All Related Articles

Economic and Budgetary Impact of Extending Full Expensing to Structures

Full expensing is one of the most powerful pro-growth policies in terms of revenue forgone. Given that structures comprise a large share of the private capital stock, improving their tax treatment would end a large bias against investment in the tax code.

14 min read

Tax Trends at the Dawn of 2020

From remote sales tax collection to taxes on marijuana and vaping products, we recap the top state tax trends from 2019 and break down which ones you should watch for in 2020.

38 min read

Analysis Of 2020 Presidential Tax Plans

Tax policy has become one of the major issues of the 2020 presidential election. Our experts are continuing to provide leading research and analysis on the latest tax proposals. Explore our resources below to see where the 2020 presidential candidates stand on taxes.

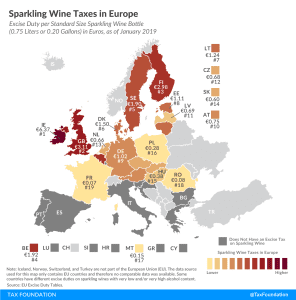

Sparkling Wine Taxes in Europe

1 min read

Virginia Governor Looks to Excise Taxes

The proposed budget reflects a growing trend as policymakers across the country look to excise taxes as long-term solutions to budget woes. While excise taxes can be a part of the revenue picture, they are not a sustainable revenue source due to their narrow base, which is easily affected by changes in consumer behavior or market conditions.

2 min read

State Tax Changes as of January 1, 2020

This year was a significant one for state tax policy, and the wide range of changes taking effect January 1, 2020, reflects the scope and intensity of that activity. With states continuing to grapple with issues like the taxation of international income and collections obligations for remote sellers and marketplace facilitators, the coming year is unlikely to be any quieter.

23 min read