If you’re like many Americans, you’ve been stockpiling bags of chocolate and nougat-based treats to share with trick-or-treaters—or, if you’re like me, to share with yourself. Generously. According to the National Retail Federation, Halloween shoppers plan to spend $2.6 billion on candy in 2019—a whopper of a number.

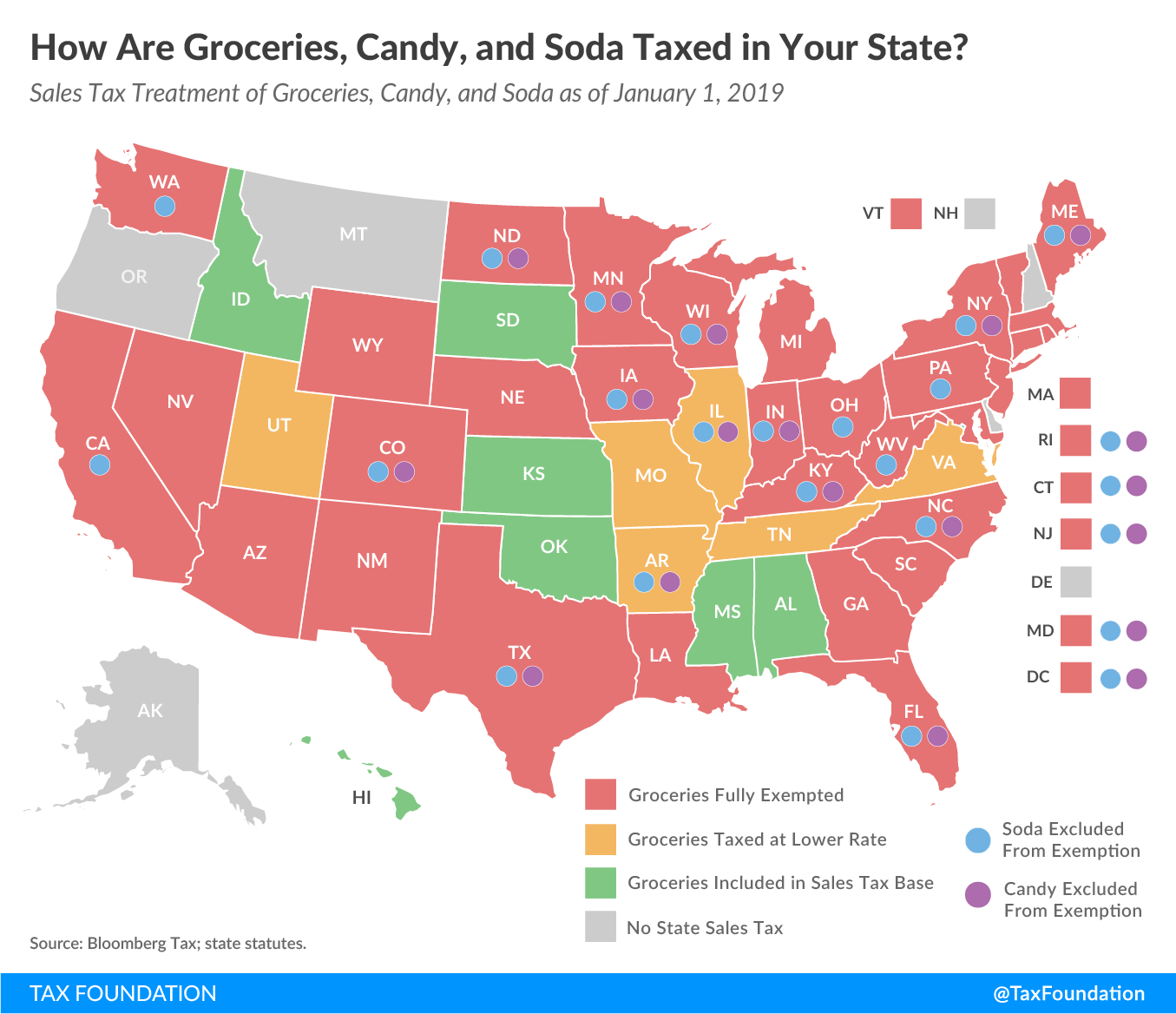

In other words, there’s no better time for a map looking at how different state sales taxes treat consumable goods like candy, groceries, and soda.

Forty-five states and the District of Columbia levy a state sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. . Of those, thirty-two states and the District of Columbia exempt groceries from the sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . Twenty-three states and D.C. treat either candy or soda differently than groceries. Eleven of the states that exempt groceries from their sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. base include both candy and soda in their definition of groceries: Arizona, Georgia, Louisiana, Massachusetts, Michigan, Nebraska, Nevada, New Mexico, South Carolina, Vermont, and Wyoming.

While 32 states exempt groceries, six additional states (Arkansas, Illinois, Missouri, Tennessee, Utah, and Virginia) tax groceries at a lower, preferential rate. Four of those six states include both candy and soda in the rate applied to those lower-taxed groceries. Arkansas and Illinois exclude soda and candy from the tax preference, taxing them at the standard rate.

