All Content

The Impact of the Tax Cuts and Jobs Act by Congressional District

A look at the data & methodology behind the Tax Foundation’s Mapping 2018 Tax Reform project which compares average 2018 tax cuts by congressional district.

3 min read

The OECD Highlights the Economic Growth Benefits of Full Expensing

The Organisation for Economic Co-operation and Development (OECD) praised a measure in the Tax Cuts and Jobs Act (TCJA) passed last December.

2 min read

New Letter Says the “Retail Glitch” is Discouraging Business Investment

Retail groups sent a letter to Congress explaining that the “retail glitch” in the Tax Cuts and Jobs Act would discourage business investment.

3 min read

Taxing Patreon Contributions

4 min read

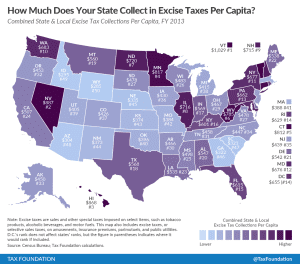

How Much Does Your State Collect in Excise Taxes?

Excise taxes make up a relatively small portion of state and local tax collections—about 11 percent—but per capita collections vary widely from state to state.

3 min read

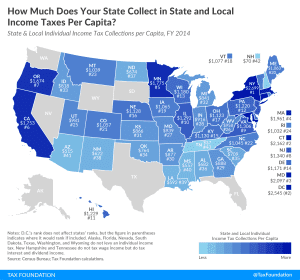

State and Local Individual Income Tax Collections Per Capita

On average, state and local governments collected $1,144 per person from individual income taxes, but collections varied widely from state to state.

2 min read

The Fixtures Fix: Correcting the Drafting Error Involving the Expensing of Qualified Improvement Property

Due to a legislative oversight, the Tax Cuts and Jobs Act excluded the category of qualified improvement property investment from 100 percent bonus depreciation.

12 min read

Highlights from the New JCT Tax Expenditure Report

How have federal tax expenditures changed since passage of the Tax Cuts and Jobs Act? We compare 2017 and 2018 Joint Committee on Taxation estimates.

8 min read

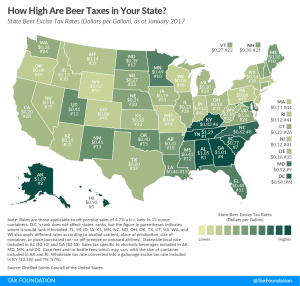

Beer Taxes by State, 2018

3 min read

Capital Cost Recovery across the OECD, 2018

One hundred percent expensing for short-life business investments was a great start but needs to be enacted on a permanent basis for it to have an impact on long-term decision-making.

15 min read

Indiana Passes Conformity Bill in One-Day Special Session

Indiana recently passed tax conformity legislation linking the state’s individual and corporate tax code to the new federal law.

2 min read