Key Findings

-

The tax gapThe tax gap is the difference between taxes legally owed and taxes collected. The gross tax gap in the U.S. accounts for at least 1 billion in lost revenue each year, according to the latest estimate by the IRS (2011 to 2013), suggesting a voluntary taxpayer compliance rate of 83.6 percent. The net tax gap is calculated by subtracting late tax collections from the gross tax gap: from 2011 to 2013, the average net gap was around 1 billion. is the gap between what taxpayers owe the U.S. government, and what the government actually collects from taxpayers.

-

TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. compliance efforts ensure that tax law applies evenly to all taxpayers. At the same time, we would like to avoid placing undue compliance burdens on taxpayers.

-

Reducing the tax gap is, on the margin, a good way to raise revenue, but is not without costs. Policymakers should consider compliance costs for law-abiding taxpayers as well as administrative costs for the IRS when evaluating measures to reduce the tax gap.

-

Improvements to the IRS’s technological infrastructure could reduce the tax gap while not creating new burdens for taxpayers.

-

Simplifications to the tax code itself could help reduce both the tax gap and compliance costs.

Table of Contents

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeIntroduction

The tax gap is the amount of tax that taxpayers legally owe the U.S. government but is not actually collected. To understand this gap, one must distinguish between tax avoidance and tax evasion.[1] Tax avoidance refers to legal ways of reducing one’s tax liability, while tax evasion is an illegal act of not paying tax liability owed.[2] The tax gap is not just attributable to tax evasion, however, as tax evasion requires deliberate noncompliance. Noncompliance due to unintentional errors on the part of taxpayers is included in the tax gap but not considered tax evasion.[3]

Reducing the tax gap is a good idea for revenue generation compared to the alternative ways to raise revenue. However, there is a wide array of estimates of how much of the tax gap can feasibly be closed, and many of the approaches for reducing the tax gap come with their own costs in the form of higher compliance burdens for taxpayers. This paper seeks to explain estimates of the tax gap and proposals to reduce it and determine which methods for improving tax compliance make the most sense for both taxpayers and tax authorities.

Policymakers should balance those concerns when weighing the potential for new revenue generated from greater tax enforcement. Improving the IRS’s informational technology and capacity has the strongest potential under this rubric—raising revenue without raising compliance costs. Stronger IRS enforcement and broader reporting requirements could also raise revenue, but it would make sense to analyze how particular changes would impact compliance costs before putting them into law.

What Is the Tax Gap and What Proposals Are Available?

There are three sources of the tax gap: non-filing, underreporting, and underpayment. Non-filing covers tax not paid on time when taxpayers do not file returns. Underreporting covers nonpayment due to understatement of income on timely-filed returns, and underpayment is making a payment below the legally owed tax on properly reported income on filed returns. Combining all three of these factors creates the gross tax gap. The net tax gap is calculated by adding back revenue generated by enforcement activities and other forms of late payment.[4]

The Biden administration has put forward several ideas for increasing tax enforcement. The American Jobs Plan (or AJP, the infrastructure proposal) focuses on increasing taxes on corporations—including with better enforcement.[5] The AJP discusses auditing companies more frequently but includes few specifics. However, the American Families Plan (AFP) has a clearer agenda, setting aside $80 billion for increased audits for high-income individuals and businesses, along with stronger reporting requirements.[6] The Bipartisan Infrastructure Framework originally contained new revenue from IRS enforcement as a pay-for, but it was dropped from the proposal.[7]

On May 20, 2021, the U.S. Department of the Treasury released a more detailed outline of its enforcement agenda.[8] There are four major components of the Biden plan. The first is increasing the Internal Revenue Service (IRS) budget by $80 billion, primarily to hire more agents and increase auditing rates for high-income and high-net-worth taxpayers and for corporations. The second is expanding third-party reporting requirements—mandating financial institutions report account inflows and outflows. The third is broadly upgrading the IRS’s information technology (IT) systems, and the fourth is regulating tax preparers and raising penalties for tax evasion. This paper will primarily consider the first three proposals.

The $80 billion increase is split between two funding streams: $72.5 billion is in a direct stream of mandatory funds over the next decade, while $6.7 billion is listed as a program integrity allocation. While the exact breakdown of how much goes to different budget functions is unclear, the proposal makes clear that $6 billion of the mandatory funds will go towards IT, with $4.5 billion of that $6 billion dedicated to developing and administering new reporting requirements.[9]

What Is the Current Tax Gap?

The most recent IRS estimates of the tax gap relies on data from 2011 to 2013. These estimates found that the average annual net tax gap over that period was $381 billion.[10] This amount was found by calculating the gross tax gap of $441 billion, or all owed taxes not paid, and adding back revenue from past noncompliance ($60 billion). A more recent study from economists Natasha Sarin and Lawrence Summers adjusted for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. and income growth since 2013 to approximate the current tax gap and arrived at $630 billion for 2020—or around 15 percent of total taxes owed. They also calculated that the tax gap over the next decade would equal $7.5 trillion.[11]

Former IRS commissioner Charles Rossotti, an advocate of increased enforcement and information reporting, reached a similar conclusion, estimating that the 2019 tax gap was around $574 billion.[12] Current IRS commissioner Chuck Rettig’s offhand comment in April 2021 that the true tax gap could be $1 trillion generated a lot of attention.[13] Rettig pointed to increased cryptocurrency uses as a source of additional noncompliance, as well as a recent report from economist Gabriel Zucman and a handful of other researchers, which found untaxed offshore holdings and higher nonreporting of passthrough business income.[14]

However, a recent National Taxpayers Union Foundation (NTUF) analysis challenged these large estimates.[15] It estimated at most $50 billion in taxes owed but not paid on cryptocurrency gains, adjusting past IRS estimates of the cryptocurrency tax gap to keep up with the total cryptocurrency market cap. It also found only $15 billion owed on untaxed offshore income and $40 billion owed based on additional unreported passthrough income. That total comes to just over $100 billion in previously underestimated contributions to the tax gap. That’s a lot, but adding $100 billion to the Sarin and Summers estimate of the current tax gap ($630 billion) does not come close to $1 trillion.

Where Is the Tax Gap?

