All Related Articles

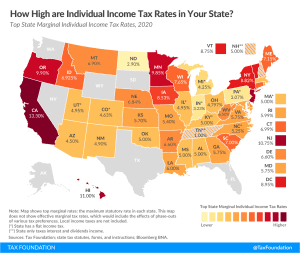

State Individual Income Tax Rates and Brackets, 2020

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

9 min read

How Controlled Foreign Corporation Rules Look Around the World: Spain

The CFC legislation in Spain is not as complicated as it is in some other countries, and it is aligned with the standards recommended by the OECD. The Spanish rules have evolved in a way that the rules are designed to comply with the EU principles not to interrupt the functioning of the Union and its single market.

4 min read

Profit Shifting: Evaluating the Evidence and Policies to Address It

The OECD has been working to assess the impact of their program of work, and it will be critical for this assessment to take into account impacts not only on revenues, but also on growth and investment.

7 min read

FAQ on Digital Services Taxes and the OECD’s BEPS Project

What is a digital services tax (DST)? What countries have announced, proposed, or implemented a DST? What are some of the criticisms of a DST? What are alternatives to a DST? What is the OECD BEPS project and what is its main objective? What is the main objective of OECD Pillar 1? What is the main objective of OECD Pillar 2?

8 min read