Philadelphia Mayor Jim Kenney is expected to propose a large soda taxA soda tax, often discussed under a broader policy category of a sugar-sweetened beverage tax, is an excise tax on sugary drinks. Most soda taxes apply a flat rate tax per ounce of a sugar-sweetened beverage, though some jurisdictions levy an ad valorem tax based on the beverage’s price. tomorrow when he presents his budget recommendations to the city council. The mayor expects that the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , which would be levied at 3 cents per ounce, would raise $400 million over five years. Most of that revenue is earmarked for increased spending on prekindergarten education, the Wall Street Journal reported this week.

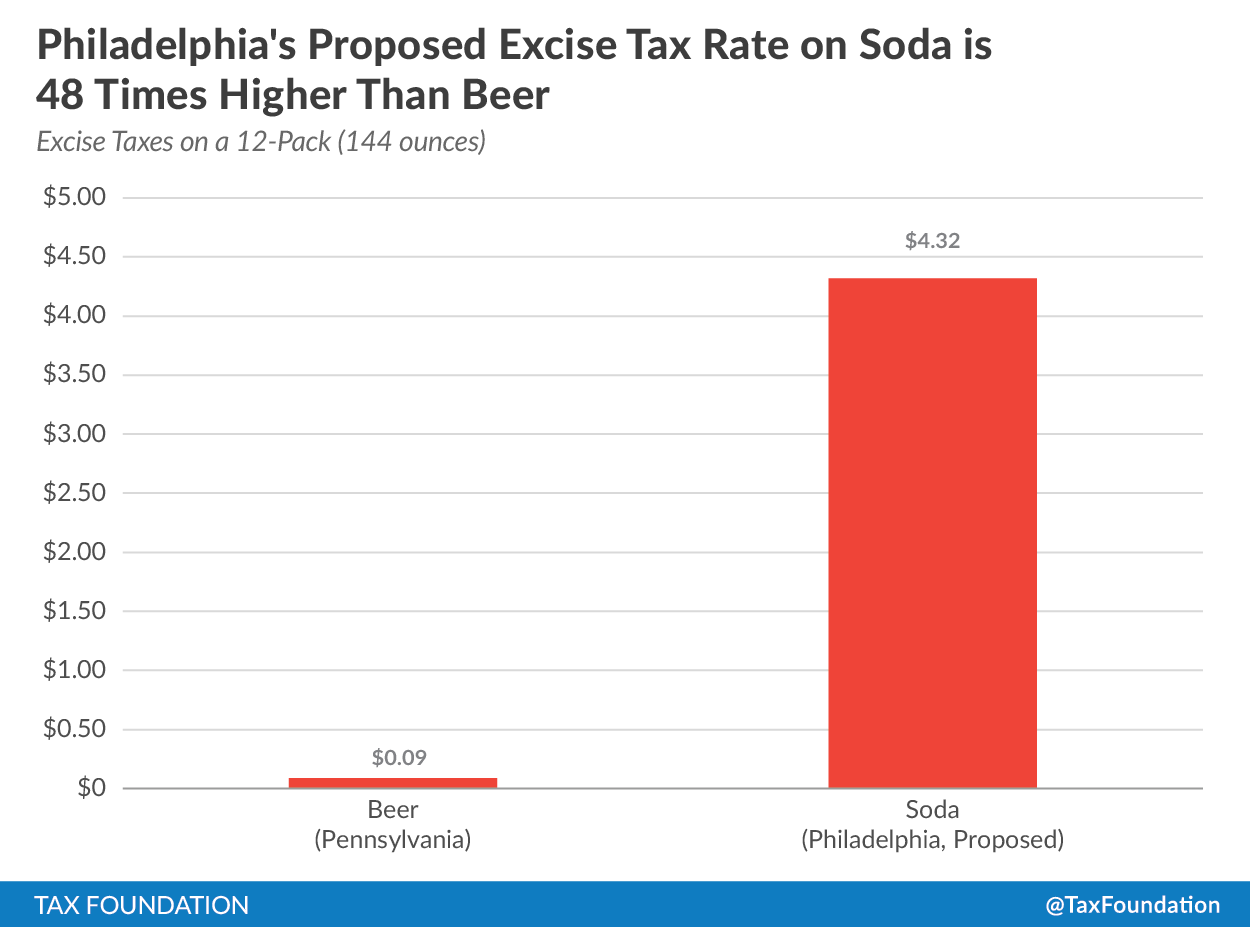

Three cents an ounce is a very large tax, and the largest soda tax proposal I’ve seen since I started writing about this issue in 2011. Thought of another way, that’s 36 cents tax per can of soda, or $4.32 tax per 12 pack of soda. For reference, a 12 pack of beer is subject to an excise tax rate of $0.09 in Pennsylvania. So this proposal would be an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. 48 times larger than the current beer excise tax.

Soda tax proposals in Philadelphia aren’t new, as former Mayor Nutter proposed them in what seemed like every year of his tenure, but the peculiar thing about this proposal, other than its size, is that it is chiefly being sold as a revenue measure, rather than an obesity reduction scheme.

Tying the revenues for a pre-K program to soda tax collections could be very problematic. Suppose a) the tax “works,” and people stop drinking soda all together. You’ve stopped soda consumption, but now you’ve got a lot of underfunded preschoolers. Or maybe suppose b) people continue drinking soda, but they just don’t buy it within the city limits of Philadelphia and instead purchase it in Camden or other surrounding suburbs which don’t have this outrageously large soda tax. Now you’ve got the same hole in your pre-K budget, and there are still people drinking soda. Both of these scenarios are possible, and the second one is the most likely.

If public pre-K is worth funding, it’s worth funding with real, broad based taxes like income and sales taxes. Those taxes provide much more stable revenue. You can’t lean on a gimmick like this to sustain an ongoing important educational program.

Follow Scott on Twitter.

Share this article