for changes in consumer purchasing power.

5 min read

By shifting to a flat income tax, Georgia has already made an important commitment to tax competitiveness. Although the state’s top rate threshold is already very low, a true single-rate income tax will help protect taxpayers from inflation-related tax increases and provide a buffer against rising tax rates in the future. To combine responsible rate reductions with these benefits, Georgia should create tax triggers that empower the state to keep pace with its competition.

3 min read

In a coordinated effort, lawmakers in seven states that collectively house about 60 percent of the nation’s wealth—California, Connecticut, Hawaii, Illinois, Maryland, New York, and Washington—are introducing wealth tax legislation on Thursday.

7 min read

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

History is clear. Lowering budget deficits via spending restraint frees resources for additional private output and jobs. Lowering them by raising taxes on business investment and labor services makes it harder to dis-inflate without a recession.

7 min read

French President Macron is coming to Washington, D.C., this week to ask President Biden the question on the minds of European leaders: “Why did you do this to us?”

6 min read

In times of high inflation, states should consider adopting permanent full expensing because it boosts long-run productivity, economic output, and wages.

7 min read

Two weeks after the 2022 midterm elections, it’s becoming clearer where tax policy may be headed for the rest of the year and into 2023. In the short term, Congress must deal with tax extenders and expiring business tax provisions that may undermine the economy.

5 min read

Policymakers face a difficult balancing act this year in what is likely to be an unusual tax extenders season.

6 min read

As we near this year’s “lame duck” session of Congress, there has been renewed interest in reforming the child tax credit as part of a tax deal. Our new analysis highlights the trade-offs that policymakers will face

5 min read

We find that the dynamic cost of permanent bonus depreciation rises by about 7 percent under 4 percent inflation, but the economic benefit, measured by the size of the economy, rises by about 25 percent.

4 min read

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

4 min read

California is no stranger to high taxes, and the state has enough going for it that its economy can withstand higher tax burdens than would be viable in other parts of the country. But there’s always a tipping point.

6 min read

The Social Security Administration (SSA) announced the cost-of-living adjustment for Social Security payments based on inflation over the previous year. This has brought renewed attention to how the tax code treats Social Security benefits, which can be a confusing subject for taxpayers.

4 min read

Federal tax collections are approaching the highest levels in U.S. history set during World War II and again during the dot-com bubble in 2000. Meanwhile, federal spending in FY 2022 was over 25 percent of GDP—a level only exceeded during the height of the pandemic in 2020 and 2021, and during World War II.

4 min read

Repealing LIFO, as some policymakers have proposed, is not sound policy. LIFO helps firms avoid the penalty on inventory investment created by FIFO and is neither a targeted tax break nor a subsidy (as some opponents suggest).

17 min read

A new CBO report reveals that lower- and middle-income households are disproportionately shouldering the burden of this current inflation wave. And historical analysis suggests there is much more to come.

5 min read

Some tax ballot initiatives will be straightforward, some will be complex, and—let’s be honest—some will be a drafting nightmare.

5 min read

Ernest S. Christian, Jr., (1937-2022) was one of the tax policy community’s most distinguished and influential experts, showing us how effective sound tax policy can be. He passed away on September 13th, leaving behind a legacy of tax reform.

4 min read

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read