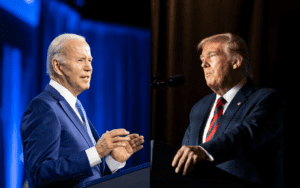

Five Things to Know about Trump’s Tariff and Income Tax Proposals

Former President Trump floated the possibility of entirely replacing the federal income tax with new tariffs. He also raised other ideas like eliminating taxes on tipped income and lowering the corporate tax rate by one percentage point.

8 min read