A Global Minimum Tax and Cross-Border Investment: Risks & Solutions

Leaders around the world are quickly moving to finalize an agreement on a global minimum tax in 2021, based on the so-called “Pillar Two” proposal from the OECD.

25 min read

Leaders around the world are quickly moving to finalize an agreement on a global minimum tax in 2021, based on the so-called “Pillar Two” proposal from the OECD.

25 min read

New data show that the recent policy changes that have been implemented by the U.S., Ireland, and dozens of other countries are having an impact. The question for policymakers is whether they will take the time to understand these impacts before jumping to the next project to change international tax rules yet again.

3 min read

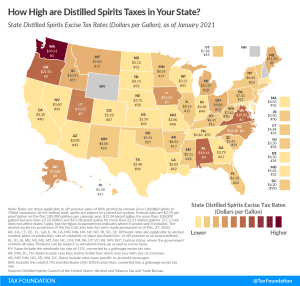

Of all alcoholic beverages subject to taxation, stiff drinks—and all distilled spirits—face the stiffest tax rates. Like many excise taxes, the treatment of distilled spirits varies widely across the states.

3 min read

Explore President Biden budget proposals, including tax and spending in American Jobs Plan and American Families Plan. See Biden tax and spending proposals.

12 min read

Taxes are once again at the forefront of the public policy debate as legislators grapple with how to fund new infrastructure spending, among other priorities. Our tax tracker helps you stay up-to-date as new tax plans emerge from the Biden administration and Congress.

1 min read

The Biden administration has suggested several tax increases for his infrastructure plan. Public infrastructure can help increase economic growth, but by raising taxes on private investment, the net effect on growth may be negative. However, tax options like retaining expensing for private R&D investment or making 100 percent bonus depreciation for equipment permanent would be complementary to the goals of infrastructure spending.

5 min read

While falling short of comprehensively reforming the complex U.S. retirement savings system, House and Senate lawmakers have proposed bipartisan bills to help simplify and expand access to retirement savings accounts to more workers.

4 min read

Early signs indicate that flavors bans will not decrease tobacco consumption. It is not in the interest of the District of Columbia to pursue a public health measure that merely sends tax revenue to its neighboring jurisdictions without improving public health.

3 min read

The negative effects of President Biden’s proposed 28 percent corporate income tax rate could be tempered by improving how the corporate income tax base treats investment expenses.

4 min read

One of the hottest topics in the tax world today is the recent announcement by G7 finance ministers that they would support enacting a new, 15-percent global minimum tax. We dive into the economic and political implications and how such a tax would impact global economies, revenues, and real people.