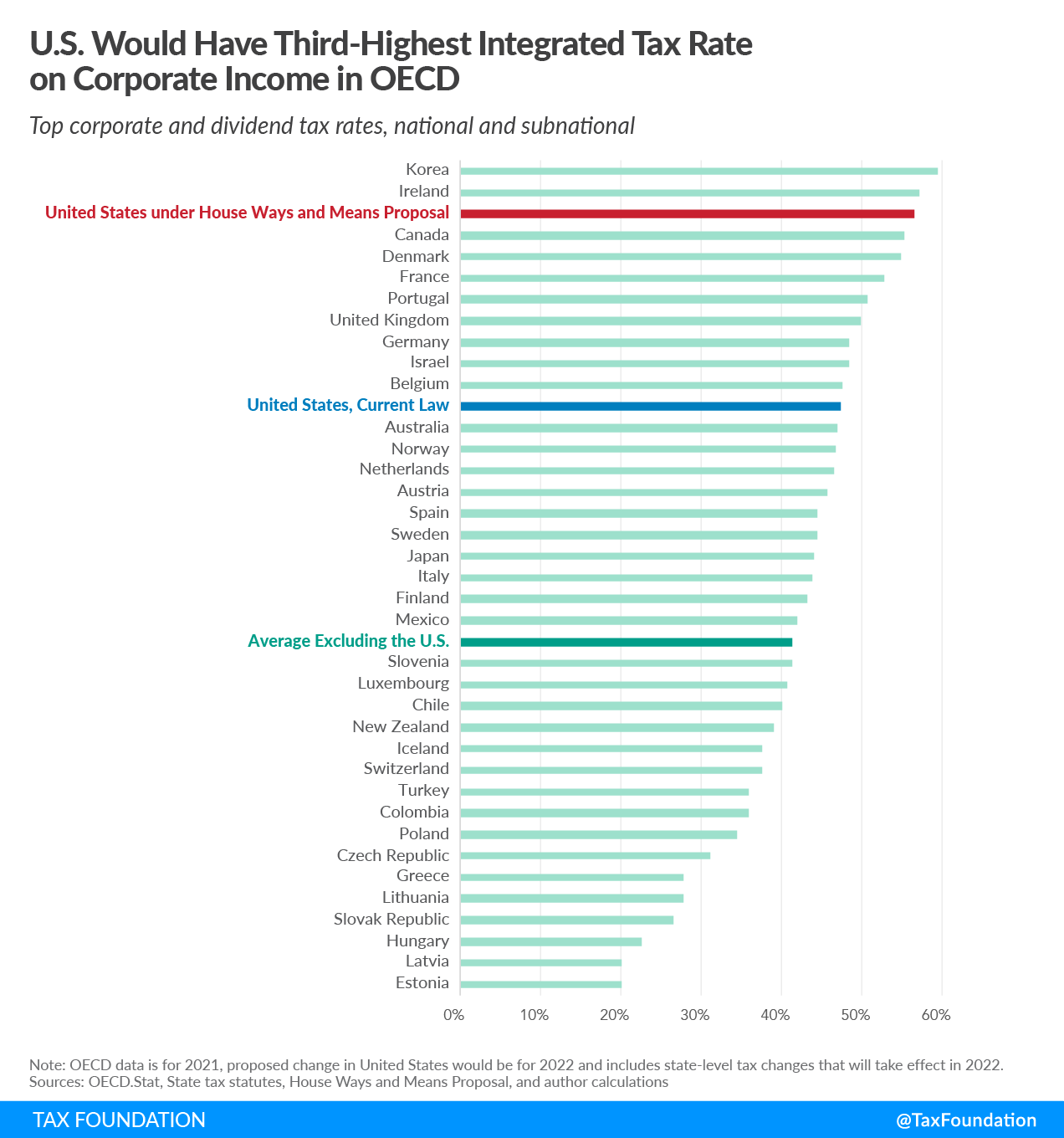

Under the House Ways and Means tax plan, the United States would taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. corporate income at the third-highest integrated tax rate among rich nations, averaging 56.6 percent.

The integrated tax rate reflects the two layers of tax that apply to income earned through corporations: the entity-level corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. and the shareholder-level capital gains and qualified dividends tax. The Ways and Means proposal increases the tax on both layers so that the integrated rate would rise from its current level of 47.4 percent to 56.6 percent.

Compared to nations in the Organisation for Economic Co-operation and Development (OECD), only South Korea and Ireland would have higher rates than the U.S., at 59.4 percent and 57.1 percent, respectively. The average integrated rate in the OECD, excluding the United States, is 41.4 percent.

