Key Findings

- The Section 232 tariffs on imports of steel and aluminum raised the cost of production for manufacturers, reducing employment in those industries, raising prices for consumers, and hurting exports.

- The jobs “saved” in the steel-producing industries from the tariffs came at a high cost to consumers, at roughly $650,000 per job saved according to the Peterson Institute for International Economics.

- A recent report from the U.S. International Trade Commission found that the tariffs increased the average prices of steel and aluminum by 2.4 percent and 1.6 percent, respectively, disproportionately hurting “downstream” industries that use steel and aluminum in their production processes.

- According to TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Foundation estimates, repealing the Section 232 tariffs and quotas would increase long-run GDP by 0.02 percent ($3.5 billion) and create more than 4,000 jobs.

- Other estimates, such as those from economists Lydia Cox and Kadee Russ, suggest the job losses from steel and aluminum tariffs were as high as 75,000.

Introduction

Economists have long recognized that tariffs on imports of intermediate inputs (i.e., goods that are used in the production process) can have a negative impact on the economy. While the tariffs may benefit producers of intermediate inputs and stimulate employment in protected industries, they often come at a high cost to other industries in the economy. Ultimately, the costs of tariffs are borne by consumers, who face higher prices for goods that use the tariffed inputs.

The Section 232 tariffs on steel and aluminum, enacted in 2018 under the Trump administration and continued under the Biden administration, fall into this camp of harmful economic policies. This paper provides an overview of Section 232 tariffs on steel and aluminum and shows how they have harmed the U.S. economy. Using the Tax Foundation’s General Equilibrium Model, we estimate that repealing the tariffs would boost long-run GDP and create thousands of jobs.

Background

Under Section 232 of the Trade Expansion Act of 1962, the president may impose tariffs if “an article is being imported in the United States in such quantities or under such circumstances as to threaten or impair the national security.” Since Section 232 was enacted, the Department of Commerce (DOC) has authorized 31 trade investigations, ruling in about half of the cases that the imports in question threatened national security.[1] Even so, in several the cases, the president did not take any action and in cases where actions were taken, the remedies were rarely tariffs. Prior to the Trump administration, the last presidential action under Section 232 occurred in 1986, when President Reagan signed voluntary export restraint agreements with trading partners regarding imports of metal-cutting and metal-forming machine tools.[2]

In 2017, President Trump asked the DOC to investigate alleged national security threats regarding imports of steel and aluminum. Notably, the DOC adopted a broader definition of national security to include the “general security and welfare of certain industries, beyond those necessary to satisfy national defense requirements,” in contrast to an earlier investigation initiated in 2001 under the Bush administration. The 2017 investigation generated nearly 300 comments, with domestic steel and aluminum producers supporting actions to reduce imports and producers in steel- and aluminum-consuming industries opposing them.[3]

The DOC concluded its investigation in early 2018, recommending that imports be reduced “to a level that should . . . enable U.S. steel mills to operate 80 percent or more of their rated production capacity.”[4] In 2017, the year preceding the tariffs, capacity utilization for the steel industry was 74 percent.[5] Following this, President Trump imposed 25 percent tariffs on $16 billion worth of imported steel and 10 percent tariffs on $9 billion worth of imported aluminum in March 2018. Several U.S. trading partners filed complaints with the World Trade Organization, arguing that the tariffs violated long-standing commitments as part of the General Agreement on Trade and Tariffs (GATT).[6] Canada, Mexico, China, the EU, India, Russia, and Turkey responded with retaliatory tariffs against U.S. exports.