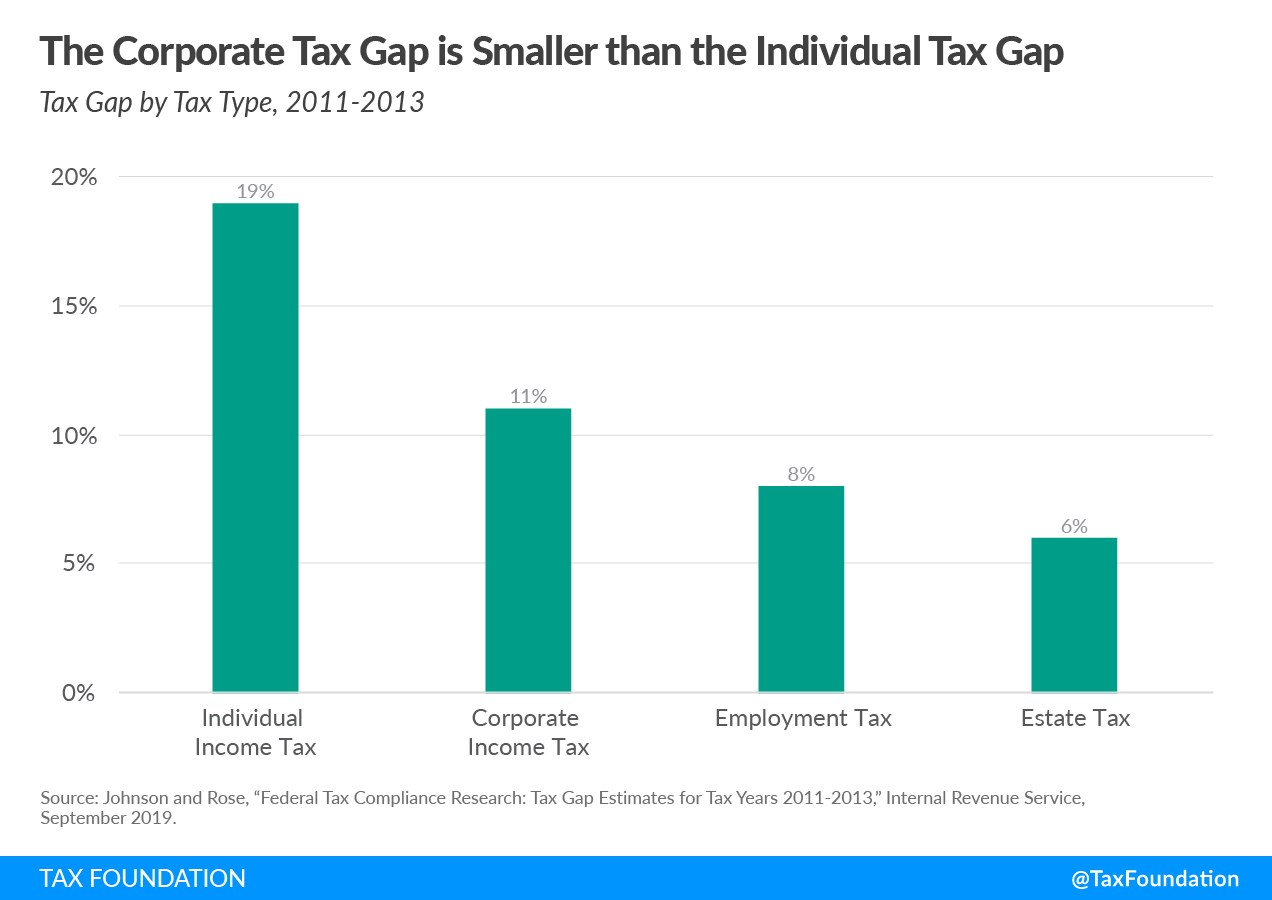

There is a perception that big corporations are the main culprits of tax evasion.[16] However, when corporations do not pay taxes in a given year, that’s usually the result of following existing tax law to minimize or eliminate their legal liability—in other words, not tax evasion at all.[17] In reality, the tax gap for the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. is smaller than the tax gap for the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. . According to the IRS’s analysis of the tax gap between 2011 and 2013, the gap between corporate income taxes owed and corporate income taxes paid was 11 percent. Meanwhile, the gap for the individual income tax was 19 percent.[18] Businesses play an important role in the tax collection process, too, as they are responsible for remitting 93 percent of all taxes collected in the U.S.—not only the corporate income tax, but also both parts of the payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. , withholdingWithholding is the income an employer takes out of an employee’s paycheck and remits to the federal, state, and/or local government. It is calculated based on the amount of income earned, the taxpayer’s filing status, the number of allowances claimed, and any additional amount the employee requests. of personal income tax, and sales and excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. .[19]

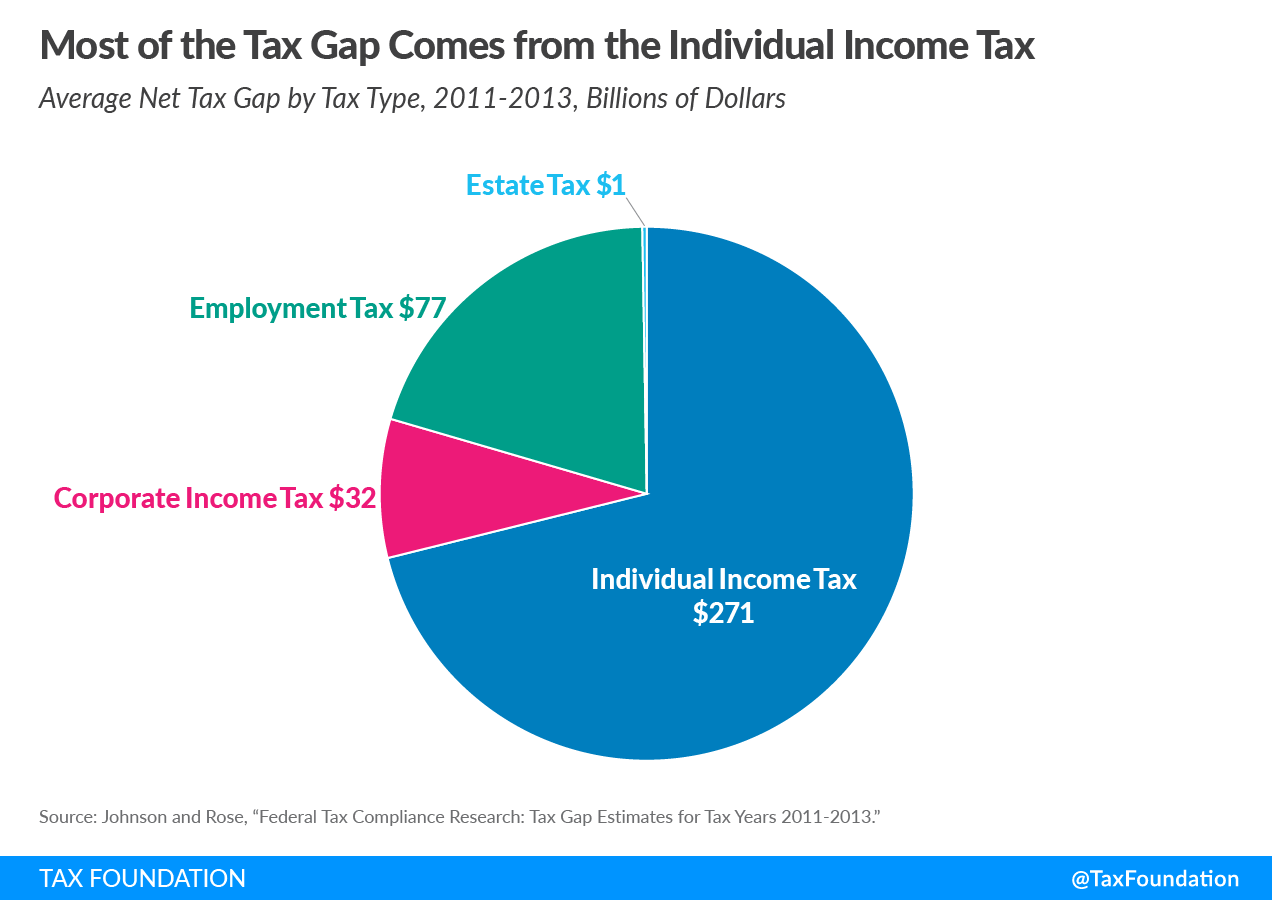

In absolute terms, the individual income tax gap also dwarfs the corporate income tax gap. This is unsurprising, given that the individual income tax is the primary way the federal government raises revenue.[20] According to the same report, the average annual net tax gap for the individual income tax was $271 billion, meaning it accounts for over 71 percent of the total average net tax gap of $381 billion.

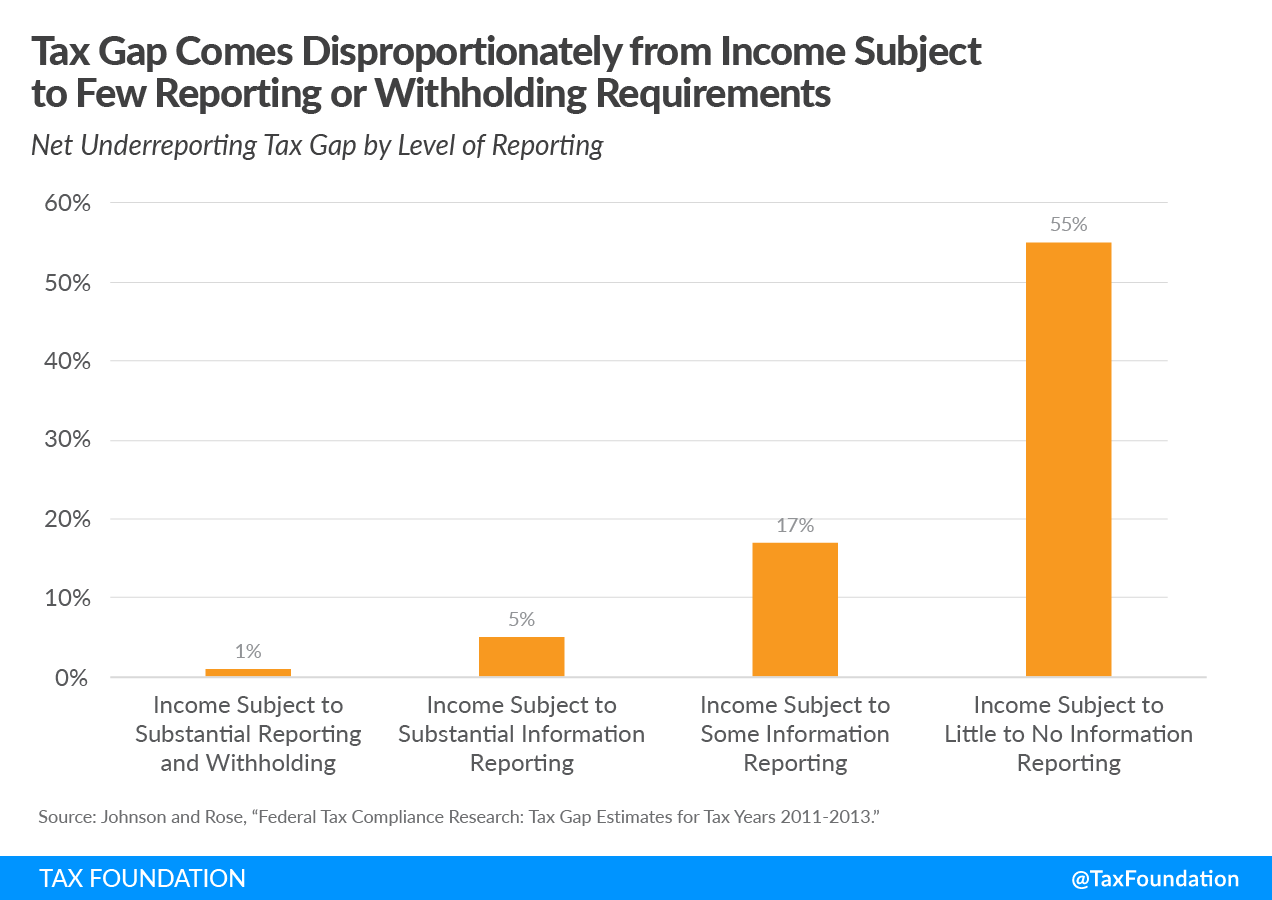

Specific types of income drive the individual income tax gap. Income subject to reporting requirements and withholding, such as employee wages, has a very low level of underreporting. The payroll tax gap is low as well for the same reason. However, the individual income tax covers many types of income that are subject to fewer reporting requirements, like passthrough business income, and contribute more to the tax gap.

More broadly, income subject to substantial information reporting requirements includes pensions, annuities, interest income, dividend income, unemployment compensation, and taxable Social Security benefits. Income subject to some information reporting includes partnership and S corporationAn S corporation is a business entity which elects to pass business income and losses through to its shareholders. The shareholders are then responsible for paying individual income taxes on this income. Unlike subchapter C corporations, an S corporation (S corp) is not subject to the corporate income tax (CIT). income, capital gains, and alimony payments, while the income subject to little or no information reporting includes farm income, nonfarm proprietor income, and rents and royalties.

How Does the U.S. Compare?

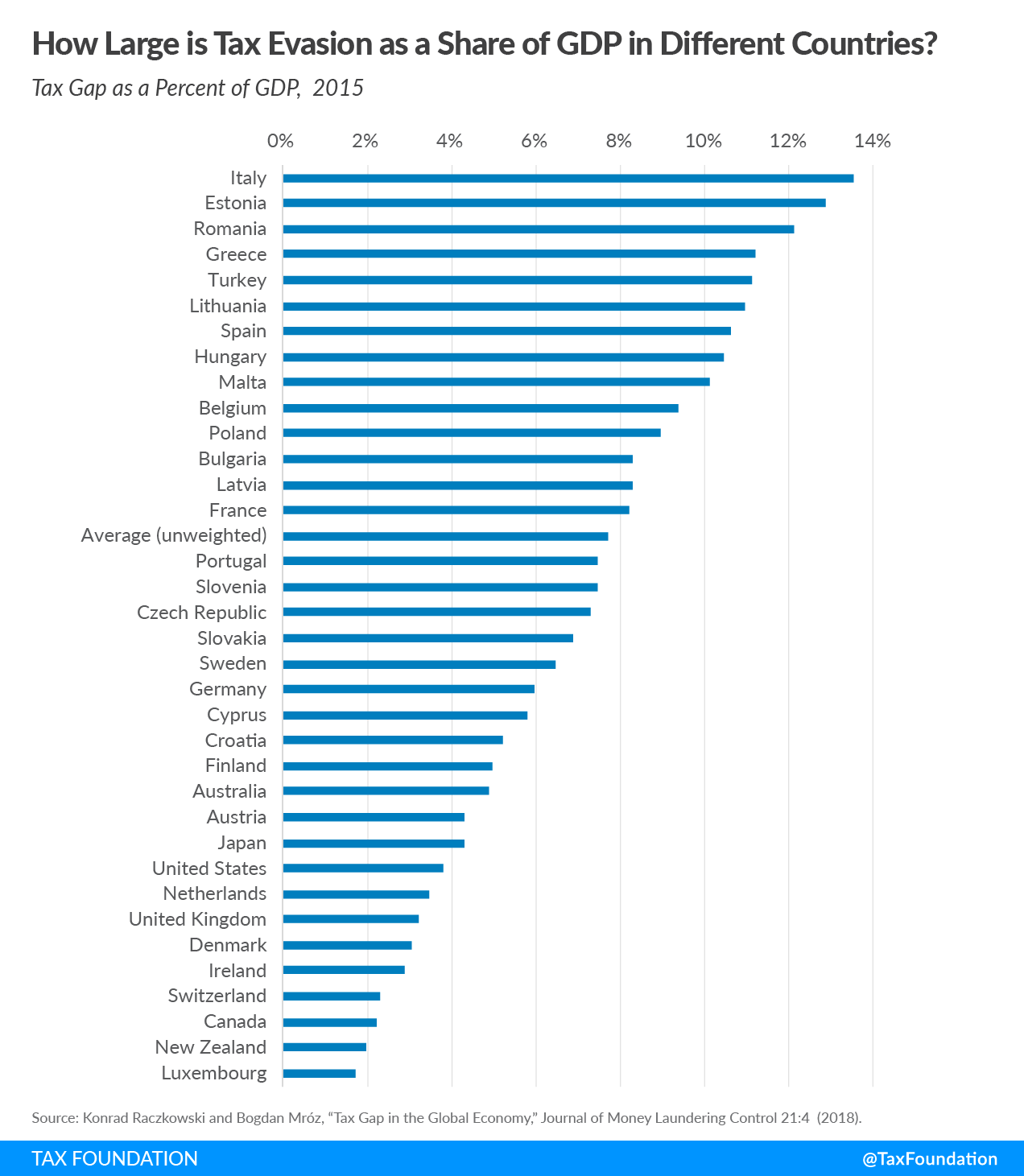

Compared to the rest of the world, the United States does not have a unique problem with tax evasion. A 2018 study comparing tax gaps across the developed world found that the United States had a below-average level of tax evasion as a share of national GDP compared to most other developed countries. While reducing the tax gap could still be an effective source of revenue, this comparison to other countries suggests that there might not be much easy tax revenue to collect by increasing enforcement.

Revenue Potential from Greater Tax Enforcement

Raising revenue by reducing the tax gap, rather than raising marginal tax rates, is an appealing policy for several reasons. There’s a moral argument that the tax code should apply evenly across taxpayers. There’s also an economic argument: making sure everyone pays the taxes we currently levy means we would not need to raise marginal tax rates to raise revenue, making better enforcement a less economically distortionary option. However, better tax enforcement would still come with costs, and estimates vary widely on how much revenue the IRS could generate from additional resourcing or information.

There are a few reasons estimates of the returns to enforcement vary so much. There are several types of IRS investment to consider. There is increased spending on existing enforcement, which would mean higher auditA tax audit is when the Internal Revenue Service (IRS) or a state or local revenue agency conducts a formal investigation of financial information to verify an individual or corporation has accurately reported and paid their taxes. Selection can be at random, or due to unusual deductions or income reported on a tax return. rates, although some proposals include more audits across the board while others target high-income taxpayers and businesses. There is also investment in IRS IT systems, many of which are very outdated. And lastly, there are proposals to increase reporting requirements.

There are several studies that attempt to estimate how much revenue these enforcement proposals may raise. These studies often use different assumptions to determine the revenue potential of enforcement proposals. For example, there are two ways increased audits can raise revenue. The first is by catching more tax evaders and making them pay what they owe, but the second is deterrence—a higher rate of audits could lead would-be tax evaders to instead follow the law thanks to a higher risk of (or fear of) being caught.[21] The following are the most important variables.

| Source | New Revenue (Over 10 Years) | Administrative Cost (Over 10 Years) | Components | Assumptions |

|---|---|---|---|---|

| Tax Compliance Agenda Treasury Report (2021) | $700 billion | $80 billion | $72.5 billion in mandatory funds, including $6 billion in information technology investment, 75 percent of which is for developing reporting requirements. $6.7 billion for program integrity. | $320 billion in projected revenue from enforcement activities, and $460 billion from reporting requirements. |

| Congressional Budget Office (2020) | $104 billion | $40 billion | Increased spending on enforcement only. | Does not include deterrence effects |

| Sarin and Summers (2019) | $1.21 trillion | $107 billion | $64 billion on traditional enforcement, $42 billion on information technology improvements. | Assumes deterrence increases returns by 3x. |

| Rossotti and Forman (2020) | $1.6 trillion | $64 billion | $12 billion for technological improvements, and $52 billion on additional enforcement staff. Includes expanded reporting requirements. | Assumes that reporting requirements will reduce the tax gap on income currently subject to little to no reporting from 55 percent to 17 percent, and the tax gap on income subject to some reporting from 17 percent to 5 percent. |

| Holtz-Eakin (2021) | $200 billion | $80 billion | Same as the American Families Plan document | Uses the CBO’s assumptions about return to greater enforcement, argues new reporting requirements are unworkable. |

|

Sources: U.S. Department of Treasury, “The American Families Plan Tax Compliance Agenda,” May 2021, https://home.treasury.gov/system/files/136/The-American-Families-Plan-Tax-Compliance-Agenda.pdf; Congressional Budget Office, “Trends in the Internal Revenue Service’s Funding and Enforcement,” July 2020, https://www.cbo.gov/system/files/2020-07/56422-CBO-IRS-enforcement.pdf; Natasha Sarin and Lawrence H. Summers, “Shrinking the Tax Gap: Approaches and Revenue Potential,” National Bureau of Economic Research, Working Paper 26475 (November 2019), https://www.nber.org/system/files/working_papers/w26475/w26475.pdf; Charles Rossotti and Fred Forman, “Recover $1.6 Trillion, Modernize Tax Compliance and Assistance,” Tax Notes, March 2020, https://www.taxnotes.com/tax-notes-federal/compliance/recover-16-trillion-modernize-tax-compliance-and-assistance/2020/03/02/2c5p2.; and Douglas Holtz-Eakin, “Closing the Tax Gap: How Much and How Fast,” American Action Forum, June 3, 2021, https://www.americanactionforum.org/daily-dish/closing-the-tax-gap-how-much-and-how-fast/. |

||||

Diminishing Returns. The IRS’s budget declined by 20 percent in inflation-adjusted terms between 2010 and 2018—from over $14 billion to $11.4 billion. A large portion of that change was due to a 29 percent decline in enforcement spending, or approximately $1 billion.[22] A decline in enforcement funding has meant lower audit rates across the board, and as a result, lower enforcement revenue: the total amount of recommended additional tax liability (in other words, additional revenue owed due to an audit not including penalties) dropped by 50 percent, from $46 billion in 2010 to $23 billion in 2018.

One might assume that an additional $1 billion in enforcement would lead to $23 billion in new revenue. However, it’s tough to extrapolate the marginal returns of much larger investments in IRS enforcement activities. The Congressional Budget Office (CBO) considered two options: a $20 billion increase in IRS funding, and a $40 billion increase, both over a decade. The CBO projected a $20 billion increase would generate $60 billion in revenue, while $40 billion would generate $104 billion. This can be broken down into parts. The first $20 billion would have an average return of 200 percent. However, an additional $20 billion would raise $44 billion, translating to an average return of only 120 percent.

Sarin and Summers argue that the CBO’s estimate of diminishing returns on IRS enforcement activities is unreasonably pessimistic. They instead argue that the decline in enforcement revenue thanks to lower spending on the IRS’s enforcement arm shows that the IRS is far from the point of diminishing returns. They note that just returning the IRS’s budget as a share of gross domestic product to where it was in 2011 would mean $82 billion more over the next decade.[23] On the other hand, former IRS commissioner John Koskinen has expressed doubts that the IRS could use $80 billion in new funding efficiently.[24]

Speed of Adoption. Another major difference among these studies is how quickly they think returns to increased enforcement will materialize. It takes time for the IRS to hire and train new agents, and to introduce new technology.[25] The Treasury Department anticipates that the IRS funding will generate $1.6 trillion in the second decade following enactment.[26] Meanwhile, Rossotti and Forman argue that much revenue could be generated within this decade.[27]

Deterrence. Another important difference between the CBO and Sarin and Summers analyses is the effect of deterring tax evasion. A higher chance of an audit could lead taxpayers who might consider tax evasion to decide the risk is not worth it. Some studies have found that the deterrence effects of increased tax enforcement raise between nine and 12 times as much revenue.[28] However, the literature is mixed. Some studies show the effects of audits on taxes paid only exist in the short term, particularly for wealthy taxpayers.[29]

There is also evidence that increased audits can actually lower voluntary compliance.[30] One of the reasons for that is lower trust in the IRS—a strong enforcement presence from the IRS can lead taxpayers to view the agency as hostile. A paper in the Journal of Economic Psychology from 2007 described two variables that determine tax compliance: trust, which increases voluntary compliance, and enforcement, which increases involuntary compliance. A stronger IRS could improve enforcement but reduce trust.[31]

Efficacy of Reporting Requirements. Lastly, a major source of disagreement among scholars studying the impact of greater tax enforcement is the efficacy of new reporting requirements. It is true that income not subject to withholding and reporting requirements have much higher rates of nonpayment. However, those types of income, such as proprietorship income, may just be easier to hide in the first place, regardless of reporting requirements. Given that concern, there’s good reason to be skeptical that the Biden administration’s new reporting requirements would raise $460 billion.[32]

In the past, new reporting requirements have proven less feasible. As former CBO Director Douglas Holtz-Eakin noted, the Affordable Care Act originally included an expansion to 1099 reporting forms.[33] Existing 1099 forms require taxpayers to report a series of different kinds of non-employment income.[34] This provision would have required businesses to report every purchase from a single vendor over $600. After opposition from then-IRS Taxpayer Advocate Nina Olson, on the basis that costs to businesses would outweigh the relatively low amount of expected revenue ($19 billion over 10 years), this provision was repealed before it went into effect.[35]

Tax Compliance Costs and Optimal Tax Enforcement

Tax compliance costs are the economic costs taxpayers incur in the process of filing taxes. According to a recent National Taxpayers Union (NTU) report, annual tax compliance costs were roughly $300 billion in 2020.[36] About $84 billion of these costs are borne by businesses, which is disproportionately large compared to the share of taxes businesses pay.

There are two components to tax compliance costs. The first is actual out-of-pocket costs, such as tax preparers and the purchase of software and other supplies. The other is opportunity costs, which are the economic losses caused by allocating resources such as one’s work hours towards tax compliance instead of more productive activities. There’s a wide range of ways to estimate the opportunity costs of tax compliance.[37]

Some calculations for tax compliance cost rely on estimates of the hours taxpayers take to comply with the tax code. However, these estimates can fluctuate significantly thanks to changes in study methodology.[38] Furthermore, there’s a question of what dollar value to place on each hour of compliance. Some studies use the median private sector hourly wage, but given that higher-income taxpayers spend more time on tax compliance, it may make sense to use a higher hourly value like the median wage for professional services workers, especially for certain provisions that mostly relate to high-income taxpayers.[39]

Taxpayers often forgo potential savings in exchange for a simpler filing process. One study by economist Youseff Benzarti used sacrificed savings from taxpayers choosing to use the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. instead of itemizing to estimate compliance costs. He found the costs of complying with the federal individual income tax alone have risen to up to 1.2 percent of GDP (about $235 billion in 2017).[40],[41] An increase in the audit rate and the complexity of the tax system, coupled with a fear of being punished for wrongly claiming a benefit by accident, could end up hitting law-abiding taxpayers in the wallet—they may pay professional preparers more to avoid errors, or forgo tax benefits out of concern they could make a mistake. They may also spend more time themselves on their returns. Policymakers should include these costs, as well as the cost of administration, when considering the optimal level of additional tax enforcement.[42]

The Benzarti study of compliance costs found that taxpayers’ expected value of the chance of an audit (or the expected cost of an audit times the taxpayer’s perception of the probability of an audit) is around $147.[43] If the IRS became more aggressive, and the public’s perception of the probability of an audit increases, then taxpayers’ compliance burdens would go up. Let’s say the perceived probability rose by 50 percent, and the expected value of the chance of an audit adjusted proportionally (increasing by around $73). Across 150 million taxpayers, that would total another $11 billion in compliance costs per year. Meanwhile, a study in Belgium estimated that a customer-unfriendly tax administration raises compliance burdens by 27 percent.[44] In an American context, that could mean up to $81 billion in new compliance costs per year.

These are very rough estimates and shouldn’t be taken as the final word on the kinds of compliance costs to expect from the Biden enforcement proposals. However, they should give a sense of the possible scale of new compliance costs and drive home the need for more analysis of the impact of these proposals on the private sector.

Expanding enforcement is not the only part of Biden’s agenda. Upgrading the IRS’s information technology, for example, has the potential to provide additional revenue without significantly raising compliance costs for taxpayers.

One example of the kind of investment in IT that could help reduce the tax gap is the Return Review Program, or RRP. The RRP is the main fraud detection service in the IRS and has proven very effective.[45] From January 2015 to November 2017, the program reduced fraudulent tax refundA tax refund is a reimbursement to taxpayers who have overpaid their taxes, often due to having employers withhold too much from paychecks. The U.S. Treasury estimates that nearly three-fourths of taxpayers are over-withheld, resulting in a tax refund for millions. Overpaying taxes can be viewed as an interest-free loan to the government. On the other hand, approximately one-fifth of taxpayers underwithhold; this can occur if a person works multiple jobs and does not appropriately adjust their W-4 to account for additional income, or if spousal income is not appropriately accounted for on W-4s. payments by $6.51 billion—on an annual budget of around $100 million. There are some RRP program upgrades the Government Accountability Office has suggested that the IRS has not yet enacted. Those changes would be good starting points.[46] However, much of the IRS’s other technology is wildly outdated. Most notably, the Individual Master File, the primary system the IRS uses to process returns, was created during the Kennedy administration.[47]

This kind of outdated technology hurts enforcement as well as taxpayers, as was noted in the 2020 Taxpayer Advocate Report to Congress.[48] In 2021, the IRS has a record backlog of unprocessed returns—the agency finished the filing season with 35 million returns awaiting manual review.[49] Although part of that issue is likely due to managing major policy changes in the midst of the pandemic, improved technology could make service faster for taxpayers as well as help IRS agents catch discrepancies. These sorts of problems are why the National Taxpayer Advocate centered information technology investment for the IRS in its policy recommendations last year.[50]

Increasing reporting requirements could increase revenue too but would pass additional compliance burdens onto the private sector.

The Treasury Department report states that the increased reporting requirements will be based on Form 1099-INT, which taxpayers receive from financial institutions whenever they earn interest income of over $10.[51] The report claims that by utilizing information financial institutions already have, these expanded reporting requirements will not create new compliance costs for taxpayers, but financial institutions will face compliance costs, and those could be passed to taxpayers. For example, 1099-INT forms alone already carry $2.35 billion in compliance costs per year, as of 2016.[52] The cost of reporting inflows and outflows, as opposed to just interest earned, would presumably be many times higher. The National Taxpayers Union Foundation has suggested the IRS present a quantification of the impact of the reporting requirements on the private sector before enactment.[53]

Additionally, as some, such as Steve Rosenthal of the Tax Policy Center, have noted, having such broad reporting requirements might end up being counterproductive, or at least inefficient. Looking at the data for every significant balance change would end up scrutinizing income already subject to withholding—and therefore not likely to be a source of tax evasion or noncompliance. The IRS struggles with analyzing the data it already collects—adding another layer of data collection and analysis might overwhelm the agency.[54] An expansion of reporting requirements specifically for types of income for which there is a large tax gap would be a more efficient approach.[55]

Ultimately, most examples of additional IRS spending would likely generate more revenue on the margin. However, the costs these policies would impose on the private sector, and how scalable these programs are (in other words, whether a large budget increase could sustain the kind of returns to investment a small budget increase would have), are still unclear. Individual proposals for strengthening the IRS should face a cost-benefit analysis considering both their budgetary costs and the compliance costs they would put on law-abiding taxpayers.

Fundamental Tax Reform

Investing in enforcement should not be the only tool policymakers use to reduce the tax gap. As suggested earlier, there are many factors that determine the level of tax noncompliance beyond resources dedicated to enforcement. One is called “tax morale,” roughly defined as how willing taxpayers are to voluntarily pay their taxes.[56] There are several other factors, such as income level, that also influence tax compliance. However, arguably the most important factor is tax complexity.[57]A simpler tax code is easier to enforce and imposes lower compliance costs on taxpayers.,[59] Additionally, higher tax rates make companies and individuals on the margin pursue either (legal) tax avoidance strategies or even tax evasion; lower tax rates make such behavior less valuable.[60]

There are many examples of this, both in the United States and abroad. The Tax Reform Act of 1986 simplified the individual income tax by condensing the number of tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. as well as limiting many tax deductions. Reported income increased in response to this change, suggesting that the lower rates and simpler code brought previously unreported income into the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. .[61] Analysis of the personal income tax increase of 1993 confirmed the reverse was also true, as a higher tax rate drove lower reported incomes.[62] However, given where current U.S. tax rates are, it’s highly unlikely that just lowering rates would lead to a net increase in revenue thanks to more income returning from evasive activities.[63] A more expansive reform, that broadened the U.S. tax base while reducing headline rates, could, however, raise revenue by lowering the potential returns to evasion.

Below we consider several options for simplifying the tax code.

Eliminate Itemized Deductions and the Alternative Minimum Tax (AMT)

Taxpayers can choose to either take the standard deduction to reduce their taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. or itemize and take advantage of a series of deductions for specific expenses. The largest itemized deductions are those for charitable contributions, mortgage interest, and state and local taxes (SALT).

