New Jersey lawmakers are again considering increasing the state’s high corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate after Senate President Stephen Sweeney (D) first raised the idea in March. The proposal would create a temporary “surcharge” in the corporate tax, increasing the rate from 9 percent to 12 percent for businesses with income above $1 million.

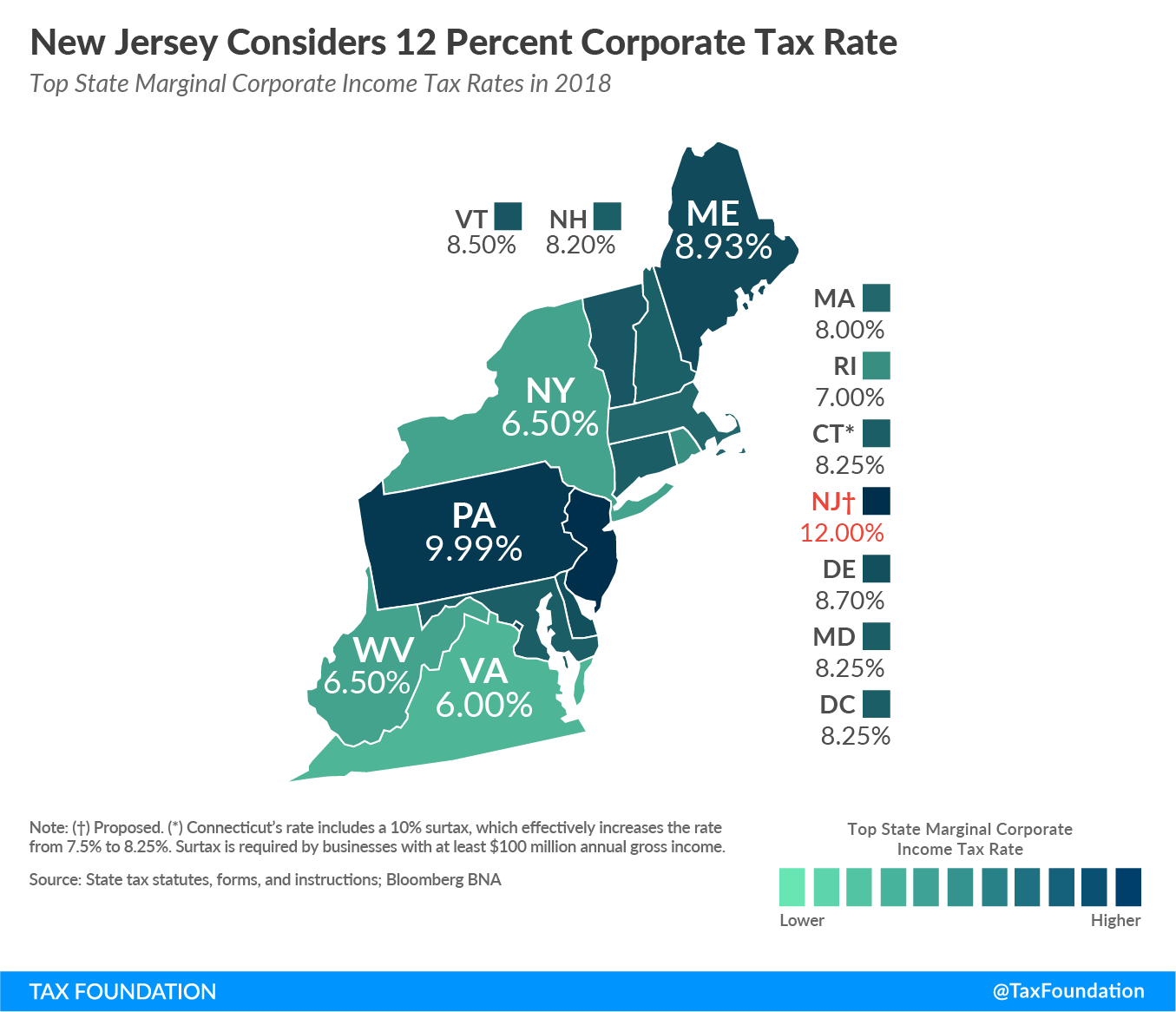

That would tie New Jersey with Iowa for the highest corporate tax rate in the country (though Iowa’s corporate rate will be reduced starting in 2021). New Jersey ranks last overall in our State Business Tax Climate Index, and while the state’s corporate tax is currently less than neighboring Pennsylvania’s, the increase would place it above both Pennsylvania’s 9.99 percent and neighboring New York’s 6.5 percent rates.

Sweeney has pointed to the recently-enacted federal corporate tax cut contained in the Tax Cuts and Jobs Act as justification for the rate increase, stating, “We’re rebalancing this and trying to treat taxpayers more fairly than Washington did.” Yet, as we wrote regarding the plan in March:

While corporations are indeed getting a tax cut relative to last year, New Jersey’s state tax policies are still evaluated by prospective businesses relative to 49 other states. …

Corporate capital is highly mobile; that is, if you tax it too much, it tends to move (and then you can’t get any revenue out of it…[some states] are already using state revenue windfalls created by federal tax reform as an opportunity to lower corporate and individual income tax rates.

According to a recent report by the New Jersey Business and Industry Association, “Regional competitors New York (6.5 percent) and Massachusetts (8 percent) have decreased their [corporate business tax] and currently have the most competitive rates in the region.”

“A CBT surcharge would only incentivize our larger corporations to expand their operations elsewhere,” NJBIA President and CEO Michele Siekerka argued. “And if they’re stagnating here, that’s just as bad as outmigration for New Jersey.”

Under the tax plan of Governor Phil Murphy (D), taxpayers may face higher taxes as well. Proposed tax hikes include increasing the sales tax from 6.625 percent to 7 percent and raising taxes on income above $1 million from 8.97 percent to 10.75 percent.

As New Jersey lawmakers spar over the upcoming budget deadline and weigh various revenue-raising options, they should consider the long-term effects a corporate tax hike would have on the state’s business climate and revenue over a short-term revenue increase.

Share this article