Louisiana legislators passed a tax reform plan that has received overwhelming support in both the House and Senate, but voters will get the ultimate say on whether that plan succeeds. In light of this, it may be valuable to walk through what is included in these reforms and what effect the changes will have on taxpayers. Ultimately, the plan would simplify the state’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code, lessen residents’ tax burdens, and make the state more competitive.

One constitutional amendment on the ballot addresses the sales tax. If approved by voters, the amendment would centralize sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. collections and administration at the state level. As Louisiana is one of only four states that lacks unified sales tax administration, this change would be an important step forward. Currently, sellers must remit tax to 64 taxing jurisdictions—a costly and burdensome task.

The other constitutional amendment would help pay for the rest of the plan: it would eliminate the state’s deduction for federal taxes paid in order to lower individual and corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rates, and would set a cap of 4.75 percent on individual income tax rates. However, it should be emphasized that the legislature’s plan includes a statutory top rate of 4.25 percent—well below the new cap.

| Current Rates | Future Rates | |||||

|---|---|---|---|---|---|---|

| Rates | Brackets | Rates | Brackets | |||

| 2% | > | $0 | 1.85% | > | $0 | |

| 4% | > | $12,500 | 3.50% | > | $12,500 | |

| 6% | > | $50,000 | 4.25% | > | $50,000 | |

| Source: Louisiana House Bill 278 | ||||||

Primarily, swapping out the federal deduction in exchange for lowering tax rates allows the state’s “sticker price” to more accurately reflect real tax burdens, and lessens the effect of federal tax changes on state revenue. In particular, it eliminates a perverse effect in which circumstances that yield lower liability at the federal level have the opposite effect on the taxpayer’s Louisiana liability, and it is better understood as a simplification than a tax cut. However, the rate changes chosen by the legislature also ensure that almost all taxpayers will see at least minor tax reductions.

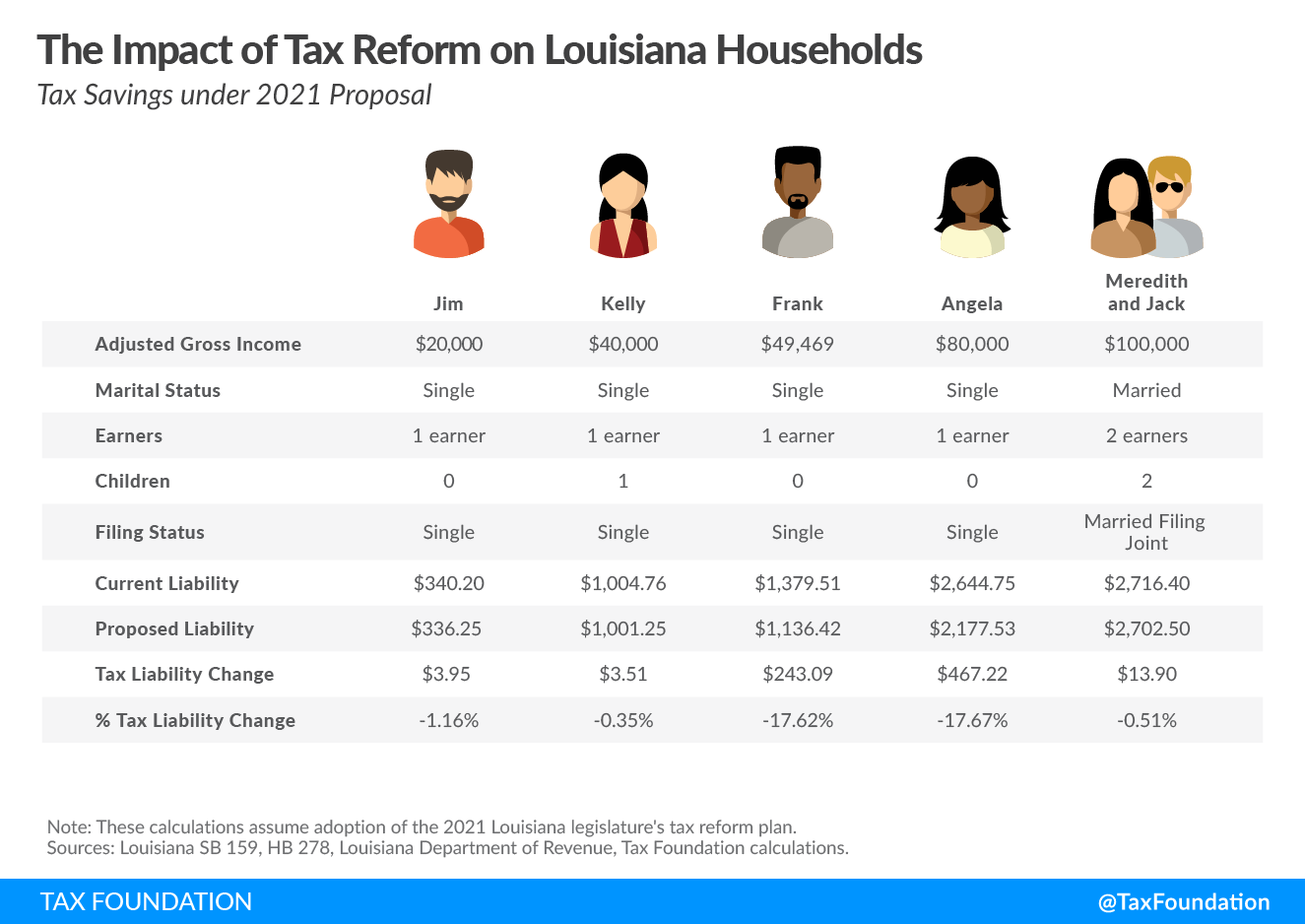

To demonstrate how this plays out, we have constructed five sample taxpayers of different family sizes throughout the income spectrum—including the median household income of $49,469—to show the effect of the income tax plan as of its planned enactment in 2022.

As these examples show, taxpayers throughout the income spectrum see small decreases in their tax liability. Taxpayer Angela sees slightly more savings than others, as her current tax burden is higher due to some of her income falling into the top bracket, but low-income taxpayers benefit as well.

Under the current deduction for federal taxes, things that are rewarded on the federal level are penalized on the state side and vice versa. Taxpayer Kelly, for example, benefits from the Earned Income Tax Credit on her federal taxes but sees her state liability automatically increase because of this. While the EITC still benefits her, her Louisiana tax liability is larger than that of a childless person with the same income. Eliminating federal deductibility and replacing it with lower rates takes away this “mirror” effect.

This initial phase of reductions may be small, since the primary focus is on structural improvement, but the approved legislation includes tax triggers that will continue to lower rates if the state reaches set goals for revenue growth and savings. As the state is already seeing growth, triggered tax cuts seem likely. We cannot model what the exact future savings would be, as the rate reductions are also determined by the amount of growth the state sees, but it is safe to say that all taxpayers would see lighter tax burdens.

Individuals are not the only ones who would benefit from the proposed changes. The new system would consolidate the current five-bracket corporate income tax system into three, and would bring the top rate down to 7.5 percent as of tax year 2022. This would be offset by the repeal of federal deductibility, which currently has the effect of increasing Louisiana tax liability when businesses make new investments or undertake any actions incentivized by the federal tax code.

| Current Rates | Future Rates | |||||

|---|---|---|---|---|---|---|

| Rates | Brackets | Rates | Brackets | |||

| 4% | > | $0 | 3.5% | > | $0 | |

| 5% | > | $25,000 | 5.5% | > | $50,000 | |

| 6% | > | $50,000 | 7.5% | > | $150,000 | |

| 7% | > | $100,000 | ||||

| 8% | > | $200,000 | ||||

| Source: Louisiana House Bill 292 | ||||||

Additionally, businesses would see some relief from the Corporation Franchise Tax, a tax that falls on a company’s net worth. Because it is levied regardless of profit, this tax can be especially burdensome in times of economic downturn. In response to the coronavirus crisis, Louisiana lawmakers temporarily suspended part of the Corporation Franchise Tax by exempting the first $300,000 of taxable capital. The tax reform plan makes this small business exemption permanent and goes further by lowering the rate from 0.3 percent to 0.275 percent for all other businesses starting in tax year 2023.

Although it is only one aspect of location decisions, a state’s tax code can matter greatly in attracting or retaining businesses. Louisiana has long been near the bottom of the Tax Foundation’s competitiveness rankings, but these proposed changes would be an important step forward. Altogether, the rate reductions, bracket consolidations, and sales tax centralization would improve the state’s tax climate and improve Louisiana’s ranking from 42nd to 38th on our State Business Tax Climate Index, finally freeing the state from the bottom 10. If the state experiences sufficient revenue growth, the revenue triggers could reduce rates and improve this ranking even further, with potentially substantial improvements in coming years.

By overwhelmingly approving this tax plan, the Louisiana legislature has demonstrated its hunger for reforms that enhance simplicity, transparency, and neutrality in the tax code, while aligning it for growth. If voters approve these reforms at the ballot, Louisiana would see a more competitive tax code that would serve residents well for years to come.

Share this article