The Tax Cuts and Jobs Act of 2017 (TCJA) helped reduce tax compliance costs by making taxpayers less likely to itemize their deductions. By doubling the standard deduction, while placing limits on itemized deductions, the law made the standard deduction advantageous for more taxpayers, reducing the share who itemized from 30 percent to 10 percent.[64] As a result, the TCJA reduced compliance costs in 2018 by between $3.1 billion and $5.4 billion.[65]

The individual alternative minimum tax (AMT) is a part of the tax code intended to minimize legal tax avoidance. Developed in response to examples of high-income taxpayers with no tax liability thanks to utilizing many deductions, the AMT is intended to prevent taxpayers from benefiting from too many tax breaks at once. However, it leads to large compliance costs, as filers have to calculate their tax liability using two separate systems.[66] The TCJA also reformed the AMT by raising the threshold to become eligible for AMT liability, thereby reducing compliance costs.[67]

Eliminating or curtailing both the AMT and itemized deductions would reduce compliance costs significantly while making the code easier for the IRS to enforce.

Keep a Lower Corporate Tax Rate, but Eliminate the Passthrough Deduction

A significant part of the reason why the United States raises less corporate tax revenue relative to other countries is that it has a smaller corporate sector. Partly thanks to the high corporate tax rate that was in place until 2017, American businesses were more likely to structure as pass-throughs (sole proprietorships, partnerships, and S corporations), meaning they were taxed through the personal income tax.[68]

Corporations are actually quite compliant with the tax code, and the IRS has an easier time enforcing tax laws on them.[69] Meanwhile, passthrough firms are a large source of tax nonpayment. While it is too soon to tell how large of an impact the TCJA will have on corporate and passthrough tax compliance, a lower corporate tax rate could, over the long term, make it more likely firms choose to incorporate rather than remain passthrough businesses, enabling easier tax enforcement.[70]

At the same time, reforming the Section 199A passthrough deduction, a provision created by the TCJA that allows individuals to deduct 20 percent of their passthrough business income, could also improve tax compliance.[71] While the TCJA reduced the gap between corporate and noncorporate taxation on net, noncorporate income still faces a lower effective marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. . Repealing the passthrough deduction would reduce or even eliminate this gap, and on the margin making firms more likely to take the corporate form.

Section 199A creates complexity for taxpayers and administrators alike. Instead of lowering tax rates on returns to noncorporate capital investment, it effectively ended up lowering taxes on very specific types of labor income.[72] There is some evidence that the law led partnerships to reduce owner compensation, instead classifying payments as business income to become eligible for this provision.[73] However, there’s also evidence that many taxpayers that could be eligible for the provision chose not to take advantage of it, likely deterred by complexity and compliance costs.[74]

Take Social Policy Out of the Tax Code

As an analysis from the Bipartisan Policy Center noted recently, the United States administers a large portion of social spending through the tax code, through programs such as the Child Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. (CTC) and the Earned Income Tax Credit (EITC).[75]

One approach to simplification would be to move programs like EITC, CTC, and Additional Child Tax Credit (ACTC) out of the tax code and transform them into spending programs. The idea of moving welfare state administration out of the tax code has proponents across the political spectrum.[76] Advocates of this approach argue that credits like the CTC and EITC muddle the purpose of the tax code beyond revenue generation.[77],[78] Administering these social programs through the tax system also muddles the IRS’s responsibilities, turning it from a revenue collection agency into a welfare administration agency. Concerns that the rollout of the American Rescue Plan’s expanded monthly CTC payments will miss a large section of the most vulnerable children has made this issue more pressing.[79]

Sen. Mitt Romney (R-UT)’s bill, the Family Security Act, would eliminate the CTC and dramatically simplify the EITC. The bill would instead create a child allowance of $350 per month for every child under 6 and $250 per month for every child between 6 and 17 administered through the Social Security Administration. There would be no minimum income threshold, but individuals would be limited to $15,000 per year in benefits, and it would begin to phase out for single taxpayers earning over $200,000 and households earning over $400,000.[80]

Conclusion

Like all other options for raising tax revenue, reducing the tax gap is not a free lunch. In light of the decline of the IRS’s budget and capacity in recent years, simply bringing enforcement levels back to where they were in 2010, as well as upgrading the IRS’s antiquated technology, look like appealing options to raise revenue.

However, the details are important. A higher IRS budget is not the only cost of more enforcement or broader reporting requirements. The Biden administration’s proposals will likely raise compliance costs for law-abiding taxpayers as well. They could nonetheless be worth enacting, if the compliance and budgetary costs are still less than the money these policies raise, but at this point we do not have strong analysis of the impact of these proposals on the private sector.

Going forward, policymakers should include taxpayer compliance costs when weighing the merits of more IRS funding. This could end up steering policy towards investment in information technology rather than more enforcement, as better technology could actually improve the tax filing experience for the average taxpayer while making it easier for the IRS to catch bad actors. Lastly, structural improvements to the tax code that make it simpler to administer and less likely to drive taxpayers to hide income could also help reduce the tax gap.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Internal Revenue Service, “The Difference Between Tax Avoidance and Tax Evasion,” https://apps.irs.gov/app/understandingTaxes/whys/thm01/les03/media/ws_ans_thm01_les03.pdf.

[2] YouTube, “The Simpsons – Tax Avoision,” July 1, 2017, https://www.youtube.com/watch?v=vYRld6e_NNI.

[3] Nina E. Olson, “Testimony on Closing the Tax Gap: Lost Revenue from Noncompliance and the role of Offshore Tax Evasion,” Senate Finance Subcommittee on Taxation and IRS Oversight, May 11, 2021, https://www.finance.senate.gov/imo/media/doc/SFC%20Subcomm%20on%20Taxation%20and%20Oversight%20Tax%20Gap%20-%20Olson%20-%2005-11-21%20(final)(rev)1.pdf.

[4] Barry W. Johnson and Peter J. Rose, “Federal Tax Compliance Research: Tax Gap Estimates for Tax Years 2011-2013,” Internal Revenue Service, Publication 1415, September 2019, https://www.irs.gov/pub/irs-pdf/p1415.pdf .

[5] Daniel Bunn, William McBride, Garrett Watson, and Erica York, “President Biden’s Infrastructure Plan Raises Taxes on U.S. Production,” Tax Foundation, Mar. 31, 2021, https://www.taxfoundation.org/biden-infrastructure-american-jobs-plan/.

[6] White House, “Fact Sheet: The American Families Plan,” Apr. 28, 2021, https://www.whitehouse.gov/briefing-room/statements-releases/2021/04/28/fact-sheet-the-american-families-plan/.

[7] Myah Ward, “Rob Portman Says IRS Enforcement Off the Table for Funding $1.2 Trillion Infrastructure Package,” Politico, July 18, 2021, https://www.politico.com/news/2021/07/18/portman-irs-enforcement-infrastructure-package-499988.

[8] U.S. Department of Treasury, “The American Families Plan Tax Compliance Agenda,” May 2021, https://home.treasury.gov/system/files/136/The-American-Families-Plan-Tax-Compliance-Agenda.pdf.

[9] Ibid.

[10] Barry W. Johnson and Peter J. Rose, “Federal Tax Compliance Research: Tax Gap Estimates for Tax Years 2011-2013.”

[11] Natasha Sarin and Lawrence H. Summers, “Shrinking the Tax Gap: Approaches and Revenue Potential,” National Bureau of Economic Research, Working Paper 26475, November 2019, https://www.nber.org/system/files/working_papers/w26475/w26475.pdf.

[12] Charles O. Rossotti, “Testimony … Before the Senate Committee on Finance: Subcommittee on Taxation and IRS Oversight,” May 11, 2021, https://www.finance.senate.gov/imo/media/doc/SFC%20written%20submission%20final05082021.pdf

[13] Chuck Rettig, “Senate Finance Committee Hearing on 2021 Tax Filing Season,” Apr. 13, 2021, https://www.c-span.org/video/?510750-1/senate-finance-committee-hearing-2021-tax-filing-season.

[14] John Guyton, Patrick Langetieg, Daniel Reck, Max Risch, and Gabriel Zucman, “Tax Evasion at the Top of the Income Distribution: Theory and Evidence,” National Bureau of Economic Research, Working Paper No. 28542, March 2021, https://www.nber.org/system/files/working_papers/w28542/w28542.pdf.

