Prepaying SALT isn’t an Option

As the Tax Cuts and Jobs Act seeks to simplify the tax code, a last-minute provision closed a potential new tax-planning strategy germinating before the bill even passed.

2 min read

As the Tax Cuts and Jobs Act seeks to simplify the tax code, a last-minute provision closed a potential new tax-planning strategy germinating before the bill even passed.

2 min read

There is no good reason to eliminate interest deductions to permit expensing. Expensing is a key element of any tax system which seeks to put all economic activity on a level playing field.

9 min read

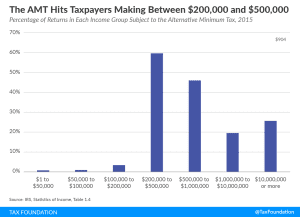

The Tax Cuts and Jobs Act will temporarily reduce alternative minimum tax liability, but retain the complexity inherent to the tax.

4 min read

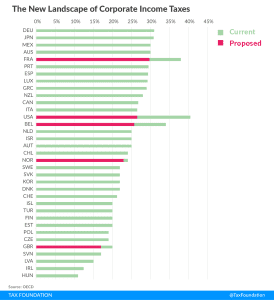

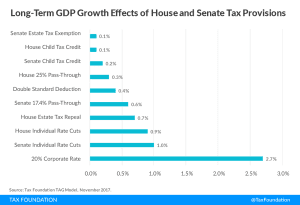

If enacted, the Tax Cuts and Jobs Act would put the U.S. corporate tax rate more in line with its international peers at 13th highest of 35 OECD countries.

2 min read

In 2018, trends to watch in state tax policy will include reductions in corporate tax rates, the spread of gross receipts taxes, new and lower taxes on marijuana, estate tax repeal, a wait-and-see approach on federal tax reform, and more.

16 min read

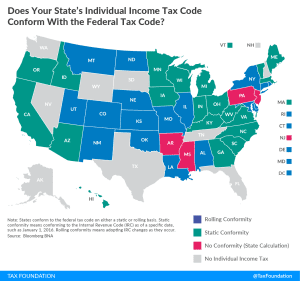

As the federal government continues to debate tax reform, states, and many taxpayers, are asking an important question: How is my state’s tax code impacted? The exact impacts won’t be known until the federal bill is finalized, but a good place to start is understanding the issue of conformity.

2 min read

This study demonstrates how Tax Foundation’s TAG model calculates the weighted average METRs for different capital assets in the corporate and noncorporate sectors. The high marginal rates of up to 53 percent in the corporate sector illustrate why there is an urgent need for business tax reform.

12 min read

If the state and local tax deduction is necessary to prevent double taxation, why don’t states offer a deduction for federal and local taxes?

2 min read

As Arkansas considers tax reform, expanding or increasing the state’s property tax, if used to finance other tax changes, would be worth exploring.

7 min read

A proposal in the Senate tax reform bill to reduce alcohol taxes wouldn’t create the negative health consequences that some claim.

2 min read