As the public grows more supportive of legalizing recreational marijuana, more and more states must figure out their approach toward taxing legal cannabis sales.

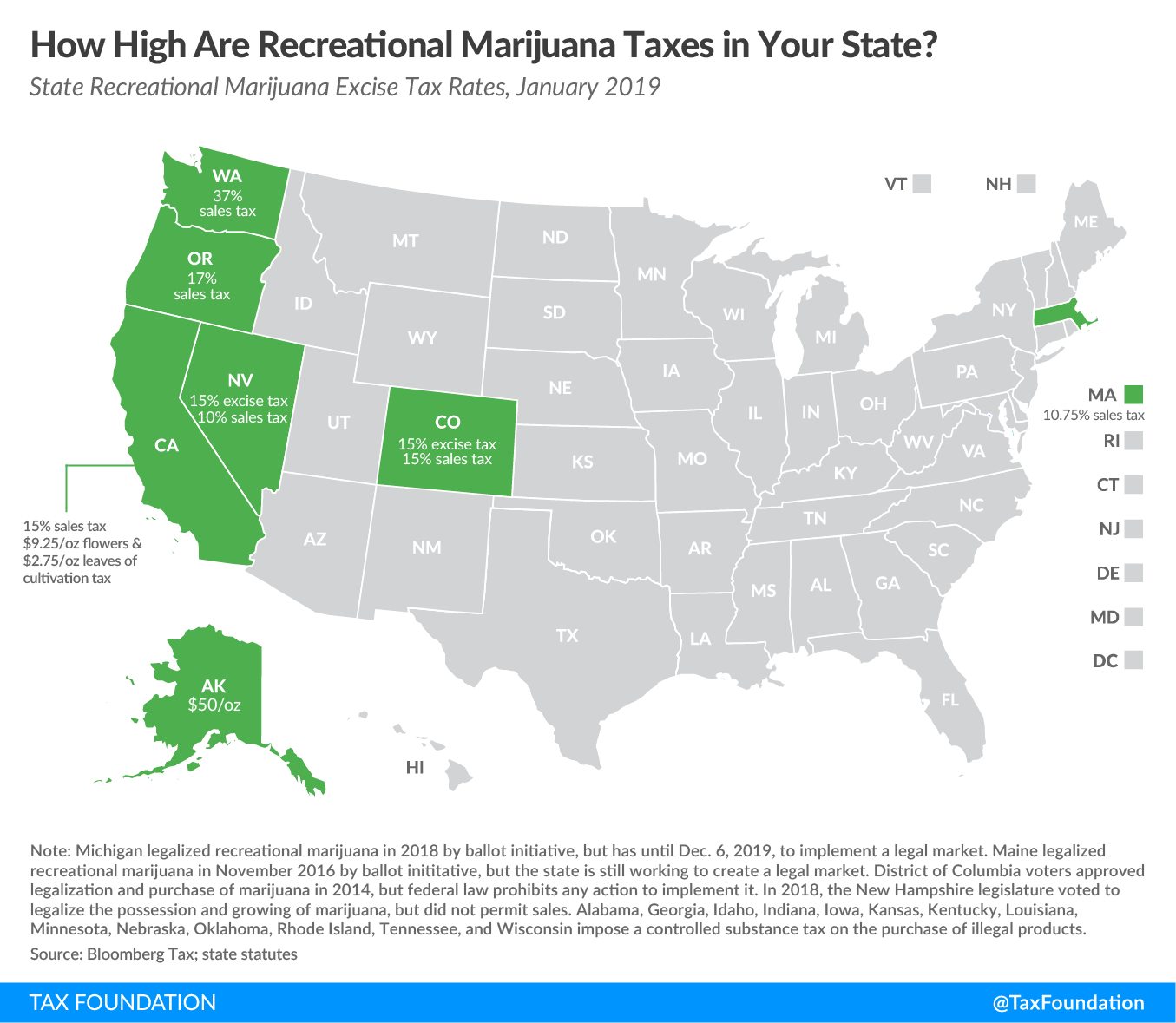

Ten states (Alaska, California, Colorado, Maine, Michigan, Massachusetts, Nevada, Oregon, Vermont, and Washington) and the District of Columbia have legalized the use and possession of recreational marijuana, but only eight of these jurisdictions have markets where the substance can be legally bought and sold. The map below highlights the states that have legal markets and levy taxes on recreational marijuana.

Of the states with legal markets, Alaska is the only one that does not impose some form of sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. on end-users. In each of the other states, marijuana purchasers are facing another kind of high: taxes on marijuana sales which far exceed the states’ general sales taxes.

- In Alaska, which has no state-level sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , marijuana growers pay a tax of $50 per ounce when selling the product to marijuana dispensaries or retailers. Even though customers absorb the cost of taxes paid in the form of higher prices, end-users do not pay a sales tax when purchasing marijuana.

- In California, cultivators pay a tax at a rate of $9.25 per ounce of marijuana flowers and $2.75 per ounce of leaves. In addition, retailers collect a 15 percent excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. from customers on the average market price of the product.

- Colorado imposes a 15 percent excise tax on the sale of marijuana from a cultivator to a retailer. In addition, the state levies a 15 percent sales tax (up from 10 percent in 2017) on retail sales to customers.

- Maine legalized recreational marijuana in 2016 by ballot initiative but has not yet established a legal market. The state created an Office of Marijuana Policy this year to oversee the legislative efforts and tracking and enforcement strategies. There is no official deadline for the creation of a state market, but the director of the office said the state was on track to roll it out this year.

- Massachusetts officials, concerned that the state’s previous ballot initiative-approved rate of 3.75 percent was too low, raised the excise tax rate to 10.75 percent in 2017.

- Michigan legalized recreational marijuana use with a ballot initiative effective December 2018. The initiative laid out a 10 percent excise tax, but the state has until December 2019 to implement a legal market.

- Nevada imposes an excise tax on the sale of marijuana by a cultivator to a distributor. This rate is set at 15 percent of the Fair Market Value as determined by the Nevada Department of Taxation. In 2017, Nevada created a 10 percent consumer sales tax.

- Oregon, which does not have a general sales tax, levies a 17 percent sales tax on marijuana.

- Washington state levies a 37 percent sales tax on recreational marijuana.

Vermont legalized the possession of marijuana in 2018 but did not create a legal market. D.C. also allows for possessing and growing of marijuana but does not allow for sales in a legal market.

Note: This is part of a map series in which we examine state excise tax collections.