TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy discussions have recently given significant attention to income taxes, but it’s important to recognize the other taxes that Americans face. As a new report by the Joint Committee on Taxation (JCT) shows, for all the attention income taxes receive, the tax burden for most Americans comes primarily from payroll taxes, not income taxes.

There are two primary payroll taxes in the United States: the Social Security payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. (at a rate of 12.4 percent) and the Medicare payroll tax (at a rate of 2.9 percent). While the Medicare payroll tax applies to all labor earnings, the Social Security payroll tax applies only to an individual’s first $132,900 of wages and self-employment income. This cap on the Social Security payroll tax is indexed to wage inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. .

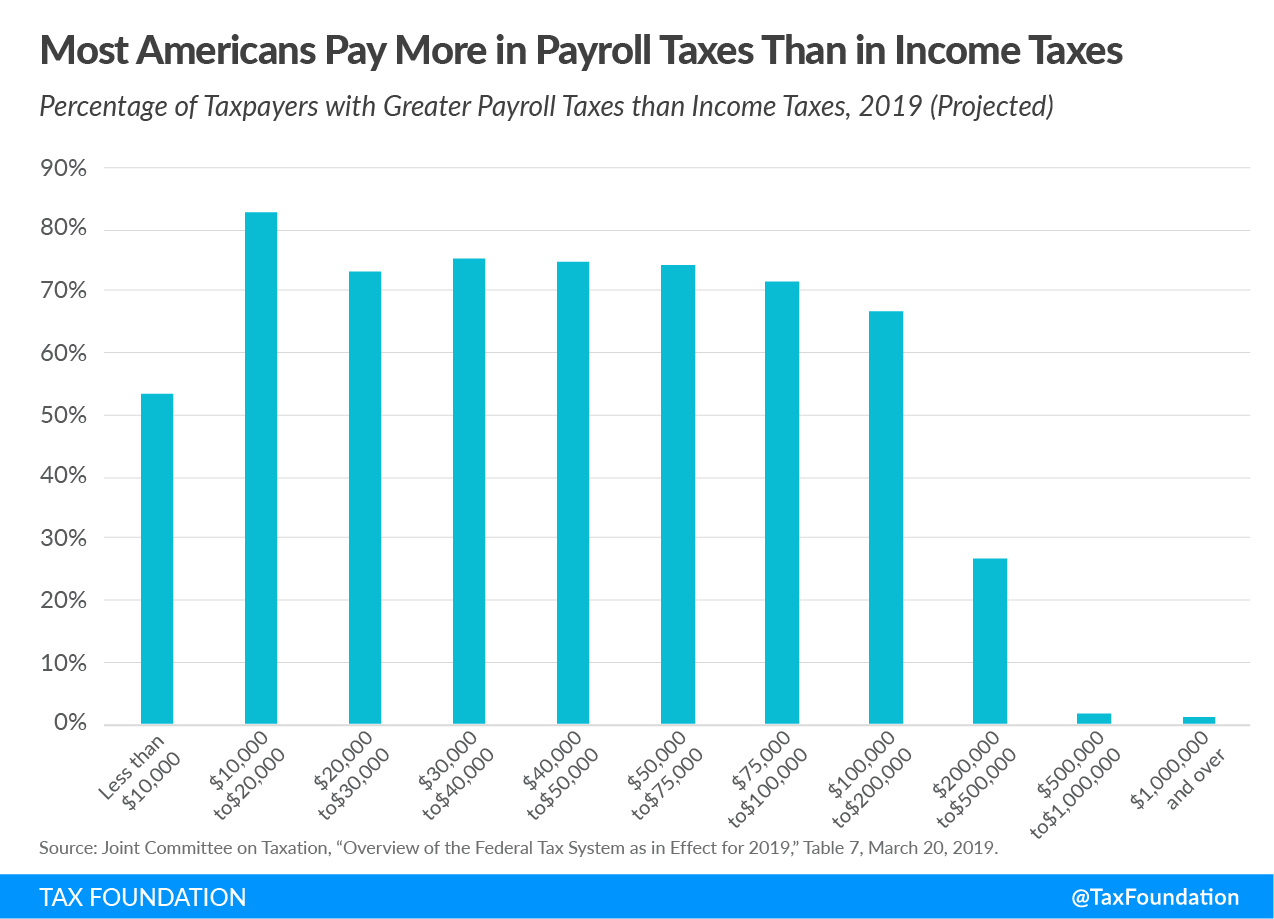

The following chart, based on data from the JCT report, shows the percentage of taxpayers projected to pay more in payroll taxes than in income taxes in 2019. The majority of taxpayers in every income group up to taxpayers earning up to $200,000 annually will face a greater burden from payroll taxes than from income taxes. In total, 67.8 percent of taxpayers will pay mostly payroll taxes.

One possible reason for the relatively heavy payroll tax burden is the Tax Cuts and Jobs Act, which lowered taxes for most individuals. Because income taxes are now lower for most low- and middle-income Americans, payroll taxes have risen relative to income taxes as a share of the overall tax burden.

