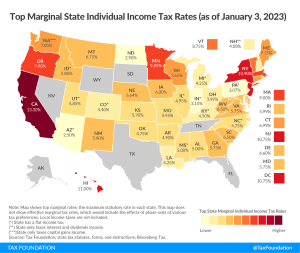

State Individual Income Tax Rates and Brackets, 2023

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read

Immediately balancing the $20 trillion budget shortfall would take drastic, unwanted policy changes. Instead, lawmakers should target a more achievable goal, such as stabilizing debt and deficits with an eye toward comprehensive tax reform that can produce sufficient revenue with minimal economic harm.

4 min read

While hoping for inflation’s continued decline, policymakers should finish the job and index the tax code to prepare for future bouts of high inflation and as a contingency in case it takes longer to defeat elevated inflation than expected.

4 min read

Despite robust revenues, some state lawmakers are champing at the bit to raise taxes on higher-income households, sometimes to extraordinary levels.

7 min read

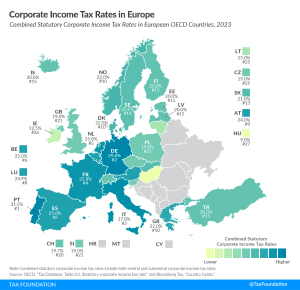

Taking into account central and subcentral taxes, Portugal has the highest corporate tax rate in Europe at 31.5 percent, followed by Germany and Italy at 29.8 percent and 27.8 percent, respectively

2 min read

When peeling back layers of the JCT report, it becomes clear that many tax expenditures are not “loopholes” or benefits for narrow special interests, but important structural elements of the tax code.

6 min read

If your state issued tax rebates last year, you might have to pay federal income tax on the rebate you received. Maybe. Who knows? Unfortunately, not the IRS—at least not yet.

5 min read

President Biden’s State of the Union Address outlined three tax proposals, including raising the tax on stock buybacks, imposing a billionaire minimum tax, and expanding the child tax credit.

6 min read

A new tax expenditures report by the Joint Committee on Taxation (JCT) reveals two problematic developments: 1) policymakers have increasingly relied on the tax code to deliver benefits to individuals, and 2) the broad, neutral tax treatment of investment has shifted to targeted subsidies for businesses.

4 min read

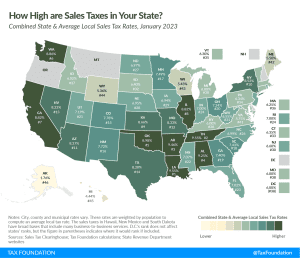

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

11 min read

Done responsibly, reducing income tax rates while consolidating brackets would return excess tax collections to taxpayers and promote long-term economic growth in Nebraska.

Forty-three states adopted tax relief in 2021 or 2022—often in both years—and of those, 21 cut state income tax rates. It’s been a remarkable trend, driven by robust state revenues and an increasingly competitive tax environment.

4 min read

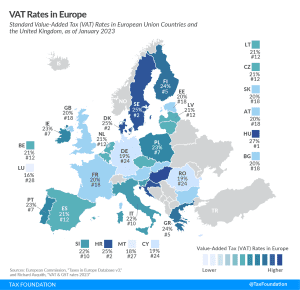

The EU countries with the highest standard VAT rates are Hungary (27 percent), Croatia, Denmark, and Sweden (all at 25 percent). Luxembourg levies the lowest standard VAT rate at 16 percent, followed by Malta (18 percent), Cyprus, Germany, and Romania (all at 19 percent).

4 min read

At the end of 2022, prices were 14.6 percent higher than they were two years prior. That’s the fastest inflation rate over any two calendar years since the stagflation era of the late 1970s. State policymakers are understandably interested in bringing any tools at their disposal to bear on the problem. And many of them are reaching for tax policy solutions.

7 min read

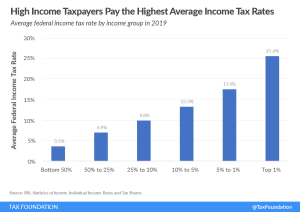

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The FairTax is a proposal to replace all major sources of the federal government’s revenue—the individual income tax, corporate income tax, estate and gift taxes, and payroll tax—with a national sales tax and rebate, abolishing the IRS in the process.

7 min read

Earlier this month, New York Governor Kathy Hochul (D) proposed increasing the state’s cigarette tax rate by $1.00 a pack, banning the sale of flavored vaping products, and ceasing the sale of all flavored tobacco products. If enacted, these policies would fuel black markets and create a fiscal hole for the state to fill, all while hurting New York businesses and consumers.

4 min read

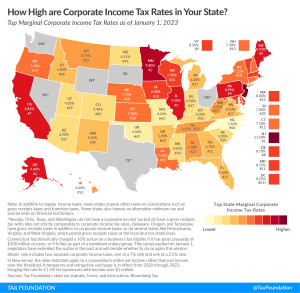

New Jersey levies the highest top statutory corporate tax rate at 11.5 percent, followed by Minnesota (9.8 percent) and Illinois (9.50 percent). Alaska and Pennsylvania levy top statutory corporate tax rates of 9.40 percent and 8.99 percent, respectively.

6 min read

The process leading to the global minimum tax has been messy, and the mess will likely continue for years to come. New revenues are hardly a salve for the setback they represent.

7 min read

West Virginia is one of only seven states that hasn’t offered any significant tax relief since 2021—and five of the other six forgo an individual income tax.

6 min read