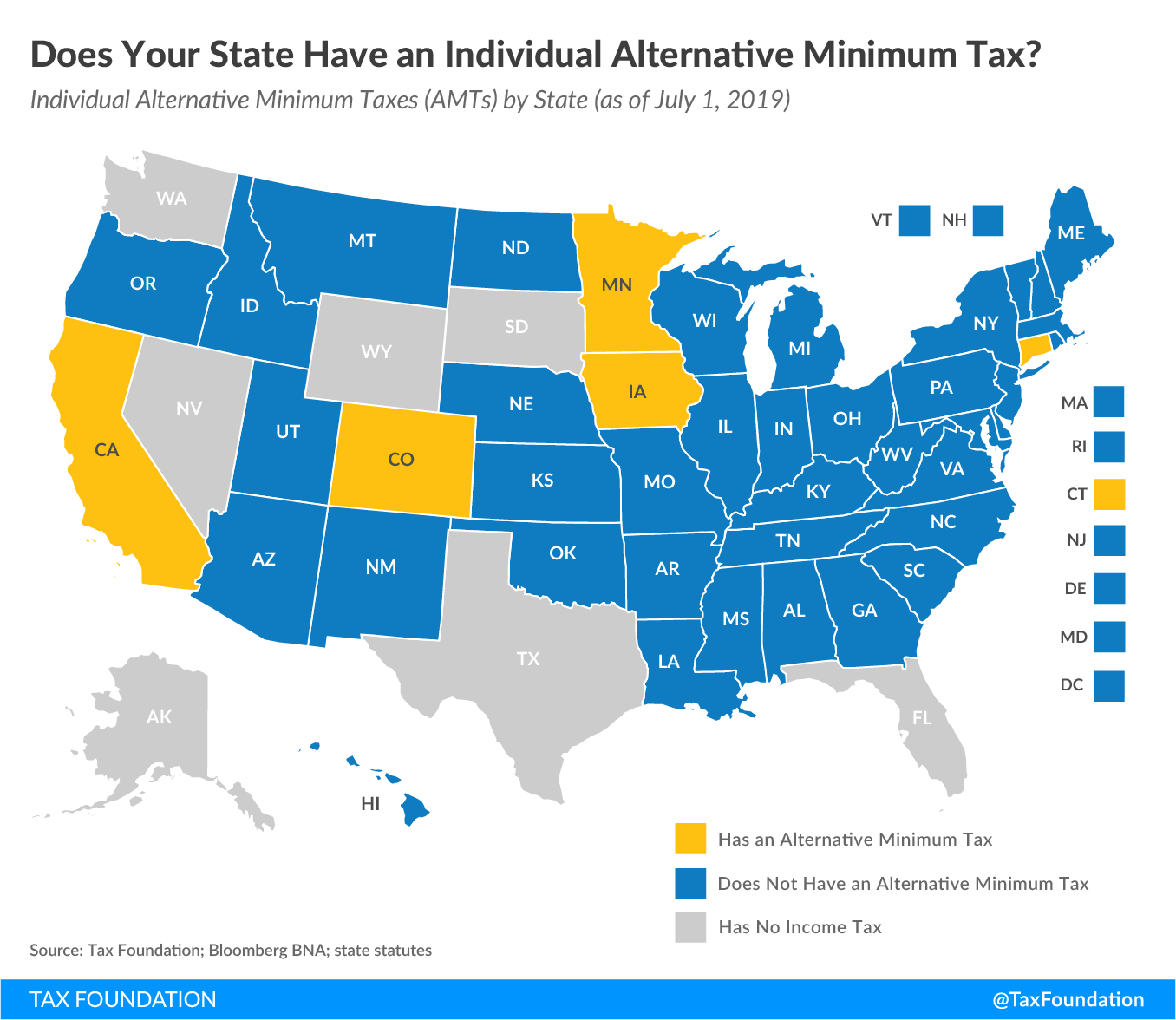

This week’s map shows the five states that have an Alternative Minimum Tax (AMT) in their individual income tax codes: California, Colorado, Connecticut, Iowa, and Minnesota. Under an individual AMT, many taxpayers are required to calculate their income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. liability under two different systems and pay the higher amount.

The federal AMT was created in 1963, after Congress discovered that 155 high-income taxpayers were eligible to claim so many deductions that they ended up with no federal income tax liability at all. The federal AMT disallows the standard deduction and adds back certain itemized deductions—including the state and local tax (SALT) deduction—thus recapturing income from taxpayers who would otherwise be eligible to claim those expenditures.

While the federal AMT was originally intended to be a narrow fix to a narrow problem, it was not indexed for inflation. As a result, it wasn’t long before many middle-income taxpayers found themselves having to calculate and pay an AMT. Several states followed suit by implementing their own AMTs. This meant some taxpayers had to calculate their tax liability four times: twice under the federal code and twice under their state’s code.

The Tax Cuts and Jobs Act increased the federal AMT’s exemption amounts and phaseout thresholds through 2025, meaning fewer taxpayers will be required to calculate and pay the federal AMT in forthcoming years. In states that conform to the federal provision or use it as the basis for their own calculation, fewer filers will be subject to the AMT—for now. (To the extent that states use old thresholds, filers will have to go through the process of calculating a state AMT even if no longer subject to a federal AMT.) Unless Congress chooses to extend it, the higher exemption amounts will sunset after 2025, a change that will also impact state tax codes.

The original goal of AMTs—to prevent deductions from eliminating income tax liability altogether—can be accomplished best by simplifying the existing tax structure, not by instating an alternative tax which adds complexity and lacks transparency and neutrality.

Share this article