Certain exemptions and exclusions were granted for particular countries. Australia was entirely exempt from the tariffs. South Korea, Brazil, and Argentina agreed to a steel quota, but all three were still subject to the aluminum tariffs. Additionally, for those three countries, the imported amount for any quarter could not exceed more than 30 percent of the total established quota.[7] The U.S., Canada, and Mexico eventually agreed to lift tariffs on each other following the signing of the United States-Mexico-Canada Agreement (USMCA), which included new rules of origin for automobiles produced in North America.[8]

After almost two years, the import tariffs failed to increase capacity utilization in the steel industry to 80 percent. President Trump responded in February 2020 by expanding the scope of covered imports to include $0.7 billion worth of “derivative” articles of steel and aluminum. He also stated in the summer of 2020 that he would reintroduce tariffs on Canadian aluminum, but eventually withdrew the request fearing retaliation.[9]

In April 2022, President Biden reached a deal with the EU and the UK to replace the tariffs with quotas for steel and aluminum, prompting the EU to lift its retaliatory tariffs on U.S. exports. Under the agreement, the EU may export tariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers that raise prices, reduce available quantities of goods and services for US businesses and consumers, and create an economic burden on foreign exporters. -free up to 3.3 million tons of steel, 18,000 metric tons of raw (unwrought) aluminum, and 363,000 metric tons of semi-finished (wrought aluminum, quotas that may be adjusted annually.[10] Biden reached a similar deal with Japan for steel, leaving the aluminum tariffs in place.[11] Although the Biden administration has recently expressed interest in increasing the Section 301 tariffs on steel and aluminum imports from China, no other major changes have been announced to the Section 232 tariffs since 2022.

The Economic Effects of Tariffs on Steel and Aluminum Historically

President Trump was not the first president to target steel imports. In the late 1970s, the Carter administration imposed “antidumping” or countervailing duties on steel imports from Japan if imports fell below a specified price. Eventually, President Reagan negotiated a quota system through voluntary export restraint agreements with Japan and other trading partners. Research by economists Stefanie Lenway, Randall Morck, and Bernard Yeung found that these trade actions increased rent-seeking by less productive steel firms and reduced R&D spending and innovation.[12] As of May 2024, 304 anti-dumping and countervailing duties orders are in place for steel-related imports, and 68 for other metals and articles of metal.[13]

In 2002, President Bush imposed tariffs on steel ranging from 8 to 30 percent after a Section 201 investigation concluded that current steel imports posed “a substantial threat of serious injury” to the steel industry. The tariffs were scheduled to be in effect for three years, but President Bush rescinded them after two, fearing retaliation from other countries after the WTO ruled that the tariffs violated international commitments.[14]

Nonetheless, even in the brief window that the tariffs were in effect, economist Lydia Cox concluded that they had persistent negative effects in “downstream” industries that use steel as intermediate inputs.[15] Rather than absorbing the tariffs, foreign exporters passed them almost entirely to U.S. firms. For industries that were highly exposed, exports fell sharply during the period the tariffs were in effect and remained depressed even after they were lifted for the next eight years. Given how disruptive tariffs are to trade patterns, even temporary ones can generate lasting effects.[16]

Because there are many more steel-consuming than steel-producing industries in the U.S., the Section 201 tariffs likely lowered manufacturing employment. Economists Joseph Francois and Laura Baughman estimated that the Bush tariffs decreased employment by between 50,000 and 197,000 workers, depending on the definition of steel-consuming industry used.[17]

The U.S. International Trade Commission (USITC) found comparatively smaller effects, estimating a less than 0.01 percent hit to GDP, which implies a smaller employment loss.[18] Nonetheless, the tariffs themselves can be quite onerous for the exposed industries. For example, the USITC found that returns to capital declined by more than $600 million in steel-consuming industries.

The Economic Effects of the Trump and Biden Section 232 Tariffs

Broadly, economists have reached negative conclusions regarding the impacts of the recent Section 232 tariffs on the economy. Lydia Cox and Kadee Russ, using an estimate derived from a Federal Reserve Board paper, calculated that the Section 232 tariffs reduced manufacturing employment by about 75,000 jobs.[19] Kyle Handley and other economists looked at the impacts of the import tariffs on export growth in the U.S. and found that companies exposed to the Section 232 tariffs experienced reduced export growth. This occurred because the cost of their inputs rose due to the tariffs, which hindered firms’ ability to increase their exports. For each 1 percent increase in the tariffs on steel and aluminum, export growth fell by 0.11 percent.[20]

