Details and Analysis of President Biden’s Fiscal Year 2025 Budget Proposal

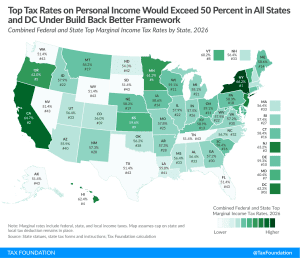

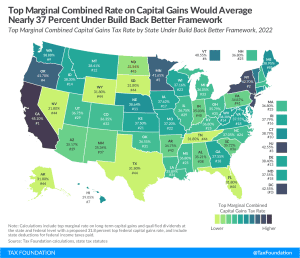

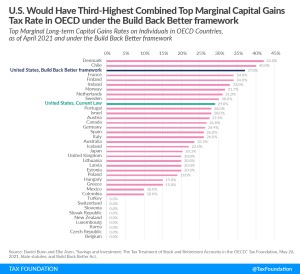

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read