The aim of a grocery exemption is to reduce tax burdens on necessities, particularly those which take up a large share of overall consumption for low-income consumers, which obligates states to decide which products are essential. When foods are categorized as necessities based on nutritional value, soda and candy are among the first products to be added to the “taxable” list. This raises obvious questions about a host of other food items like chips, baked goods, and ice cream. In the name of narrowing the exemption to necessities, most states end up excluding certain foods and beverages.

This picking and choosing creates arbitrary and counterintuitive discrepancies that go beyond the bowl of Halloween candy. If you live in New Jersey, it also affects the jack-o-lantern on your front porch. A recent tweet by the New Jersey Division of Taxation reminded consumers that decorative pumpkins are subject to sales tax, but pumpkins intended to be eaten are exempt. This seems to have struck a “gourd” with the public, who have questioned the logic and enforceability of such a carveout.

Some state definitions can make food and candy taxation counterintuitive. Twenty-four states align with the Streamlined Sales and Use Tax Agreement (SSUTA), which determines that candy is different from other sweet foods because it comes in the form of bars, drops, or pieces, and does not contain flour. Base uniformity across states is a good thing, but this particular definition leads to some interesting distinctions: If you bought a Hershey’s® bar, it would be subject to sales tax. If you bought a Twix® bar, it would be tax-free. Similar conundrums appear when you get into the difference in definitions between prepared food and food intended for off-site consumption: a rotisserie chicken would be taxed if it’s heated by a warming device, but untaxed if it’s packaged and refrigerated.

Ultimately, states and consumers alike would benefit from a low, flat-rate sales tax that captures all final consumer products. Such a tax would be easy to administer, providing a stable source of revenue through a neutral and transparent structure.

See Table 1 below for more specific information on how groceries are treated in different states.

|

(a) Alaska, Delaware, Montana, New Hampshire, and Oregon do not levy taxes on groceries, candy, or soda. (b) Three states levy mandatory, statewide, local add-on sales taxes: California (1%), Utah (1.25%), and Virginia (1%). We include these in their state sales tax. Source: Bloomberg Tax. |

||||

| State | State General Sales Tax | Grocery Treatment | Candy Treated as Groceries? | Soda Treated as Groceries? |

|---|---|---|---|---|

| Ala. | 4.00% | Included in Base | Yes | Yes |

| Alaska (a) | — | — | — | — |

| Ariz. | 5.60% | Exempt | Yes | Yes |

| Ark. | 6.50% | 1.50% | No | No |

| Calif. (b) | 8.25% | Exempt | Yes | No |

| Colo. | 2.90% | Exempt | No | No |

| Conn. | 6.35% | Exempt | No | No |

| Del. (a) | — | — | — | — |

| Fla. | 6.00% | Exempt | No | No |

| Ga. | 4.00% | Exempt | Yes | Yes |

| Hawaii | 4.00% | Included in Base | Yes | Yes |

| Idaho | 6.00% | Included in Base | Yes | Yes |

| Ill. | 6.25% | 1.00% | No | No |

| Ind. | 7.00% | Exempt | No | No |

| Iowa | 6.00% | Exempt | No | No |

| Kans. | 6.50% | Included in Base | Yes | Yes |

| Ky. | 6.00% | Exempt | No | No |

| La. | 4.45% | Exempt | Yes | Yes |

| Maine | 5.50% | Exempt | No | No |

| Md. | 6.00% | Exempt | No | No |

| Mass. | 6.25% | Exempt | Yes | Yes |

| Mich. | 6.00% | Exempt | Yes | Yes |

| Minn. | 6.875% | Exempt | No | No |

| Miss. | 7.00% | Included in Base | Yes | Yes |

| Mo. | 4.225% | 1.225% | Yes | Yes |

| Mont. (a) | — | — | — | — |

| Nebr. | 5.50% | Exempt | Yes | Yes |

| Nev. | 6.85% | Exempt | Yes | Yes |

| N.H. (a) | — | — | — | — |

| N.J. | 6.625% | Exempt | No | No |

| N.M. | 5.125% | Exempt | Yes | Yes |

| N.Y. | 4.00% | Exempt | No | No |

| N.C. | 4.75% | Exempt | No | No |

| N.D. | 5.00% | Exempt | No | No |

| Ohio | 5.75% | Exempt | Yes | No |

| Okla. | 4.50% | Included in Base | Yes | Yes |

| Ore. (a) | — | — | — | — |

| Pa. | 6.00% | Exempt | Yes | No |

| R.I. | 7.00% | Exempt | No | No |

| S.C. | 6.00% | Exempt | Yes | Yes |

| S.D. | 4.50% | Included in Base | Yes | Yes |

| Tenn. | 7.00% | 4.00% | Yes | Yes |

| Tex. | 6.25% | Exempt | No | No |

| Utah (b) | 5.00% | 1.75% | Yes | Yes |

| Vt. | 6.00% | Exempt | Yes | Yes |

| Va. (b) | 5.30% | 2.50% | Yes | Yes |

| Wash. | 6.50% | Exempt | Yes | No |

| W.Va. | 6.00% | Exempt | Yes | No |

| Wis. | 5.00% | Exempt | No | No |

| Wyo. | 4.00% | Exempt | Yes | Yes |

| D.C. | 6.00% | Exempt | No | No |

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe