Testimony: Pro-Growth Tax Reforms to Boost Competitiveness in Louisiana

Louisiana’s tax code currently features a number of inefficient and uncompetitive policies that are leaving the state further and further behind.

Louisiana’s tax code currently features a number of inefficient and uncompetitive policies that are leaving the state further and further behind.

Sports stadium subsidies are salient political gimmicks designed to appear as if politicians are providing tangible benefits to taxpayers. The empirical evidence shows repeatedly that stadium subsidies fail to generate new tax revenue and new jobs or attract new businesses.

6 min read

Raising the combined US corporate rate to the second highest in the OECD would encourage corporations to depart from the US, reducing economic output and worker wages across the income spectrum.

2 min read

Both candidates’ policies would ultimately stifle the kinds of broad economic expansion they claim to seek.

If voters are being asked to charge state legislators with raising the equivalent of a doubling of the current income and sales tax, shouldn’t they get to know what the plan is first?

The 2024 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

7 min read

Using tariff policy to reallocate investment and jobs is a costly mistake—that’s a history lesson we should not forget.

6 min read

The Department of Justice (DOJ) recently announced that it would move to reschedule marijuana. This move doesn’t do as much for legal cannabis sales as proposed federal legislation like the States 2.0 Act, but rescheduling cannabis has major ramifications for cannabis businesses.

4 min read

Estimating the economic effects of different types of taxes informs policymakers about the trade-offs of raising revenue in a given way.

5 min read

With a changing economy—the law is about companies selling tangible products, but our economy is increasingly service-oriented—and state-level tests to the ongoing validity of the law, perhaps the time has come for Congress to update and expand upon these protections, which are designed to limit states from imposing substantial tax remittance and compliance burdens on businesses with only the most minimal of contacts with the state.

5 min read

CBO data shows that the federal fiscal system—both taxes and direct federal benefits—is getting more progressive and redistributive in 2024.

7 min read

A new analysis finds that the tax increase would reduce average wages by as much as $597 per US worker each year. In some states, the drop in wages would exceed $700 per worker.

4 min read

Growing levels of waste and pollution, paired with increasing burdens on taxpayers to address environmental problems, have spurned policymakers in the US and abroad to encourage producers to be responsible, either financially or operationally, for the end-life of their products.

34 min read

Under the tax created by Measure 118, Oregon businesses would be significantly disadvantaged against their larger and out-of-state rivals.

6 min read

Social Security is by far the largest federal government spending program. The latest trustees report shows the program is on a fiscally unsustainable path that will exacerbate the US debt crisis if its imbalances are not addressed in the near term.

33 min read

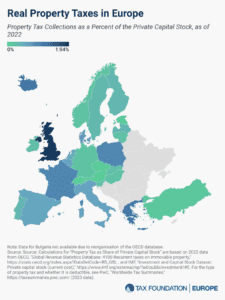

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

3 min read

Smart tax policy takes into account how policy changes impact real people. Understanding who bears the burden of the corporate tax and the effects of a higher rate are essential to sound policymaking.

4 min read

As lawmakers look to renew or revise the 2017 tax cuts that expire next year, they should reconsider the need for a charitable tax deduction in the tax code.

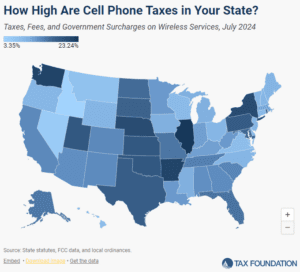

Wireless taxes and fees set a new record high in 2024.

23 min read

As part of the 2024 presidential campaign, Vice President Kamala Harris is proposing to tax long-term capital gains at a top rate of 33 percent for high earners, taking the top federal rate to highs not seen since the 1970s.

3 min read