[15] Andrew Wilford, Andrew Moylan, and Pete Sepp, “The Tax Gap: No Trillion Dollar Silver Bullet,” National Taxpayers Union Foundation, May 13, 2021, https://www.ntu.org/foundation/detail/the-tax-gap-no-trillion-dollar-silver-bullet.

[16] Craig Harris, “Biden Cites Left-Leaning Study That 55 of the Top U.S. Companies Pay No Federal Income Taxes,” USA TODAY, Apr. 29, 2021, https://www.usatoday.com/story/money/2021/04/29/president-biden-cites-study-saying-55-big-u-s-firms-paid-no-fed-taxes/4889916001/.

[17] Erica York, “Explaining the GAAP Between Book and Taxable Income,” Tax Foundation, June 3, 2021, https://www.taxfoundation.org/corporations-zero-corporate-tax/.

[18] Barry W. Johnson and Peter J. Rose, “Federal Tax Compliance Research: Tax Gap Estimates for Tax Years 2011-2013.”

[19] Tax Foundation, “Taxes: The Price We Pay For Government,” Tax Basics, https://www.taxfoundation.org/taxes-price-for-government/.

[20]Ibid.

[21] Marcelo L. Bérgolo, Rodrigo Ceni, Guillermo Cruces, Matias Giaccobasso, and Ricardo Perez-Truglia, “Tax Audits as Scarecrows: Evidence from a Large-Scale Field Experiment,” National Bureau of Economic Research, Working Paper No. 23631, May 2019, https://www.nber.org/system/files/working_papers/w23631/revisions/w23631.rev2.pdf.

[22] Congressional Budget Office, “Trends in the Internal Revenue Service’s Funding and Enforcement,” July 2020, https://www.cbo.gov/system/files/2020-07/56422-CBO-IRS-enforcement.pdf.

[23] Natasha Sarin and Lawrence H. Summers, “Understanding the Revenue Potential of Tax Compliance Investment,” National Bureau of Economic Research Working Paper 27521, July 2020, https://www.nber.org/system/files/working_papers/w27571/w27571.pdf.

[24] Jim Tankersley and Alan Rappeport, “Biden Seeks $80 Billion to Beef Up IRS Audits of High Earners,” The New York Times, July 7, 2021, https://www.nytimes.com/2021/04/27/business/economy/biden-american-families-plan.html.

[25] Richard Rubin, “Biden’s Big Agenda Relies on a Shrunken, Strained Agency: The IRS,” The Wall Street Journal, Apr. 20, 2021, https://www.wsj.com/articles/biden-agenda-relies-on-shrunken-strained-irs-11618928830.

[26] U.S. Department of Treasury, “The American Families Plan Tax Compliance Agenda.”

[27] Charles Rossotti and Fred Forman, “Recover $1.6 Trillion, Modernize Tax Compliance and Assistance,” Tax Notes, Mar. 20, 2020, https://www.taxnotes.com/tax-notes-federal/compliance/recover-16-trillion-modernize-tax-compliance-and-assistance/2020/03/02/2c5p2.

[28] Congressional Budget Office, “Trends in the Internal Revenue Service’s Funding and Enforcement”; see also Alan H. Plumley, “The Impact of the IRS on Voluntary Tax Compliance: Preliminary Empirical Results,” National Tax Association, 95th Annual Conference on Taxation, Nov. 14-16, 2002, irs.gov/pub/irs-soi/irsvtc.pdf; and Jeffrey A. Dubin, “Criminal Investigation Enforcement Activities and Taxpayer Noncompliance,” Public Finance Review 35:4 (July 2007), https://www.irs.gov/pub/irs-soi/04dubin.pdf.

[29] Jason DeBacker, Bradley T. Heim, Ahn Tran, and Alexander Yuskavage, “Once Bitten, Twice Shy? The Lasting Impact of Enforcement on Tax Compliance,” The Journal of Law and Economics 61:1 (February 2018), https://www.jasondebacker.com/papers/DHTY_IndivAudit.pdf.

[30] Joel Slemrod, Marsha Blumenthal, and Charles Christian, “Taxpayer Response to the Probability of an Audit: Evidence from a Controlled Experiment in Minnesota,” Journal of Public Economics 79 (2001), http://fieldexperiments-papers2.s3.amazonaws.com/papers/00332.pdf.

[31] Erich Kirchler, Erik Hoelzl, and Ingrid Wahl, “Enforced Versus Voluntary Tax Compliance: the ‘Slippery Slope’ Framework,” Journal of Economic Psychology 29:2 (April 2008), https://www.sciencedirect.com/science/article/abs/pii/S016748700700044X.

[32] U.S. Department of Treasury, “The American Families Plan Tax Compliance Agenda.”

[33] Douglas Holtz-Eakin, “Closing the Tax Gap: How Much and How Fast,” American Action Forum, June 3, 2021, https://www.americanactionforum.org/daily-dish/closing-the-tax-gap-how-much-and-how-fast/.

[34] Robert W. Wood, “10 Things You Should Know About 1099s,” Investopedia, June 27, 2021, https://www.investopedia.com/financial-edge/0110/10-things-you-should-know-about-1099s.aspx.

[35] Nina Olson, “2011 Annual Report to Congress,” National Taxpayer Advocate, Dec. 31, 2011, https://www.taxpayeradvocate.irs.gov/wp-content/uploads/2020/08/IRS-TAS-ARC-2011-VOL-1.pdf.

[36] Demian Brady, “Tax Complexity 2021: Compliance Burdens Ease for Third Year in a Row After Tax Reform,” National Taxpayers Union, Apr. 15, 2021, https://www.ntu.org/foundation/detail/tax-complexity-2021-compliance-burdens-ease-for-third-year-since-tax-reform.

[37] Erica York and Alex Muresianu, “Reviewing Different Methods for Calculating Tax Compliance Costs,” Tax Foundation, Aug. 21, 2018, https://www.taxfoundation.org/different-methods-calculating-tax-compliance-costs/.

[38] Demian Brady, “Tax Complexity 2021: Compliance Burdens Ease for Third Year in a Row After Tax Reform.”

[39] Scott A. Hodge, “The Compliance Costs of IRS Regulations,” Tax Foundation, June 15, 2016, https://www.taxfoundation.org/compliance-costs-irs-regulations/.

[40] Youssef Benzarti, “How Taxing Is Tax Filing? Using Revealed Preferences to Estimate Tax Compliance Costs,” American Economic Journal: Economic Policy 12:4 (November 2020), https://www.aeaweb.org/articles?id=10.1257/pol.20180664.

[41] Using 2017 as the example year because the data being used predates changes made in the Tax Cuts and Jobs Act.

[42] Michael Keen and Joel Slemrod, “Optimal Tax Administration,” Journal of Public Economics 152 (August 2017), https://www.sciencedirect.com/science/article/abs/pii/S0047272717300658; see also Joel Slemrod, “Tax Compliance and Enforcement,” Journal of Economic Literature, 57:4 (December 2019), https://www.aeaweb.org/articles?id=10.1257/jel.20181437.

[43] Youssef Benzarti, “How Taxing Is Tax Filing? Using Revealed Preferences to Estimate Tax Compliance Costs.”

[44] Sebastian Eichfelder and Chantal Kegels, “Compliance Costs Caused by Agency Action? Empirical Evidence and Implications for Tax Compliance,” Journal of Economic Psychology 40 (February 2014), https://www.sciencedirect.com/science/article/abs/pii/S0167487012000980.

[45] Vijay A. DeSouza, “Information Technology: IRS Needs to Address Operational Challenges and Opportunities to Improve Management,” Government Accountability Office, Oct. 7, 2020, https://www.gao.gov/assets/gao-21-178t.pdf.

[46] Government Accountability Office, “Tax Fraud and Noncompliance: IRS Could Further Leverage the Return Review Program to Strengthen Tax Enforcement,” July 2018, https://www.gao.gov/assets/gao-18-544.pdf.

[47] Vijay DeSouza, “Information Technology: IRS Needs to Address Operational Challenges and Opportunities to Improve Management.”