The Peterson Institute for International Economics concluded that the tariffs would only create about 8,700 jobs in the steel industry and would come at a high cost as well. The Section 232 tariffs would raise aggregate income in the steel industry by about $2.4 billion in 2018 but raise costs for steel consumers by about $5.6 billion. This implies a cost of nearly $650,000 for every job created.[21]

Contrary to the intentions of the policy’s creators, it is even less clear that the tariffs have aided the communities they were designed to help. Economist David Autor and his coauthors examined the impacts of the Trump administration’s tariffs on commuting zones with industries that faced protection and found that the tariffs failed to raise employment across these communities. They noted that the jobs “saved” in the protected industries were completely offset by jobs lost in the “customer” industries that used tariffed goods as inputs into production. On the steel and aluminum tariffs specifically, they had this to say: “The adverse spillover effect to customer industries may be particularly important for firms that rely on steel and aluminum inputs, given that US tariffs on these products applied to most trade partners and allowed little room for trade diversion.”[22]

The aluminum tariffs in particular have disproportionately harmed certain industries. For example, the beverage industry saw its costs rise by $2.2 billion nearly six years after the tariffs were imposed, with 94 percent going to U.S. rolling mills, U.S. smelters, and Canadian smelters, and the remainder going to the U.S. Treasury, according to one analysis by the research group HARBOR Aluminum.[23] Ford and General Motors estimated that the tariffs cost them about $1 billion each the first year they were in effect—roughly $700 per vehicle produced.[24]

In many cases, firms may face the tariff-burdened price even if the type of aluminum itself is not covered by Section 232. This occurs because firms that use aluminum as inputs typically buy it in bulk, often scrap or recycled content, based on a specific pricing formula. Although recycled content is supposed to be exempt from the tariffs, aluminum producers charge what is known as the “Midwest Premium” price, a benchmark price that accounts for regional variations in supply and demand.[25]

For example, following the immediate announcement of the tariffs, the Midwest Premium price rose by 11.8 percent, larger than the 10 percent tariff on primary aluminum.[26] While broader supply and demand factors determine the price of aluminum, this provides suggestive evidence that aluminum producers may raise prices in excess of tariffs.