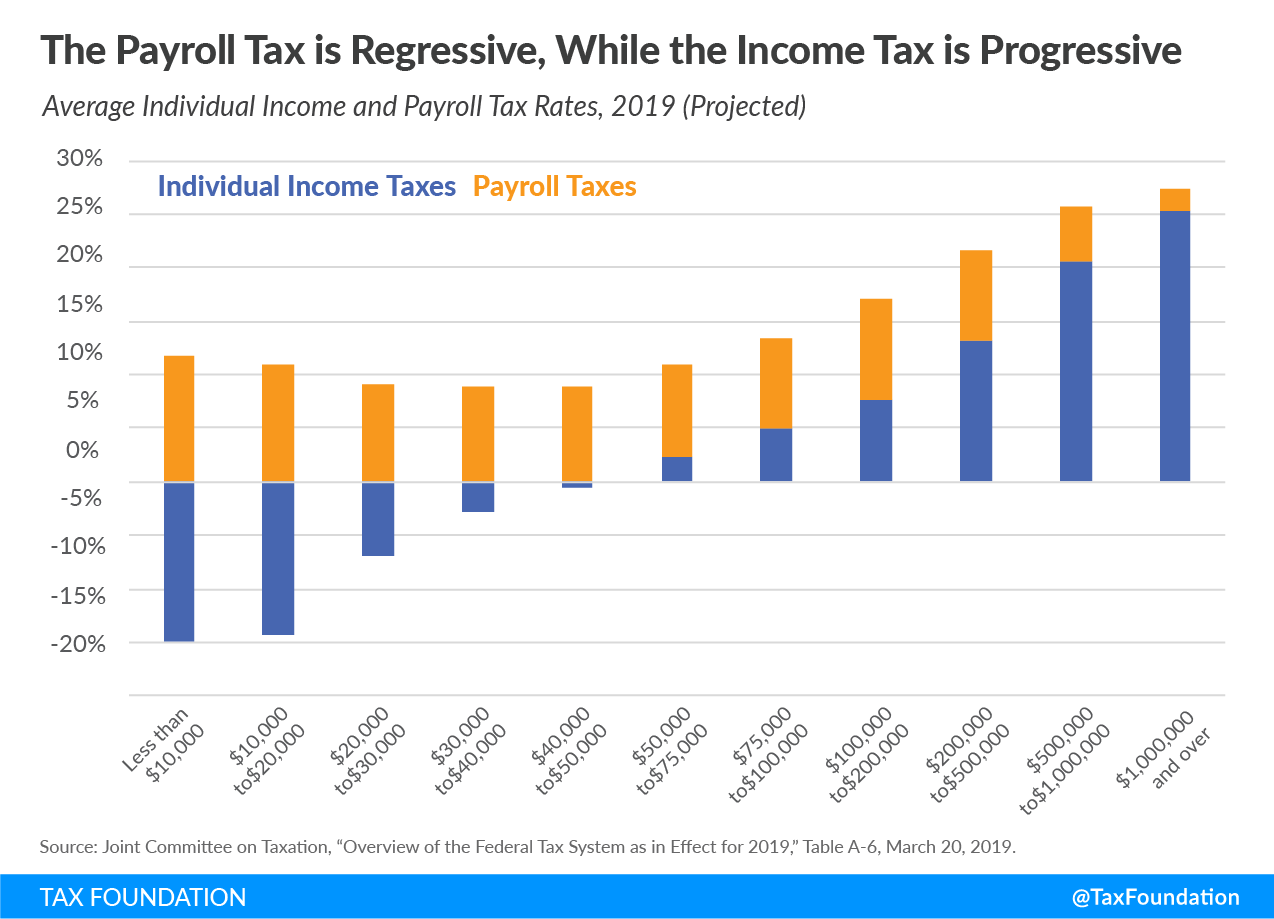

Payroll and income tax rates also differ in how their average rates change with income. The following chart shows the JCT’s 2019 projections of the average income and payroll tax rates.

The payroll tax is regressive, with the highest average rate falling on Americans with the lowest incomes. For example, for people making between $30,000 and $40,000, the average payroll tax rate is projected to be 8.8 percent, while for those making between $500,000 and $1 million, the average rate is projected to be 5 percent. This is in part due to the impact of the cap on taxable wages. In contrast, the income tax is progressive, with the average rate rising with income. For example, those making between $30,000 and $40,000 will pay an average income tax rate of -2.9 percent, while those making between $500,000 and $1 million will pay an average rate of 20.7 percent.

What makes it possible to have a negative income tax rate—in other words, to have one’s income increase—is a number of refundable tax credits, including the Earned Income Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. and Child Tax Credit. I recently noted the impact of negative rates on the distribution of the income tax burden:

As fewer Americans pay income taxes, the remaining taxpayers shoulder a greater share of the burden. As a result, the income tax burden has grown more progressive over time. From 1986 to 2016, for example, the top 1 percent’s share of income taxes rose from 25.8 percent to 37.3 percent, while the bottom 90 percent’s share fell from 45.3 percent to 30.5 percent.

As the JCT report makes clear, policymakers and the public would do well to keep in mind the importance and regressivity of payroll taxes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeNote: This is part of our “Putting a Face on America’s Tax Returns” blog series

- Who Shoulders the Burden of Federal Income Taxes?

- America Already Has a Progressive Tax System

- The Composition of Federal Revenue Has Changed Over Time

- The Top 1 Percent’s Tax Rates Over Time

- Who Benefits from Itemized Deductions?

- Income Taxes on the Top 0.1 Percent Weren’t Much Higher in the 1950s

- How Do Transfers and Progressive Taxes Affect the Distribution of Income?

- A Growing Percentage of Americans Have Zero Income Tax Liability

- Increasing Individual Income Tax Rates Would Impact a Majority of U.S. Businesses

- Average Income Tends to Rise with Age