All Content

8846 Results

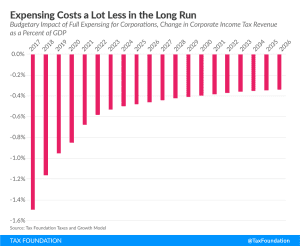

Full Expensing Costs Less Than You’d Think

Full expensing could grow the long-run size of the U.S. economy by 4.2 percent, which would lead to 3.6 percent higher wages and 808,000 full-time jobs. What’s more, it wouldn’t cost as much revenue as some think.

12 min read

Why Temporary Corporate Income Tax Cuts Won’t Generate Much Growth

Real tax reform should boost incomes for all. A corporate income tax cut could be a means to do that, but not if it’s temporary. A temporary cut is less likely to promote growth and less likely to benefit American workers.

14 min read

Ohio Illustrated: A Visual Guide to Taxes & The Economy

This new chart book cuts through the complexity and gives you a broad perspective of Ohio’s overall economy and tax system. The result is a powerful diagnostic tool you can use to identify your state’s unique strengths and weaknesses.

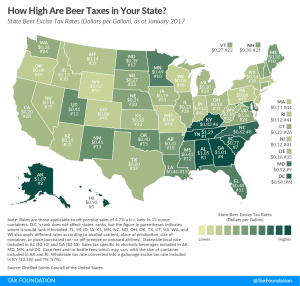

Beer Taxes by State, 2017

3 min read