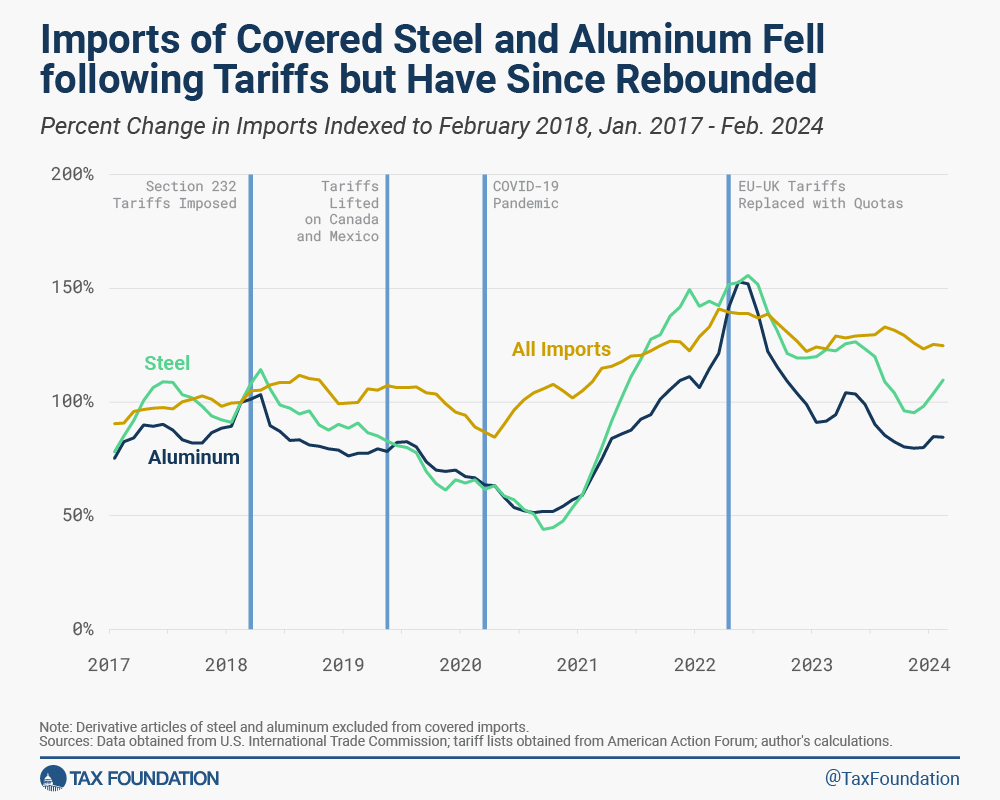

The totality of evidence suggests that the costs of tariffs have largely been borne by U.S. consumers and firms. Federal Reserve Board economist Mary Amiti along with other academics found complete pass-through to U.S. consumers and firms the first year the steel tariffs were in effect. In the following years, the pass-through rate fell 50 percent, implying that half of the costs were borne by foreign exporters of steel—mostly the EU, South Korea, and Japan. Although certain exporters lowered prices somewhat in response to the tariffs, U.S. firms and consumers still paid higher prices than they would have without the tariffs.[27] Imports of covered steel declined by 39 percent in the two years following the tariffs, prior to the COVID-19 pandemic, while imports of covered aluminum declined by 24 percent over the same period (Figure 1). Covered steel imports continued to fall until September 2020 and then rebounded significantly, but have since fallen to their 2018 levels. Notably, imports of covered steel recovered much more rapidly than overall U.S. imports, which exhibited a similar upward trajectory as the pandemic began winding down. Covered aluminum imports began rising sharply in early 2021 after bottoming out in August 2020 and continued to increase until the summer of 2022, having now also fallen to their 2018 levels.

To isolate specifically the impacts of tariffs on import volumes and prices, and abstract from the broader trends in the steel and aluminum industries and COVID-related supply shocks, the USITC developed economic models to control for other factors and published a report on its findings in March 2023. While the analysis does not look at broad, economy-wide impacts, as our own modeling does later in this report, it considers the effects of the tariffs on the steel and aluminum industries, as well as the “downstream” industries that use steel and aluminum in production.[28]

Table 1. USITC Estimates of the Section 232 Tariffs’ Economic Effects

| Steel | Aluminum | |

|---|---|---|

| Change in Imports | -24% | -31.1% |

| Change in Production | +1.9% | +3.6% |

| Change in Imported Price | +22.7% | +8.0% |

| Change in Average Price | +2.4% | +1.6% |

| Change in Domestic Price | +0.7% | +0.9% |

As expected, the tariffs significantly increased the prices of imported steel and aluminum subject to the tariffs. Prices increased by 22.7 percent for covered steel and by 8.0 percent for covered aluminum. Much like the studies cited earlier, the USITC report found a nearly complete pass-through of the tariffs to U.S. importers. The USITC estimated that the tariffs reduced steel and aluminum imports on average by 24 percent and 31.1 percent, respectively.

Overall steel and aluminum prices, beyond the covered products, rose as well. The average price of steel and aluminum increased by 2.4 percent and 1.6 percent, and prices of domestically produced steel and aluminum increased by 0.7 and 0.9 percent, respectively, due to the tariffs. The tariffs increased steel production by 1.9 percent, amounting to $1.5 billion, and aluminum by 3.6 percent, amounting to $1.3 billion, all on average each year.

As a consequence of the increased prices, many industries that use steel and aluminum in their production were negatively impacted. The USITC report found that “downstream” industries experienced an annual $3.4 billion decrease in production from 2018 to 2021 due to the price increases, a 0.6 percent reduction per year on average. The construction and the automotive industries were the most impacted by the steel tariffs, accounting for 47 percent and 25 percent of all steel consumption, respectively.

