A New State Payroll Tax Could Drive Jobs out of Washington

With a wealth tax, property tax increases, and this new payroll tax on the agenda, Washington lawmakers have reason to fear that many employers could be looking for the exits.

5 min read

With a wealth tax, property tax increases, and this new payroll tax on the agenda, Washington lawmakers have reason to fear that many employers could be looking for the exits.

5 min read

Policymakers should aim for neutral tax policies that support stable revenues like VATs and avoid inviting trade conflicts with discriminatory and economically harmful policies like DSTs.

6 min read

The empirical evidence thus far on sugar-sweetened beverage taxes fails to support claims that these taxes will create substantial health benefits. At the same time, their structural limitations make them ill-suited for generating stable, equitable revenue.

54 min read

This legislative session, local taxes are a major topic of debate in Indiana. Although the state’s property tax system is already nationally competitive, dramatic increases in assessed values have created discontent in recent years.

8 min read

Surtaxes such as Germany’s solidarity surtax run counter to the principles of simplicity and transparency of the tax system because they impose an additional layer of tax on taxpayers and create a more complex tax structure that often obscures the actual tax burden.

4 min read

With the imposition of American tariffs on steel and aluminum imports on March 12th, the European Union was officially pulled into the global trade war.

Maryland’s proposed budget has garnered headlines for many reasons, but another momentous change is flying under the radar: backdoor adoption of potentially mandatory worldwide combined reporting.

6 min read

Montana’s 2025 legislative session has seen a flurry of property tax reform proposals, a response to the surge in property valuations in the state. Unfortunately, hasty decision-making can result in suboptimal policy outcomes.

6 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

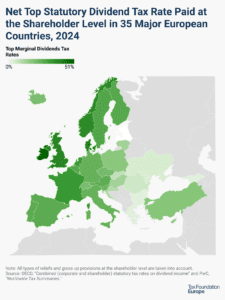

Many countries’ personal income tax systems tax various sources of individual income—including investment income such as dividends and capital gains.

4 min read

A North Carolina House bill titled “No Tax on Tips, Overtime, Bonus Pay,” is gaining bipartisan traction in the General Assembly, mirroring similar proposals nationwide, including those championed by President Trump.

4 min read

Lawmakers should prioritize pro-growth tax policies and use the least economically damaging offsets to make the legislation fiscally responsible. If lawmakers choose to use C-SALT, they should carefully consider the economic trade-off with permanent, pro-growth tax cuts that support investment and innovation in the US.

7 min read

Whether we look at it as consumers of these goods, or as middle-class workers who transform them, low-cost goods have been the underpinning of American prosperity.

With such an important change to Iowa’s property tax system, it’s important that lawmakers get the details right.

33 min read

President Donald Trump surprised many in the tax community by making the global tax deal a day one issue. His Jan. 20 memorandum gave his Treasury secretary 60 days to recommend interactions with tax treaties and possible protective measures to ensure the minimum tax rules have no force or effect in the US.

The Inflation Reduction Act (IRA) introduced a series of new targeted tax breaks, many of which seem to be much more expensive than originally forecasted. Understandably, repealing these subsidies is a key option for policymakers looking to pay to extend the expiring broader tax cuts passed in the Tax Cuts and Jobs Act (TCJA).

7 min read

Policymakers are right that Kansas has an opportunity to reform property taxes while providing long-term relief. But one idea gaining traction in the statehouse — which would introduce assessment limits that artificially cap valuation increases — would be a step backward.

An update to the EU’s Excise Tax Directive that embraces harm reduction principles would save lives and provide a steady stream of revenue to support public health expenditures.

22 min read

Contrary to the president’s promises, the tariffs will cause short-term pain and long-term pain, no matter the ways people and businesses change their behavior.

5 min read

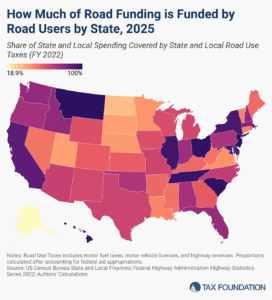

The amount of revenue states raise through roadway-related revenues varies significantly across the US. Only three states raise enough revenue to fully cover their highway spending.

5 min read