Taxes, Fiscal Policy, and Inflation

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

While hoping for inflation’s continued decline, policymakers should finish the job and index the tax code to prepare for future bouts of high inflation and as a contingency in case it takes longer to defeat elevated inflation than expected.

4 min read

Inflation is often called a hidden tax, but in many states it yields a far more literal tax increase as tax brackets fail to adjust for changes in consumer purchasing power.

5 min read

At least 32 notable tax policy changes recently took effect across 18 states, including alterations to income taxes, payroll taxes, sales and use taxes, property taxes, and excise taxes. See if your state tax code changed.

16 min read

What does the tax reform package do well? What does it do poorly? How would it affect me?

4 min read

Lawmakers should focus on simplifying the federal tax code, creating stability, and broadly improving economic incentives. There are incremental steps that can be made on the path to fundamental tax reform.

By extending bonus depreciation and introducing neutral cost recovery, the RSC budget would significantly improve the treatment of investment leading to increased growth, expanded employment, and higher wages.

3 min read

The current tax treatment of R&D expenses is irrational, complicated, and counterproductive. Fortunately, fixing this problem is a bipartisan issue.

4 min read

To address the more challenging parts of the budget, especially the unsustainable growth in mandatory spending, lawmakers should follow up on this debt ceiling agreement with a focus on long-term fiscal sustainability.

6 min read

Making expensing permanent is especially important now, when the economy is threatened with a recession and inflation remains high.

7 min read

According to the International Monetary Fund (IMF), the U.S. federal government is among the most indebted governments in the world.

6 min read

By letting the corporate surtax expire, eliminating taxes on GILTI, and embracing full expensing, New Jersey would take important steps toward creating a more welcoming and competitive tax environment.

6 min read

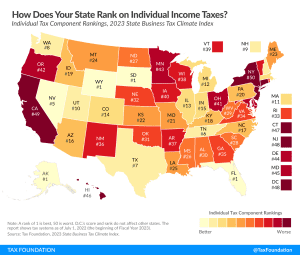

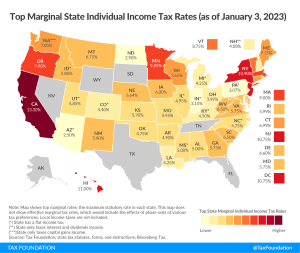

Individual income tax rates can influence location decision-making, especially in an era of enhanced mobility, where it is easier for individuals to move without jeopardizing their current job, or without limiting the scope of their search for a new one.

5 min read

Our recent policy conference brought together academics and political leaders to present research on some of the most pressing issues in global tax policy and to discuss solutions that can unlock genuine global growth.

9 min read

Michiganders will pay a lower individual income tax rate next year thanks to high general fund revenues, but these savings may be short-lived following an opinion released by the state’s attorney general.

7 min read

The Portuguese government has introduced plans to exempt “essential” food items from its value-added tax (VAT) in response to the recent inflation spike. While this may sound like a reasonable measure on the surface, it comes with numerous unintended consequences that compromise its effectiveness.

4 min read

To recover from the pandemic and put the global economy on a trajectory for growth, policymakers need to aim for more generous and permanent capital allowances. This will spur real investment and can also contribute to more environmentally friendly production across the globe.

33 min read

A recently enacted bill in Mississippi made the Magnolia State only the second state in the country to make full expensing permanent. The bill joins reductions to the individual income tax and capital stock tax rates, already in progress, as model, pro-growth reforms for the region.

5 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read

While hoping for inflation’s continued decline, policymakers should finish the job and index the tax code to prepare for future bouts of high inflation and as a contingency in case it takes longer to defeat elevated inflation than expected.

4 min read

Forty-three states adopted tax relief in 2021 or 2022—often in both years—and of those, 21 cut state income tax rates. It’s been a remarkable trend, driven by robust state revenues and an increasingly competitive tax environment.

4 min read

At the end of 2022, prices were 14.6 percent higher than they were two years prior. That’s the fastest inflation rate over any two calendar years since the stagflation era of the late 1970s. State policymakers are understandably interested in bringing any tools at their disposal to bear on the problem. And many of them are reaching for tax policy solutions.

7 min read