The transportation, construction, and packaging industries were most impacted by the aluminum tariffs, with the packing industry accounting for 35 percent of aluminum consumption in 2021. However, other industries where aluminum constitutes a large share of production costs, but not necessarily the largest volume, also faced strongly negative effects from the tariffs. For instance, aluminum accounts for 18.4 percent of the production costs in the soft drink and ice manufacturing industry.

Currently, just over half of all aluminum used in production is imported, according to one estimate by HARBOR Aluminum.[29] And around 78 percent of all steel is imported.[30] As imports constitute a significant share of steel and aluminum used in production, tariffs can have notable impacts on producer prices in manufacturing.

Looking at the industry level, the tariffs immediately increased producer prices at foundries and refineries. The primary metals and fabricated metals industries saw their prices increase by 6 percent and 4 percent, respectively, one year after the tariffs were imposed.[31] As noted earlier, based on research studying export growth in steel- and aluminum-consuming industries, these costs were eventually passed onto other consumers through higher prices, ultimately reducing their exports.

An additional concern with the Section 232 tariffs, and tariff policy in general, is the potential for what Cato scholar Scott Lincicome terms “cascading protectionism.”[32] In other words, tariffs ultimately beget more tariffs. Consider the case of aluminum. When producers of primary aluminum in the U.S. complained that they were still losing money after the Section 232 tariffs were proposed, they argued that they were still being undercut by “downstream” industries overseas that were not subject to the tariffs and could offer lower prices for their goods to American consumers. As a consequence, the Trump administration then applied the Section 232 tariffs to derivative articles of aluminum and imposed anti-dumping and countervailing duties on aluminum sheet ranging from 5 percent to 242 percent.

Similarly, the tariff exclusion process is rife with political favoritism for select companies. While it is generally preferable that as few companies as possible face the tariffs since they are so harmful to the economy, companies can take advantage of the exclusion process to shield themselves. For example, Kodak asked for duties on imported printing plates, a derivative aluminum product, arguing that Japanese competitor Fujifilm was undercutting it.[33] It then subsequently asked for an exclusion on imported plates from Europe, since it has a manufacturing facility in Germany that exports such plates to Kodak’s U.S. facilities. And Kodak has already successfully petitioned the government to exclude it from the Section 232 tariffs in general, as the tariffs on the raw materials hurt its bottom line, even while demanding further duties on other aluminum products.

Modeling the Revenue and Economic Impacts of Repealing the Section 232 Tariffs

Currently, $2.7 billion worth of tariffs remain on $53 billion of steel and aluminum (based on 2023 import levels), down from about $5 billion when the tariffs were first imposed in 2018.[34] Changes to tariff policy have somewhat dampened the negative effects. Exempting Canada—the largest exporter of aluminum to the U.S.—from the tariffs mitigated some of the harmful impacts, although as noted earlier, purchasers of aluminum are still generally paying tariff-burdened prices. Similarly, President Biden exempting the EU—the largest exporter of steel to the U.S.—from most of the tariffs likely further reduced the harm.[35] Nonetheless, a significant share of U.S. imports of steel and aluminum are still subject to the tariffs, and even temporary tariffs can have persistent effects, as explained earlier.[36] We estimate that repealing the steel and aluminum tariffs and the quotas would boost long-run GDP by 0.02 percent and create more than 4,000 jobs. Notably, our GDP estimates are comparable to the USITC’s original estimate for the Bush steel tariffs. Government revenues per year would decline by $2.2 billion, slightly less than the $2.7 billion currently raised through the tariffs due to the increased income and payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. revenue from the boost to GDP.

Table 2. Economic Effects of Repealing Section 232 Tariffs

| Long-Run GDP | +0.02% |

| GDP (Billions) | +$3.5 |

| Change in Revenue per Year (Billions) | -$2.2 |

| Wages | +0.01% |

| Capital Stock | +0.02% |

| FTE Jobs | +4,330 |

If other countries withdrew their retaliatory tariffs on U.S. exports, totaling $1.6 billion, there would be further economic benefits. GDP would increase by an additional $2.1 billion, or 0.01 percent.