The higher integrated rate in the U.S. is driven by the proposed increase in the corporate income tax rate from 21 percent to 26.5 percent and the increase in the top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. on long-term capital gains and qualified dividends from 23.8 percent to 31.8 percent. (The proposal would raise the long-term capital gains and qualified dividends tax rate to 25 percent and create a new 3 percent tax on modified adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” above $5 million, in addition to the current law 3.8 percent net investment income tax.)

When factoring in state level taxes, the federal-state corporate income tax would rise from 25.8 percent under current law to 30.9 percent, and the federal-state dividend income tax would rise from 29.2 percent to 37.2 percent. Table 1 illustrates how both layers of tax combine to result in the integrated tax rate on corporate income.

According to the IRS, taxpayers reported $243.7 billion of qualified dividends (and $321.1 billion of ordinary dividends, which are taxed as ordinary income) in 2018. Tax returns filed by people 65 or older accounted for 56 percent of qualified dividends and 56 percent of ordinary dividends in 2018.

| Integrated Tax Rate Under Current Law | Integrated Tax Rate Under House Ways and Means Plan | |

|---|---|---|

| A. Corporate Profits | $100.00 | $100.00 |

| B. Combined Corporate Income Tax | $25.75 | $30.92 |

| C. Distributed Dividend (A-B) | $74.25 | $69.08 |

| D. Combined Dividend Income Tax | $21.67 | $25.67 |

| E. Total After Tax Income (C-D) | $52.58 | $43.41 |

| Integrated Tax Rate (A-E) / A | 47.4% | 56.6% |

|

Note: Proposed change in United States would be for 2022 and includes state-level tax changes that will take effect in 2022. Sources: State tax statutes; House Ways and Means proposal; and author calculations. |

||

| Top Combined Corporate Tax Rate | Top Combined Dividend Tax Rate | Integrated Tax Rate | |

|---|---|---|---|

| Australia | 30.0% | 24.3% | 47.0% |

| Austria | 25.0% | 27.5% | 45.6% |

| Belgium | 25.0% | 30.0% | 47.5% |

| Canada | 26.2% | 39.3% | 55.2% |

| Chile | 10.0% | 33.3% | 40.0% |

| Colombia* | 31.0% | 10.0% | 36.0% |

| Czech Republic | 19.0% | 15.0% | 31.2% |

| Denmark | 22.0% | 42.0% | 54.8% |

| Estonia | 20.0% | 0.0% | 20.0% |

| Finland | 20.0% | 28.9% | 43.1% |

| France | 28.4% | 34.0% | 52.7% |

| Germany | 29.9% | 26.4% | 48.4% |

| Greece | 24.0% | 5.0% | 27.8% |

| Hungary | 9.0% | 15.0% | 22.7% |

| Iceland | 20.0% | 22.0% | 37.6% |

| Ireland | 12.5% | 51.0% | 57.1% |

| Israel | 23.0% | 33.0% | 48.4% |

| Italy | 24.0% | 26.0% | 43.8% |

| Japan | 29.7% | 20.3% | 44.0% |

| Korea | 27.5% | 44.0% | 59.4% |

| Latvia | 20.0% | 0.0% | 20.0% |

| Lithuania | 15.0% | 15.0% | 27.7% |

| Luxembourg | 24.9% | 21.0% | 40.7% |

| Mexico | 30.0% | 17.1% | 42.0% |

| Netherlands | 25.0% | 26.9% | 46.6% |

| New Zealand | 28.0% | 15.3% | 39.0% |

| Norway | 22.0% | 31.7% | 46.7% |

| Poland | 19.0% | 19.0% | 34.4% |

| Portugal | 31.5% | 28.0% | 50.7% |

| Slovak Republic | 21.0% | 7.0% | 26.5% |

| Slovenia | 19.0% | 27.5% | 41.3% |

| Spain | 25.0% | 26.0% | 44.5% |

| Sweden | 20.6% | 30.0% | 44.4% |

| Switzerland | 19.7% | 22.3% | 37.6% |

| Turkey | 20.0% | 20.0% | 36.0% |

| United Kingdom | 19.0% | 38.1% | 49.9% |

| United States, Current Law | 25.8% | 29.2% | 47.4% |

| United States under House Ways and Means Proposal | 30.9% | 37.2% | 56.6% |

| Average Excluding the U.S. | 22.7% | 24.2% | 41.4% |

|

*Colombia researched separately. See Daniel Bunn and Elke Asen, “Savings and Investment: The Tax Treatment of Stock and Retirement Accounts in the OECD,” Tax Foundation, May 26, 2021, https://taxfoundation.org/savings-and-investment-oecd/. Note: OECD data is for 2021; proposed change in United States would be for 2022 and includes state-level tax changes that will take effect in 2022. Sources: OECD; state tax statutes; House Ways and Means proposal; and author calculations. |

|||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe