As part of congressional negotiations this week over President Biden’s $1.9 trillion coronavirus relief package, the Senate Democrats’ compromise of faster phaseout rates to be eligible for checks will create high marginal tax rates on taxpayers over a narrow range of income. This change makes the direct payments more targeted to those in need but also creates higher marginal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates.

These higher marginal rates would encourage taxpayers to adjust their earnings in 2021 either by earning less or finding ways to reduce income subject to tax. Keeping the phaseout rates lower, as in the House bill, strikes a better balance between targeting those in need and preventing a spike in tax rates as one earns more income.

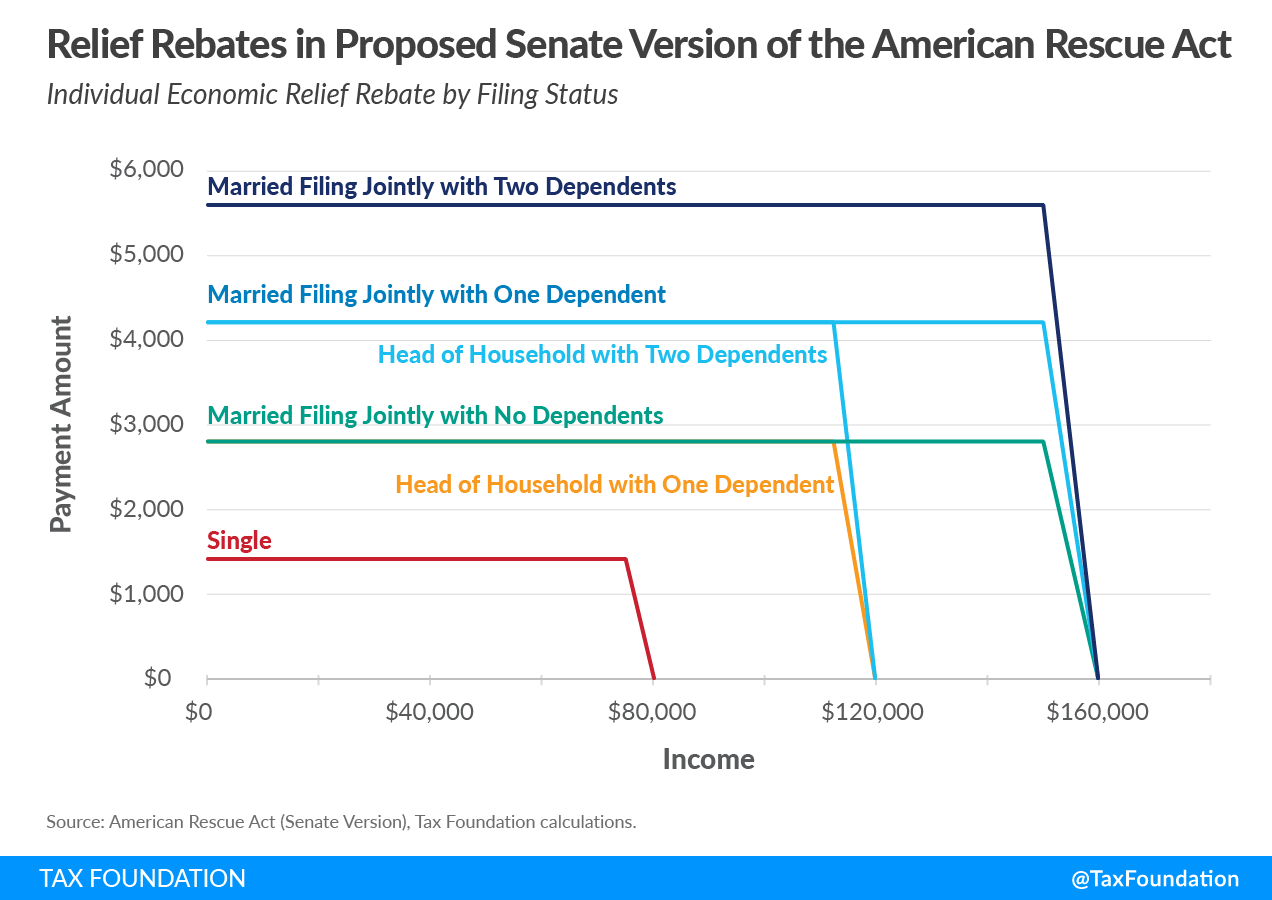

The latest design for the bill would reduce the number of higher earners receiving partial direct payments. The maximum adjusted gross income (AGI) to receive a relief check would be reduced from $100,000 to $80,000 for single filers, $200,000 to $160,000 for joint filers, and $125,000 to $120,000 for heads of households. So, for example, single taxpayers earning $76,000 would see their payment reduced by $280.

The direct payments phase out much more steeply than the two previous rounds of direct payments, resulting in high implicit marginal tax rates (see Chart 1).

Using the Tax Foundation General Equilibrium, we estimate the lower income thresholds would reduce the cost of the direct payments by about $17 billion. About 89 percent of filers would receive a rebate, compared to 93.3 percent of filers under the design the House passed last week (see Table 1). At least 6.5 million fewer filers would receive a payment under the Senate bill as compared to the original House design.

| Income level | Percent Change in After-Tax Income | Share of Filers with a Rebate | Average Rebate Amount |

|---|---|---|---|

| 0% to 20% | 24.70% | 100% | $2,172 |

| 20% to 40% | 10.81% | 100% | $2,537 |

| 40% to 60% | 6.41% | 100% | $2,431 |

| 60% to 80% | 4.21% | 99.5% | $2,611 |

| 80% to 90% | 1.97% | 74.5% | $1,792 |

| 90% to 95% | 0.40% | 25.0% | $509 |

| 95% to 99% | 0.01% | 1.6% | $17 |

| 99% to 100% | 0.00% | 0% | $0 |

| Total | 3.7% | 89.0% | $2,157 |

|

Source: Tax Foundation General Equilibrium Model, January 2021 |

|||

