The reconciliation legislation introduced by Democrats on the House Ways and Means committeeThe Committee on Ways and Means, more commonly referred to as the House Ways and Means Committee, is the chief tax-writing committee in the US. The House Ways and Means Committee has jurisdiction over all bills relating to taxes and other revenue generation, as well as spending programs like Social Security, Medicare, and unemployment insurance, among others. would increase the top federal corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate from 21 to 26.5 percent. However, most companies would face a higher tax rate than 26.5 percent, given that most states also levy a corporate income tax.

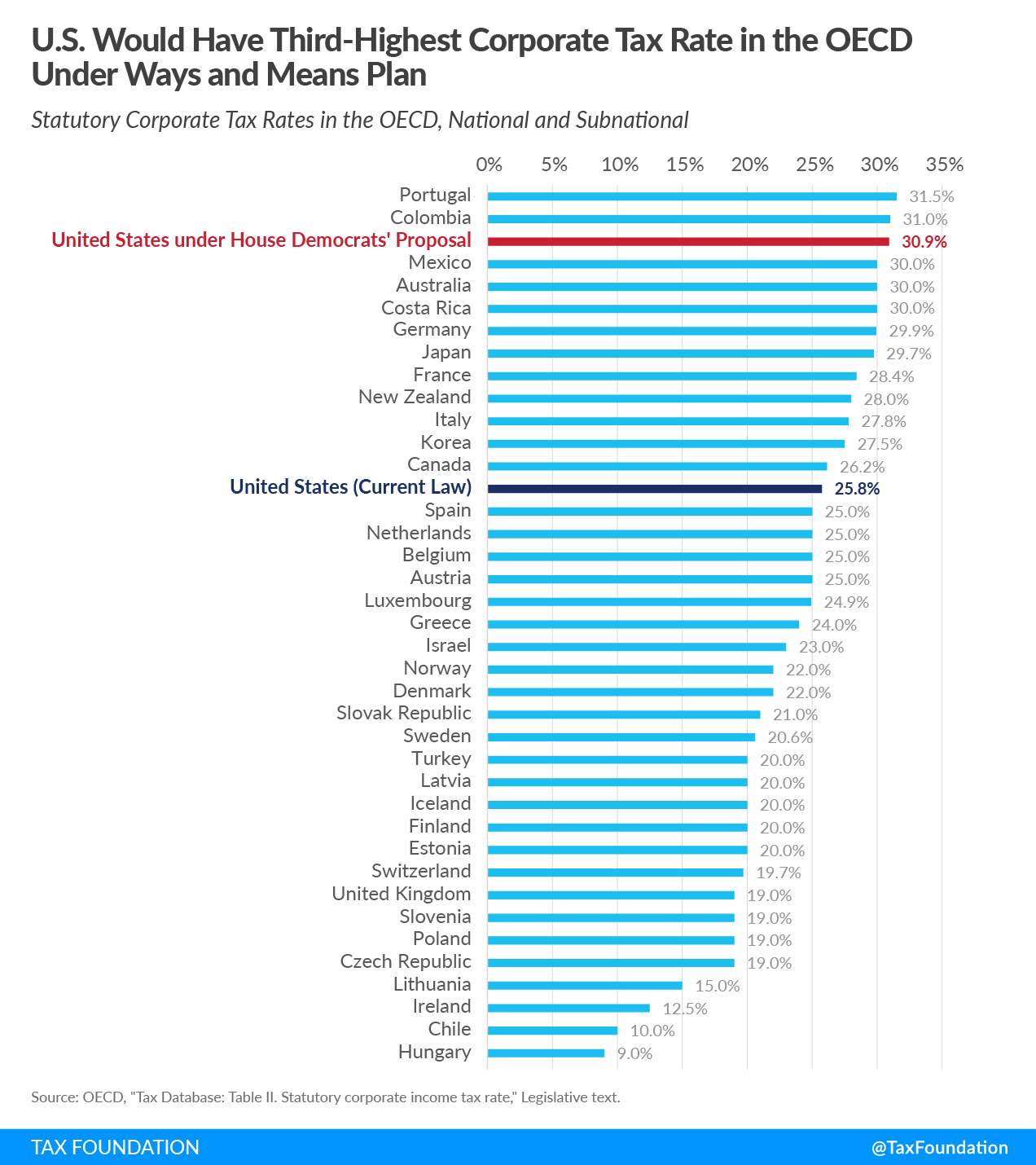

In the initial Biden administration infrastructure proposal, which would raise the federal corporate income tax rate to 28 percent, the United States would have had the highest average corporate tax rate in the Organisation for Economic Co-operation and Development (OECD), at 32.3 percent, inclusive of the average state corporate tax rate. Under the Ways and Means text, the U.S. would have an average corporate tax rate of 30.9 percent, which would be the third-highest corporate tax rate in the OECD, behind only Colombia and Portugal.

Under current law, the U.S. is right in line with OECD peer countries, and actually near the middle of the pack as far as corporate taxation goes. Returning to near the top of the OECD in corporate tax rates would be costly for a few reasons: it would disincentivize investment and encourage firms to shift profits and locate elsewhere, resulting in fewer job opportunities for Americans and less tax revenue for the U.S. government.