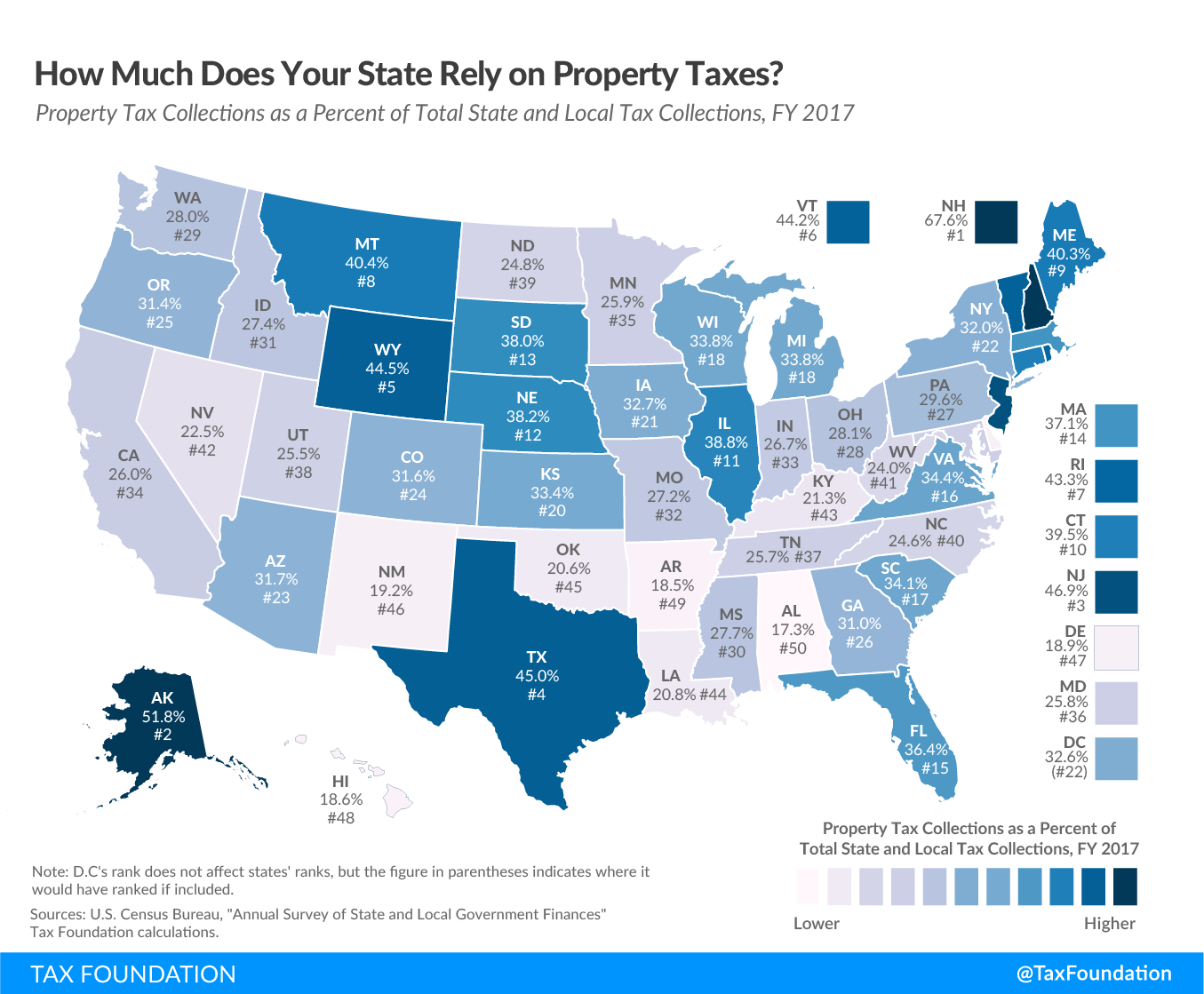

Property taxes represent a major source of revenue for states and the largest source of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue for localities. In fiscal year 2017, the most recent data available, property taxes were such a significant source of local revenue that they accounted for 72.1 percent of local tax collections nationwide and 31.9 percent of total U.S. state and local tax collections, a greater portion than any other source of tax revenue. In that same year, 26 states and the District of Columbia collected the greatest share of their combined state and local tax revenue from property taxes (see Table 8 in our Facts & Figures), with property taxes the largest share of local revenue in all but two states (Arkansas and Louisiana).

A variety of local political subdivisions—counties, cities, school boards, fire departments, utility commissions, to name a few—have the authority to set property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. rates. While most tax jurisdictions levy property taxes based on the fair market value of a property, some base it on income potential (in the case of commercial properties) or other factors. In addition, some states place limits on how much property tax rates may increase per year or impose rate adjustments to achieve uniformity throughout the state.

New Hampshire and Alaska relied most heavily on property taxes, which respectively accounted for 67.6 percent and 51.8 percent of their tax collections in FY 2017. Alabama and Arkansas landed at the other end of the spectrum, raising the smallest portion of their state and local tax revenue through property taxes: 17.3 percent and 18.5 percent, respectively.

It is important to note that a heavy reliance on property taxes does not necessarily indicate a high overall tax burden in any given state. For example, while Alaska is among the states that rely most heavily on property taxes, it is also among the states with the lowest state and local tax collections per capita (see Facts & Figures Table 6).

At the same time, states and localities that generate less revenue through property taxes tend to depend more on general sales taxes, individual income taxes, corporate income taxes, excise taxes, and others, and state governments may assume a greater responsibility for funding local governments or local schools.

Note: This is part of a map series in which we examine the primary sources of state and local tax collections.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe