Breaking Down State and Local Aid under the SMART Act

The SMART Act, sponsored by Senators Bob Menendez and Bill Cassidy and Rep. Mikie Sherrill, would provide $500 billion in flexible funding to state and local governments.

6 min read

The SMART Act, sponsored by Senators Bob Menendez and Bill Cassidy and Rep. Mikie Sherrill, would provide $500 billion in flexible funding to state and local governments.

6 min read

As stated by Rep. Jack Kemp in 1985, “Neutral cost recovery is designed to provide the present value of investment expensing without some of its practical problems.”

5 min read

The Tax Foundation’s General Equilibrium Model suggests that allowing businesses to immediately deduct or “expense” their capital investments in the year in which they are purchased delivers the biggest bang for the buck in spurring economic growth and jobs compared to other tax policies.

7 min read

State recovery plans should lessen the burden on businesses by shifting from capital stock taxes and other taxes that are charged regardless of profitability. Louisiana does well to target its Corporation Franchise Tax, a burdensome tax that would target businesses that may already be struggling.

2 min read

Improving the tax treatment of structures is one of the most cost-effective tax policy changes available to lawmakers as they consider how to remove investment barriers in the tax code to hasten the economic recovery. Policymakers must weigh the trade-offs among long-run economic output goals, revenue constraints, and the existing stock of structures.

13 min read

The HEROES Act, the $3 trillion relief package proposed by House Democrats, is the first bid to provide additional phase 4 aid for businesses and individuals amid the coronavirus pandemic.

7 min read

Revenue shortfalls and deficits can be addressed best by considering when to consider the deficit as the primary priority and reevaluating how revenue can be raised most efficiently through sound tax policy principles.

5 min read

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay about 30 percent of their wages in taxes.

15 min read

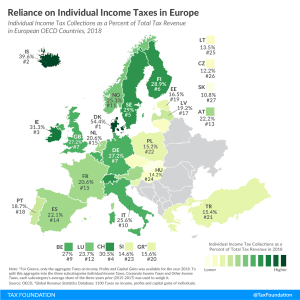

While the current crisis has caused consumption to drop dramatically, it is generally true that income taxes are more volatile than consumption taxes in an economic downturn and income taxes tend to be more harmful to economic growth than consumption taxes and property taxes.

3 min read