The corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. is one of the smallest sources of state taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue. According to Census data, in FY 2015, the corporate income tax only comprised 5.3 percent of state tax collections. As we outlined earlier this year, there are several reasons why the corporate income tax share is so low on average.

Some mistake the corporate income tax as the entirety of a business’s tax burden. However, businesses pay many types of taxes outside of the corporate income tax, including sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. , property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. , excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. , payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. , and more. The corporate income tax makes up only 9.5 percent of total business taxes.

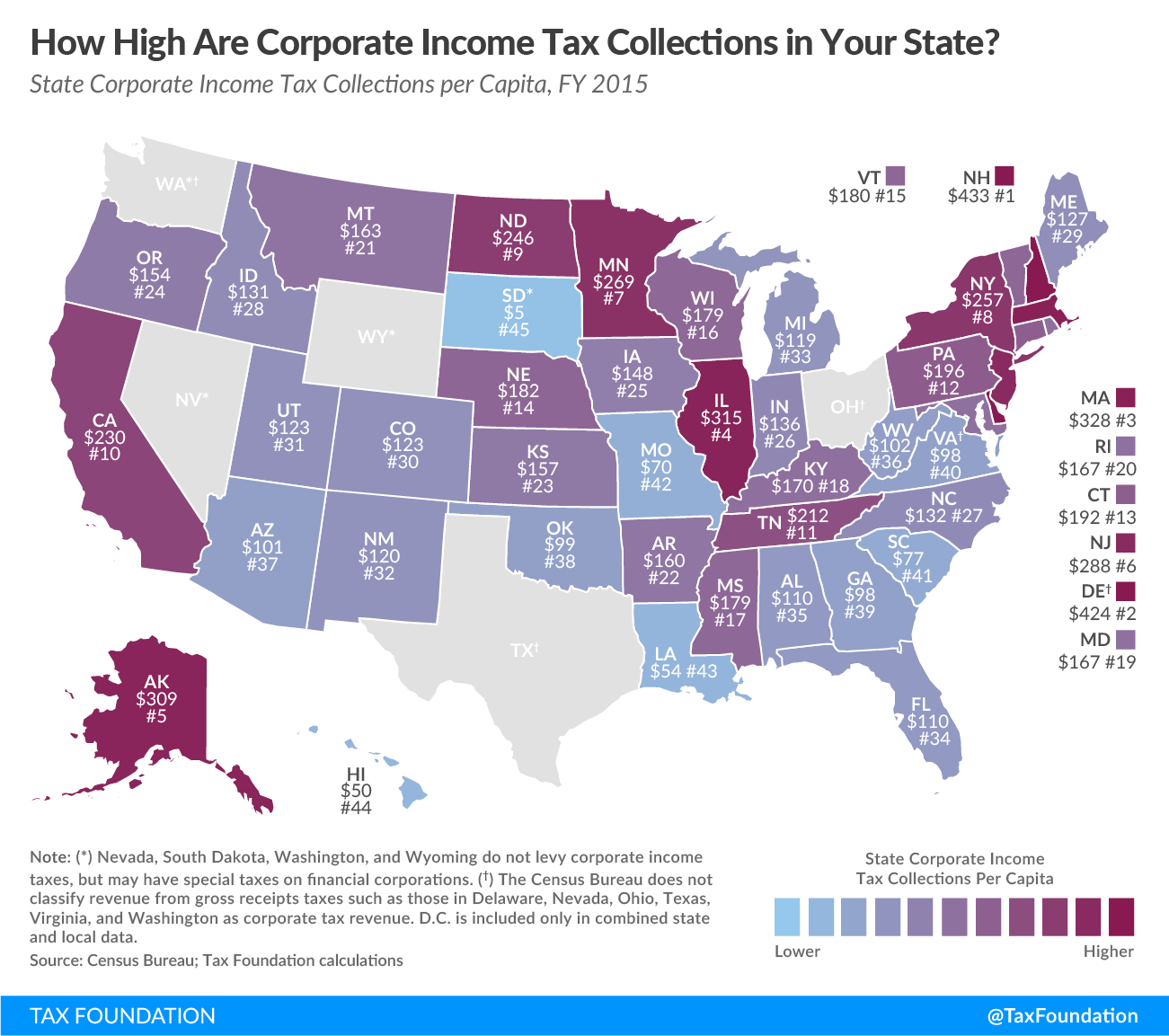

Today’s map shows how much state governments collect in corporate income taxes per capita. New Hampshire collects the most at $433 per capita, with Delaware shortly behind at $424 per capita. Delaware also levies a gross receipts tax in addition to the corporate income tax. Alaska’s ranking of fifth highest in the country may surprise people, but it is mainly due to a large number of extractive companies and the relatively small population.

On the other end of the spectrum, there are six states that do not levy a corporate income tax at all: Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming. Some still show a small amount of revenue collected from the corporate income tax due to taxes on special kinds of corporations, like financial institutions. Nevada, Ohio, Texas, and Washington do levy economically harmful gross receipts taxes in lieu of the traditional corporate income tax.