Conclusion

Although the tariffs were enacted to address national security concerns, they have had negative unintended consequences on American industries and consumers. While steel- and aluminum-producing industries may have experienced a short-run boost in employment due to the tariffs, it came at a high cost to purchasers of steel and aluminum, with one estimate suggesting a cost of $650,000 per job created in the steel industry. Downstream industries that use steel and aluminum were negatively affected, experiencing an annual $3.4 billion loss in production from 2018 to 2021. Because tariffs are taxes on imports and raise the cost of production, we estimate that repealing the Section 232 tariffs would strengthen the U.S. economy and create jobs.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Rachel F. Fefer et al., “Section 232 Investigations: Overview and Issues for Congress,” Congressional Research Service, May 18, 2021, https://crsreports.congress.gov/product/pdf/R/R45249.

[2] Ibid.

[3] Ibid.

[4] Ibid.

[5] St. Louis Federal Reserve Economic Data (FRED), “Capacity Utilization, Manufacturing, Durable Goods, Iron and Steel Products.”

[6] Marin Weaver, “Section 232 and 301 Trade Actions in 2018,” U.S. International Trade Commission, accessed Sep. 12, 2022, https://www.usitc.gov/research_and_analysis/trade_shifts_2018/special_topic.htm.

[7] Proclamation No. 9759, 83 Fed. Reg. 25857 (June 5, 2018).

[8] Ibid.

[9] Rachel F. Fefer et al., “Section 232 Investigations: Overview and Issues for Congress,” Congressional Research Service, May 18, 2021, https://crsreports.congress.gov/product/pdf/R/R45249.

[10] Congressional Research Service, “What’s in the New U.S.-E.U. Steel and Aluminum Deal,” CRS Report IN11799, Nov. 12, 2021.

[11] Erica York, “Tracking the Economic Impact of U.S. Tariffs and Retaliatory Actions,” Tax Foundation, Apr. 1, 2022, https://taxfoundation.org/tariffs-trump-trade-war/.

[12] Stefanie Lenway, Randall Morck, and Bernard Yeung, “Rent Seeking, Protectionism, and Innovation in the American Steel Industry,” The Economic Journal 106:435 (March 1996): 410-421, https://pages.stern.nyu.edu/~byeung/rentseeking.pdf.

[13] Department of Commerce, ADCVD Proceedings, accessed May 13, 2024, https://www.trade.gov/data-visualization/adcvd-proceedings.

[14] Lydia Cox, “The Long-Term Impact of Steel Tariffs on U.S. Manufacturing,” Harvard University Department of Economics (Nov. 7, 2021), https://scholar.harvard.edu/files/lydiacox/files/cox_steel_tariffs_jmp.pdf.

[15] Ibid.

[16] Ibid.

[17] Joseph Francois and Laura M. Baughman, “The Unintended Consequences of U.S. Steel Import Tariffs: A Quantification of the Impact During 2002,” Trade Partnership Worldwide, LLC (Feb. 4, 2003), https://tradepartnership.com/wp-content/uploads/2014/06/2002jobstudy.pdf.

[18] Bonnie J. Noreen et al., “Steel-Consuming Industries: Competitive Condition with Respect to Steel Safeguard Measures,” U.S. International Trade Commission (September 2003), https://www.usitc.gov/publications/safeguards/3632/pub3632_vol3_all.pdf.

[19] Kadee Russ and Lydia Cox, “Steel Tariffs and U.S. Jobs Revisited,” EconoFact, Feb. 6, 2020, https://econofact.org/steel-tariffs-and-u-s-jobs-revisited.

[20] Kyle Handley, Fariha Kamal, and Ryan Monarch, “Rising Import Tariffs, Falling Export Growth: When Modern Supply Chains Meet Old-Style Protectionism,” National Bureau of Economic Research, Working Paper 26611 (August 2020), https://www.nber.org/papers/w26611.