[48] Erin Collins, “National Taxpayer Advocate: Annual Report to Congress,” Taxpayer Advocate Service, Dec. 30, 2020, https://www.taxpayeradvocate.irs.gov/wp-content/uploads/2021/01/ARC20_FullReport.pdf.

[49] Erin Collins, “National Taxpayer Advocate: Objectives Report to Congress, Fiscal Year 2022,” Taxpayer Advocate Service, June 30, 2021, https://www.taxpayeradvocate.irs.gov/wp-content/uploads/2021/06/JRC22_FullReport.pdf.

[50] Erin Collins, “National Taxpayer Advocate 2021 Purple Book: Compilation of Proposals to Strengthen Taxpayer Rights and Improve Tax Administration,” Taxpayer Advocacy Service, Dec. 31, 2020, https://www.taxpayeradvocate.irs.gov/wp-content/uploads/2021/01/ARC20_PurpleBook.pdf.

[51] U.S. Department of Treasury, “The American Families Plan Tax Compliance Agenda.”

[52] Scott A. Hodge, “The Compliance Cost of IRS Regulations.”

[53] Pete Sepp and Andrew Lautz, “14 Recommendations for Congress as They Attempt to Narrow the Tax Gap,” National Taxpayers Union, June 9, 2021, https://www.ntu.org/publications/detail/14-recommendations-for-congress-and-the-irs-as-they-attempt-to-narrow-the-tax-gap.

[54] Erin Collins, “National Taxpayer Advocate: Objectives Report to Congress, Fiscal Year 2022.”

[55] Steven M. Rosenthal, “Biden’s Effort to Close the Tax Gap is Well-Intentioned But Flawed,” Tax Policy Center, May 3, 2021, https://www.taxpolicycenter.org/taxvox/bidens-effort-close-tax-gap-well-intentioned-flawed.

[56] Erzo F.P. Luttmer and Monica Singhal, “Tax Morale,” Journal of Economic Perspectives 28:4 (Fall 2014), https://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.28.4.149.

[57] Grant Richardson, “Determinants of Tax Evasion: A Cross-Country Examination,” Journal of International Accounting, Auditing, and Taxation 15:2 (2006), https://www.sciencedirect.com/science/article/abs/pii/S1061951806000280.

[58] Rajul Awasthi and Nihal Bayraktar, “Can Tax Simplification Help Lower Tax Corruption,” The World Bank, Policy Research Working Paper 6988, July 2014, https://elibrary.worldbank.org/doi/abs/10.1596/1813-9450-6988.

[59] Garrett Watson, “Closing the Tax Gap and Improving the Tax Code are Complementary Goals,” Tax Foundation, Nov. 21, 2019, https://www.taxfoundation.org/closing-tax-gap-improving-tax-code/.

[60] Michael G. Allingham and Agnar Sandmo, “Income Tax Evasion: A Theoretical Analysis,” Journal of Public Economics 1 (1972), https://eml.berkeley.edu//~saez/course/Allingham&SandmoJPubE(1972).pdf; see also Charles T. Clotfelter, “Tax Evasion and Tax Rates: An Analysis of Individual Returns,” The Review of Economics and Statistics, 65:3 (August 1983), https://www.jstor.org/stable/1924181.

[61] Wojciech Kopczuk, “Tax Bases, Tax Rates, and the Elasticity of Reported Income,” Journal of Public Economics 89:11-12 (December 2005), http://www.columbia.edu/~wk2110/bin/taxBase.pdf.

[62] Emmanuel Saez, Joel Slemrod, and Seth H. Giertz, “The Elasticity of Taxable Income With Respect to Marginal Tax Rates: A Critical Review,” Journal of Economic Literature 50:1 (2012), https://eml.berkeley.edu/~saez/saez-slemrod-giertzJEL12.pdf.

[63] Ibid.

[64] Nicole Kaeding and Anna Tyger, “A Preliminary Look at 2018 Tax Return Data,” Tax Foundation, July 19, 2019, https://www.taxfoundation.org/2018-tax-return-data/.

[65] Erica York and Alex Muresianu, “The Tax Cuts and Jobs Act Simplified the Tax Filing Process for Millions of Households,” Tax Foundation, Aug. 7, 2018, https://www.taxfoundation.org/the-tax-cuts-and-jobs-act-simplified-the-tax-filing-process-for-millions-of-americans/.

[66] Scott Eastman, “The Alternative Minimum Tax Still Burdens Taxpayers,” Tax Foundation, Apr. 4, 2019, https://www.taxfoundation.org/alternative-minimum-tax-burden-compliance/.

[67] Erica York and Alex Muresianu, “The Tax Cuts and Jobs Act Simplified the Tax Filing Process for Millions of Households.”

[68] Kyle Pomerleau and Donald Schneider, “The Biden Administration’s Corporate Tax Statistic is Misleading,” Bloomberg Tax, Apr. 16, 2021, https://news.bloombergtax.com/daily-tax-report/the-biden-administrations-corporate-tax-statistic-is-misleading.

[69] Barry W. Johnson and Peter J. Rose, “Federal Tax Compliance Research: Tax Gap Estimates for Tax Years 2011-2013.”

[70] Alex Muresianu, “How Biden’s Corporate Tax Increases Could Make Tax Enforcement Harder,” Tax Foundation, May 18, 2021, https://www.taxfoundation.org/biden-tax-enforcement/.

[71] Scott Greenberg, “Reforming the Pass-Through Deduction,” Tax Foundation, June 21, 2018, https://taxfoundation.org/reforming-pass-through-deduction-199a/.

[72] Ari Glogower and David Kamin, “Missing the Mark: Evaluating the New Tax Preferences for Business Income,” National Tax Journal 71:4 (2018), http://www.ntanet.org/NTJ/71/4/ntj-v71n04p789-806-Evaluating-the-New-Tax-Preferences-for-Business-Income.html.

[73] Lucas Goodman, Katherine Lim, Bruce Sacerdote, and Andrew Whitten, “How Do Business Owners Respond to a Tax Cut? Examining the 199A Deduction for Pass-Through Firms,” National Bureau of Economic Research, Working Paper No. 28680, April 2021, https://www.nber.org/papers/w28680.

[74] Gary Guenther, “Section 199A Deduction: Economic Effects and Policy Options,” Congressional Research Service, Jan. 6, 2021, https://fas.org/sgp/crs/misc/R46650.pdf.

[75] Jason J. Fichtner, William G. Gale, and Jeff Trinca, “Tax Administration: Compliance, Complexity, and Capacity,” Bipartisan Policy Center, April 2019, https://bipartisanpolicy.org/wp-content/uploads/2019/04/Tax-Administration-Compliance-Complexity-Capacity.pdf.

[76] Samuel Hammond and David Koggan, “The IRS: A Broken Home in Need of Repair,” Niskanen Center, June 4, 2021, https://www.niskanencenter.org/the-irs-a-broken-home-in-need-of-repair/.

[77] Scott Hodge, “Testimony on Distribution and Efficiency of Spending in the Tax Code,” U.S. Senate Budget Committee, Mar. 9, 2011, /wp-content/uploads/2011/03/testimony_hodge_senate_budget_committee_2011-03-09.pdf.

[78] Matt Bruenig, “Now is the Time for an American Child Benefit,” People’s Policy Project, Jan. 14, 2021, https://www.peoplespolicyproject.org/wp-content/uploads/2021/01/AmericanChildBenefit.pdf.

[79] Dylan Matthews, “Biden’s Biggest Anti-Poverty Program Is a Reality. Here’s How He Can Make It Even Better,” Vox, July 15, 2021, https://www.vox.com/future-perfect/22543868/biden-child-tax-credit-july-15-monthly-payment.

[80] Erica York and Garrett Watson, “Sen. Romney’s Child Tax Reform Proposal Aims to Expand the Social Safety Net and Simplify Tax Credits,” Tax Foundation, Feb. 5, 2021, https://www.taxfoundation.org/child-allowance-romney-tax-proposal/.

Share this article