Senators Must Hold Down the SALT Cap

As the Senate considers next steps for the House-passed “big, beautiful” tax bill, the battle lines have been drawn for a showdown over the state and local tax (SALT) deduction.

As the Senate considers next steps for the House-passed “big, beautiful” tax bill, the battle lines have been drawn for a showdown over the state and local tax (SALT) deduction.

Unlike banks, credit unions remain exempt from most taxes. The credit union tax exemption doesn’t make dollars, and now, it doesn’t make sense.

When you hear about tax policy, you may think of the IRS, the agency responsible for collecting federal taxes. But who is responsible for drafting, reviewing, assessing, and passing tax legislation at the federal level?

4 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Dominika Langenmayr, Professor of Economics at Catholic University of Eichstätt-Ingolstadt, about the future of the EU tax mix.

15 min read

To make the taxation of labor more efficient, policymakers should understand their country’s tax wedge and how their tax burden funds government services.

5 min read

The tariffs amount to an average tax increase of nearly $1,200 per US household in 2025.

37 min read

Instead of doubling down on a shrinking tax base, Ohio lawmakers should instead look towards tax solutions that secure the state’s long-term fiscal health.

4 min read

Between Russia’s war in Ukraine, President Trump’s uncertain policies towards Europe, and Poland’s attempt to increase domestic defense capabilities, raising revenue has become one of the most critical topics in the campaign.

7 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

The House reconciliation bill includes numerous changes to the tax code: good, bad, and ugly. However, the new corporate alternative minimum tax, or CAMT, goes largely untouched.

4 min read

Florida’s latest property tax debate highlights the familiar challenge of prioritizing pro-growth tax policy while tackling rising property tax burdens.

6 min read

The EV fee in the reconciliation package would help the fiscal situation but would overcorrect the hole in the gas tax base EVs create. There are intermediate options, such as VMT taxes for EVs and commercial traffic or pairing flat EV fees with gas and diesel tax increases, that would be incrementally better than the reconciliation package’s approach.

7 min read

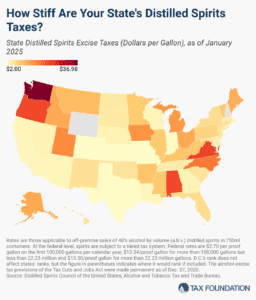

The significant disparity in tax rates across states underscores the complex tax and regulatory environment governing distilled spirits.

6 min read

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

13 min read

When governments restrict trade—through tariffs and retaliation—no one truly wins.

Developed countries raise tax revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a tax system is.

4 min read

For owners of pass-through businesses, the reconciliation package (1) raises the state and local tax (SALT) deduction cap, (2) denies the benefit of pass-through entity-level taxes that had previously worked around the SALT cap for such pass-through businesses, and (3) increases the Section 199A deduction for qualifying pass-through entities.

4 min read

The House of Representatives just passed President Trump’s “One Big Beautiful Bill,” marking a critical step in the Republican tax agenda. At first glance, the bill might appear to complete the legacy of the 2017 Tax Cuts and Jobs Act (TCJA). But it falls short of emulating the TCJA’s core strengths in two key respects: it doesn’t prioritize economic growth, and it doesn’t simplify the tax code.

As the US House hashes out its “One, Big, Beautiful Bill,” statehouse lawmakers are watching closely, given the impact of both its tax and spending provisions on state budgets.

12 min read

The US Ways and Means Committee’s “Big Beautiful Bill” includes a retaliatory provision called Section 899, along with an expansion of the base erosion and anti-abuse tax (BEAT).

7 min read