All Related Articles

Booker’s Plan to Eliminate Step-up in Basis and Expand the Estate Tax

Removing step-up in basis would encourage taxpayers to realize capital gains and it would plug a hole in the current income tax, while increasing federal revenue. Combined, however, with the estate tax, this would result in a significant tax burden on certain saving by requiring both the appreciation in and total value of transferred property to be taxed at death

2 min read

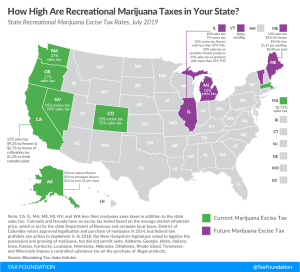

Marijuana Revenues Could Take a Hit

3 min read

Senator Sanders Proposes a Tax on “Extreme” Wealth

Bernie Sanders recently became the second major Democratic presidential candidate to propose a wealth tax.

2 min read

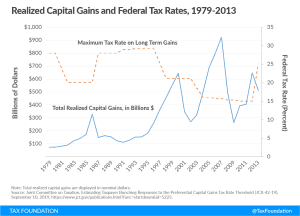

JCT Report Shows Capital Gains are Sensitive to Taxation

JCT’s report on capital gains elasticities reminds us that capital gains realizations, at least under a tax system that allows deferral, are sensitive to tax rates. Moving to mark-to-market taxation of all capital gains would remove this sensitivity by taxing capital gains annually.

4 min read