Japan’s Tax and Benefit System for Working Parents Isn’t Working

The Japanese tax and benefit system comes with trade-offs that policymakers must keep in mind when planning to reform the tax policy.

7 min read

The Japanese tax and benefit system comes with trade-offs that policymakers must keep in mind when planning to reform the tax policy.

7 min read

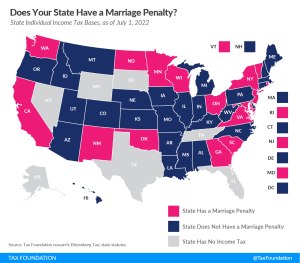

A marriage penalty exists when a state’s income brackets for married taxpayers filing jointly are less than double the bracket widths that apply to single filers. In other words, married couples who file jointly under this scenario have a higher effective tax rate than they would if they filed as two single individuals with the same amount of combined income.

3 min read

The Inflation Reduction Act calls for a new 1 percent excise tax on stock buybacks, the argument being it would be better for the economy if firms invested their surplus cash in the business, rather than returning this value to shareholders.

3 min read

In dollar terms, the industries that would account for the largest book minimum tax liabilities are manufacturing, at $73.2 billion, followed by finance, insurance, and management at $46.9 billion.

6 min read

How will the Inflation Reduction Act taxes impact inflation, economic growth, tax revenue, and everyday taxpayers? See Inflation Reduction Act tax changes.

12 min read

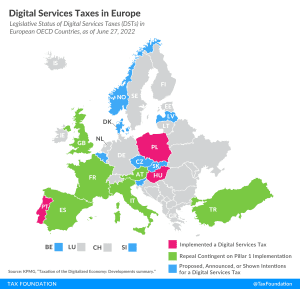

About half of all European OECD countries have either announced, proposed, or implemented a digital services tax.

7 min read

While exempting accelerated depreciation from the book minimum tax would reduce some of the economic harm of the tax, there remain many unresolved problems within the design and structure of the tax that make it a poorly chosen revenue option.

3 min read

In the rush to pass the Inflation Reduction Act, which features an ill-conceived tax on the book income of U.S. corporations, it is worth reminding policymakers of a well-established finding in the economic literature.

3 min read

The Inflation Reduction Act may be smaller than the proposed Build Back Better legislation from 2021, but both sets of legislation propose a reintroduced corporate alternative minimum tax (AMT). The 30-year experience with a corporate AMT shows it is not a good solution.

4 min read

While the tax and benefit system can be successful in keeping low-income working households out of poverty and encouraging workforce participation, high marginal tax rates like the one observed in the case of this Australian working parent act as barriers to upward mobility.

6 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. tax rules for large companies. However, as proposals have been debated in recent months, there are have been clear divides between U.S. proposals and the global minimum tax rules.

6 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

43 min read

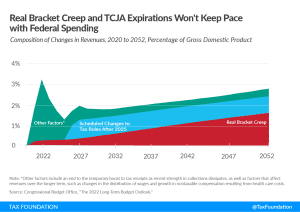

The latest CBO long-term budget outlook paints a troubling picture of fiscal irresponsibility. Rather than halt this rampant spending, Congress is actively adding programs that will exacerbate these long-term trends.

7 min read

Expediting income tax rate reductions and indexing major income tax provisions for inflation are two of the most important tax policy changes policymakers could make to provide meaningful tax relief to Hoosiers both now and in the years to come.

4 min read

Canadian workers could face up to two important marginal tax rate spikes and lose 60 percent of additional earnings to the provincial health-care premium.

4 min read

Some 40 years ago, the U.S. dealt with high inflation and slow economic growth. Then as now, the solution is a long-term focus on stronger economic growth and sustainable federal budgets.

5 min read

The Senate has begun debate on the so-called Chips bill, which would provide $52 billion in grants and $24 billion in tax credits to supposedly strengthen the production of semiconductors in the U.S.

3 min read

New Jersey lawmakers should be weary of flavor bans after seeing the results in Massachusetts.

3 min read

Policymakers should continue to focus on longer term impacts rather than emphasizing the short-term stimulus effects of tax cuts.

3 min read

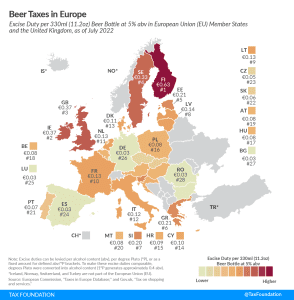

’Tis the season to crack open a cold one. Ahead of International Beer Day on August 5th, let’s take a minute to discover how much of your cash is actually going toward the cost of a brew with this week’s tax map, which explores excise duties on beer.

3 min read