Don’t Add More Temporary Tax Policies in Budget Reconciliation

Temporary policy creates uncertainty for taxpayers and scheduling more expirations will add to the already-expiring provisions under the Tax Cuts and Jobs Act (TCJA) of 2017.

3 min read

Temporary policy creates uncertainty for taxpayers and scheduling more expirations will add to the already-expiring provisions under the Tax Cuts and Jobs Act (TCJA) of 2017.

3 min read

Increasing tax compliance is a major part of the Biden administration proposal to raise revenue for physical and social infrastructure. Reducing the tax gap—the difference between taxes owed and taxes paid—is a good way to raise revenue, but it doesn’t come without trade-offs, and it’s important to go about it in the right way.

3 min read

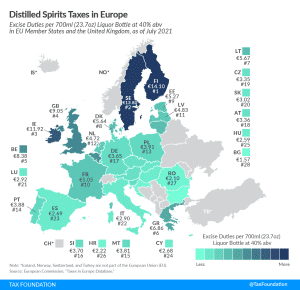

The highest excise duties are applied in Finland, Sweden, and Ireland, where the rates for a standard-size bottle of liquor are €14.10 ($16.08), €13.80 ($15.73), and €11.92 ($13.59), respectively.

3 min read

While arcane, expense allocation rules are relevant to current debates because they result in a heavier tax burden for U.S. companies under current law than the recently negotiated global minimum tax proposal.

10 min read

One of the ways lawmakers intend to pay for $3.5 trillion of new spending in the budget reconciliation package is by creating “health care savings.” The leading proposal to achieve this is H.R. 3, the Elijah Cummings Lower Drug Costs Now Act, which would change the way that prescription drug prices are negotiated under Medicare Part D.

5 min read

It is important to understand how the SALT deduction’s benefits have changed since the SALT cap was put into place in 2018 before repealing the cap or making the deduction more generous. Doing so would disproportionately benefit higher earners, making the tax code more regressive.

6 min read

How do current federal individual income tax rates and brackets compare historically?

1 min read

There are many ways the U.S.’s international tax rules could be changed, reformed, improved, or worsened. Reflexively jacking up taxes on U.S. multinationals does not necessarily accomplish the goal of reducing or eliminating profit shifting, and it would in fact worsen it.

6 min read

The Biden administration recently cited an analysis from Treasury claiming that “the President’s agenda will protect 97 percent of small business owners from income tax rate increases.” However, the figure is misleading. To assess the economic effect of higher marginal tax rates, it matters how much income or investment will be affected—not how many taxpayers.

3 min read

According to the Tax Policy Center, an estimated 60 percent of U.S. households paid no income tax in 2020, up from around 43 percent of households in 2019.

4 min read