The other aspects of the direct payments considered by the Senate are identical to the House version. The maximum payment per adult and qualifying dependent is $1,400. Mixed-status families and adult dependents would be eligible for a payment. The income thresholds where the phaseout begins remain at $75,000 for single filers, $112,500 for head of household filers, and $150,000 for joint filers.

The last two direct payments made in the Coroanvirus Aid, Relief and Economic Security (CARES) Act and the $900 billion appropriations package passed in December used a 5 percent phaseout for all filers: for every $1,000 earned over the threshold, a filer received $50 less in a direct payment.

Under the new round of direct payments, the phaseout rate depends on filing status and number of dependents because a fixed maximum income threshold to receive any payment means the phaseout rates must vary. For example, a single filer with no dependents faces a phaseout rate of 28 percent between $75,000 and $80,000. However, a head of household filer with two dependents would face a 56 percent phaseout rate between $112,500 and $120,000. The head of household filer has a higher maximum payment than the single filer ($4,200 compared to $1,400) that must be reduced to $0 over a narrow range of income.

The rapid phaseouts under the Senate design would create an incentive to reduce one’s AGI in 2021 to claim an additional credit on the filer’s 2021 tax return if they are close to the phaseout thresholds. For example, a single filer with an AGI of $80,000 could reduce that by $5,000 by reducing hours worked or contributing $5,000 to a traditional IRA and receive an additional $1,400 credit on their 2021 tax return if they did not receive one in advance.

The phaseouts would combine with other marginal tax rates on earned income, producing marginal tax rates that may approach or exceed 100 percent. This would be a big incentive to reduce one’s earnings or engage in tax planning to avoid a very high marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. .

As the Senate debates the relief package and makes progress in the budget reconciliation process, policymakers should keep in mind the trade-off between targeted economic relief and increasing marginal tax rates in the tax code, which can distort incentives to earn income and induce taxpayers to creatively adjust their AGI to receive a payment in the next tax season.

Related Resources

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe