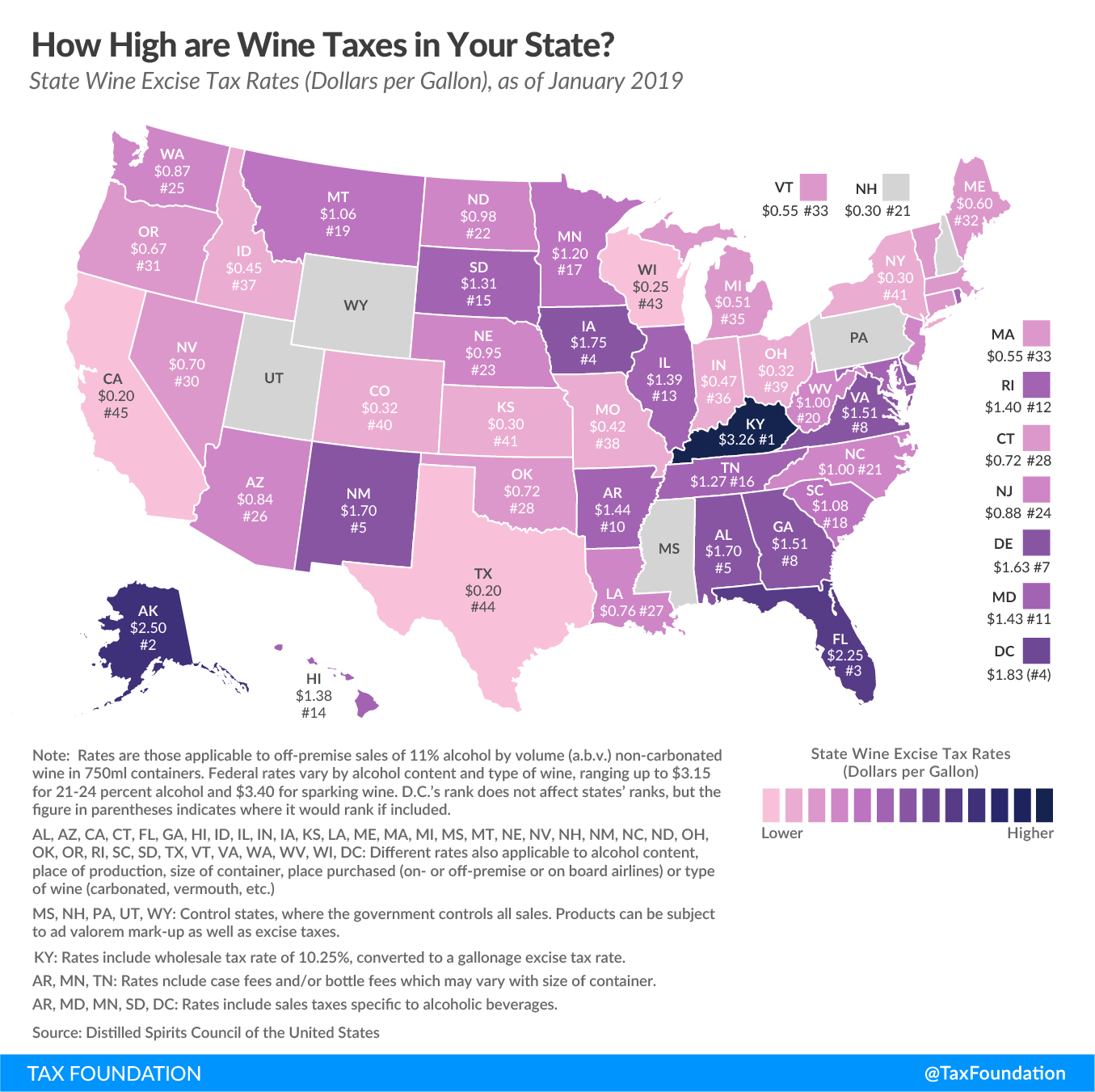

Whether you’re a self-appointed connoisseur or an occasional sipper of chardonnay, you may not have thought about the taxes that go into your wine purchase. But now you can quench your newly found thirst for excise tax info with this week’s map, which compares wine taxes among the 50 states, expressed in dollars per gallon.

States tend to taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. wine at a higher rate than beer but at a lower rate than distilled spirts due to wine’s mid-range alcohol content. You’ll find the highest wine excise taxes in Kentucky at $3.26 per gallon. This rate fell slightly from last year’s $3.47, thanks to a drop in the wholesale rate from 10.25% to 10% in June of 2018. However, the Bluegrass State has a long way to go before it drops below Alaska’s second-place spot of $2.50 per gallon. Those two states are followed by Florida ($2.25), Iowa ($1.75), and Alabama and New Mexico (tied at $1.70). On the other end of the spectrum, the lowest excise taxes can be found in California and Texas ($0.20), followed by Wisconsin ($0.25), and Kansas and New York ($0.30).

Most states levy per-gallon taxes on wine vendors for the privilege of producing, importing, possessing, or selling wine in their state, but states vary widely in their specific approaches.

A volume-based wine tax is the most common, but many states impose additional layers of taxes that vary based on wine type, container size, alcohol content, place of production, and place of purchase, among other factors. Arkansas and Tennessee, for example, levy case fees in addition to per-gallon taxes. Minnesota levies bottle fees that vary according to container size, taxing standard bottles at $0.01 per bottle and miniature bottles at a higher rate of $0.14 per bottle.

Even though states can levy taxes at the production, wholesale, or retail level, vendors ultimately pass along those taxes to consumers in the form of higher prices. On the other hand, four states and the District of Columbia levy sales taxes specific to alcoholic beverages that consumers pay directly.

While most states use a licensing system to regulate the sale of alcoholic beverages, other states–known as “control” states–impose a government monopoly on the wholesale or retail sale of beer, wine, spirits, or all alcoholic beverages. Wine “control” states include Mississippi, New Hampshire, Pennsylvania, Utah, and Wyoming.

How does your state compare?

Note: This is part of a map series in which we examine state excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. collections.