All Related Articles

Raising the Corporate Rate to 28 Percent Reduces GDP by $720 Billion Over Ten Years

The Options guide presents the economic effects we estimate would occur in the long term, or 20 to 30 years from now, but we can also use our model to show the cumulative effects of the policy change—providing more context, for instance, about how the effects of a higher corporate income tax rate compound over time, which we estimate would reduce GDP by a cumulative $720 billion over the next 10 years.

4 min read

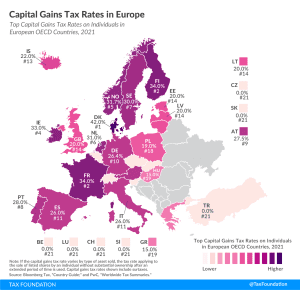

Road Taxes and Funding by State, 2021

Traditionally, revenue dedicated to infrastructure spending has been raised through taxes on motor fuel, license fees, and tolls, but revenue from motor fuel has proven less effective over the last few decades.

6 min read

More Tax Hikes Than Investment Projects?

Tax hikes implemented in the near term might undermine Spain’s economic recovery. Spain should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting private investment and employment while increasing its internal and international tax competitiveness.

5 min read

New Research Finds Limited Effects on Taxpayer Behavior from Pass-through Deduction

While proponents of the Section 199A pass-through deduction claimed it would boost investment and critics claimed it would encourage tax avoidance and income shifting, new research casts doubt on both claims.

3 min read

Imposing New Taxes on Peer-to-Peer Car Sharing Will Not Help Texas Economic Recovery

Imposing the rental car excise tax on peer-to-peer car sharing would be a move in the wrong direction by expanding a costly and distortive tax for visitors whose business will help Texans recover post-pandemic.

4 min read

Options for Reforming America’s Tax Code 2.0

A robust collection of 70 potential US tax reform changes and US tax reform options for reforming the tax code. See the comprehensive tax reform guide.

Common Tax Questions, Answered

Get answers to some of the tax policy questions we hear most often from taxpayers, businesses, and journalists. Learn everything from the basics of who pays taxes and the difference between credits and deductions, to how taxes impact the economy and what constitutes sound tax policy. Discover additional resources to explore each question and topic in more depth.

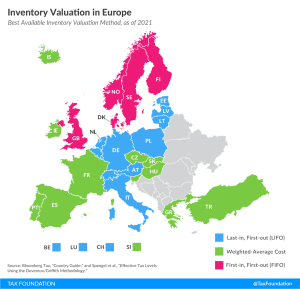

Inventory Valuation in Europe

The method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case due to factors like inflation, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale.

2 min read