[21] Gary Clyde Hufbauer and Euijin Jung, “Steel Profits Gain, but Steel Users Pay, under Trump’s Protectionism,” Peterson Institute for International Economics, Dec. 20, 2018, https://www.piie.com/blogs/trade-and-investment-policy-watch/steel-profits-gain-steel-users-pay-under-trumps.

[22] David Autor et al., “Help for the Heartland? The Employment and Electoral Effects of the Trump Tariffs in the U.S.,” National Bureau of Economic Research, Working Paper 32082 (January 2024), https://www.nber.org/papers/w32082.

[23] Beer Institute, “New Research Shows the Tariffs on Aluminum Have Cost the U.S. Beverage Industry Nearly $2.2 Billion,” Dec. 5, 2023, https://www.beerinstitute.org/press-releases/new-research-shows-tariffs-on-aluminum-have-cost-the-u-s-beverage-industry-nearly-2-2-billion/.

[24] Michael Schultz et al., “U.S. Consumer & Economic Impacts of U.S. Automotive Trade Policies,” Center for Automotive Research, February 2019, https://www.cargroup.org/wp-content/uploads/2019/02/US-Consumer-Economic-Impacts-of-US-Automotive-Trade-Policies-.pdf.

[25] S&P Global, “Platts Aluminum Midwest Premium Explained,” accessed Sep. 12, 2022, https://www.spglobal.com/en/perspectives/platts-aluminum-midwest-premium-explained.

[26] Douglas Holtx-Eakin and Jacqueline Varas, “Do Tariffs Impact Aluminum Prices? The Case of Aluminum,” American Action Forum, Jan. 28, 2020, https://www.americanactionforum.org/research/do-tariffs-impact-prices-the-case-of-aluminum/.

[27] Mary Amiti, Stephen J. Redding, and David E. Weinstein, “Who’s Paying for the U.S. Tariffs? A Longer-Term Perspective,” American Economic Association Papers and Proceedings 110 (May 2020): 541–546, http://www.princeton.edu/~reddings/pubpapers/ARW-May-2020.pdf.

[28] David S. Johanson et al, “Economic Impact of Section 232 and 301 Tariffs on U.S. Industries,” U.S. International Trade Commission, March 2023, https://www.usitc.gov/publications/332/pub5405.pdf.

[29] Kust Desai, “Fact Check: Does the U.S. Import 90% of its Aluminum?,” CheckYourFact, Mar. 8, 2018, https://checkyourfact.com/2018/03/08/fact-check-us-imports-90-percent-aluminum/.

[30] Meghan Keneally, “Key Facts about the U.S. Steel and Aluminum Industries,” ABC News, Mar. 8, 2018, https://abcnews.go.com/Business/key-facts-us-steel-aluminum-industries/story?id=53616380.

[31] International Trade Administration, “ITA Manufacturing Industry Tracker,” accessed Sep. 12, 2022, https://www.trade.gov/data-visualization/ita-manufacturing-industry-tracker

[32] Scott Lincicome, “Aluminum Tariff Follies,” Cato Institute, Feb. 14, 2024.

[33] Ibid.

[34] U.S. International Trade Commission Database, “Imports for Consumption,” accessed May 14, 2024.

[35] Mary Amiti, Sebastian Heise, and Noah Kwicklis, “Will New Steel Tariffs Protect U.S. Jobs?,” Liberty Street Economics, Apr. 19, 2018, https://libertystreeteconomics.newyorkfed.org/2018/04/will-new-steel-tariffs-protect-us-jobs/.

[36] See “Tracking the Economic Impact of U.S. Tariffs and Retaliatory Actions” for our original estimates. Differences are due to changes to the Section 232 tariffs since they were implemented and changes to the model baseline to reflect current economic and budget conditions. See Erica York, “Tracking the Economic Impact of U.S. Tariffs and Retaliatory Actions,” Tax Foundation, Jul. 7, 2023, https://taxfoundation.org/tariffs-trump-trade-war/.

Share this article