The FDA’s proposal to ban flavored cigars would be a disruptive force in the cigar market and would carry significant revenue implications for many state governments. Flavored cigars make up between one-third and one-half of all cigar sales. We estimate that the aggregate effect of a ban on flavored cigar sales in the U.S. would be a decline of $836 million in excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. revenue annually. This estimate does not include lost revenues from state sales taxes or import and customs duties.

On April 28, the FDA introduced a new product standard that would prohibit the sale of menthol cigarettes and flavored cigars. We previously estimated that the ban on menthol cigarettes would eliminate over $6.5 billion in revenue the first year following the ban. The $836 million in lost revenue from flavored cigar excise taxes adds to the lost revenue from menthol cigarettes, meaning the total decline in state and federal revenues from the FDA’s decision to ban menthol cigarettes and flavored cigars could exceed $7.3 billion annually.

In the United States, more than 15 billion cigars are sold each year. Most of those are large cigars or cigarillos, defined for taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. purposes as weighing more than 3 pounds per 1,000 cigars. Little cigars, weighing less than 3 pounds per 1,000 cigars, are commonly sold in packs of 20 and account for a smaller share of the market than larger cigars.

Like cigarettes, cigars are taxed by the federal government and state governments. Small cigars carry the same federal tax as cigarettes, $1.01 per pack of 20 cigars. The federal government taxes large cigars 52.75 percent of the manufacturer price up to a maximum of $0.4026 per cigar.

State tax rates vary widely. Florida doesn’t tax cigars at all. Pennsylvania and New Hampshire levy no tax on large cigars, but tax small cigars the same as cigarettes. Washington and Minnesota levy a tax of 95 percent of the manufacturer’s price on large cigars and similarly tax small cigars at the same rate as cigarettes. The following table details the tax rates for each state for both large and small cigars.

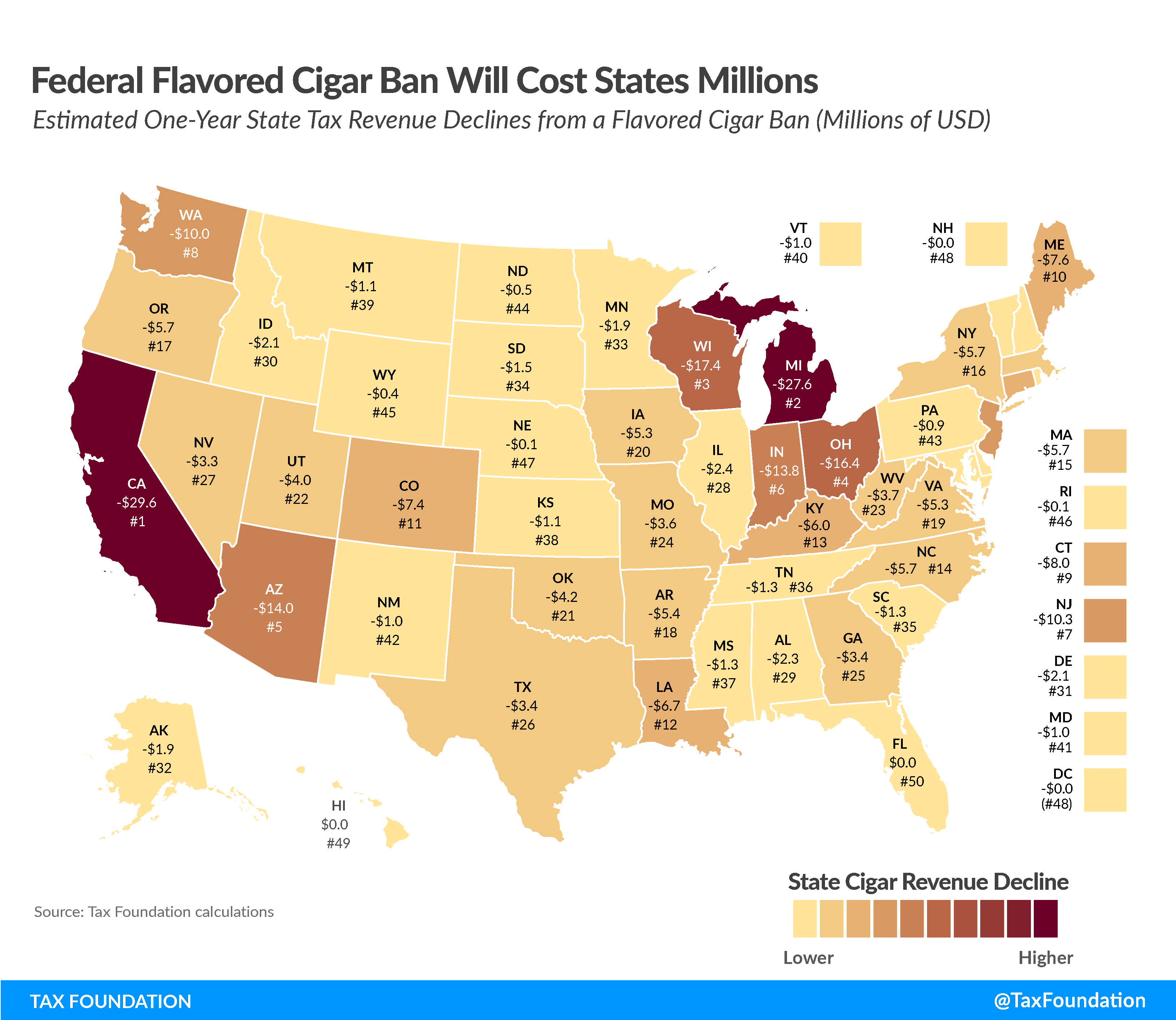

Preference for flavored cigars also varies significantly by state. In Hawaii, flavored cigar sales are almost nonexistent. In Utah, flavored products comprise the majority of market sales. The combination of different tax rate structures and consumer flavor preferences results in a broad range of state revenue effects from the proposed cigar flavor ban.

Florida would lose no revenue, because Florida imposes no taxes on cigars, and Hawaii’s revenue loss is almost zero because flavored cigars have such a small market share. Midwest states, including Michigan ($27.6 million), Wisconsin ($17.4 million), and Ohio ($16.4 million) that have relatively high cigar consumption, strong preferences for flavored products, and high cigar tax rates would see revenue declines that are only exceeded by California ($29.6 million). We estimate the total revenue decline for all states and the District of Columbia to be as much as $266 million.

The revenue decline for the federal government would be even greater. The federal government would lose $558 million in excise taxes on large cigars and an additional $11 million on excise taxes on little cigars, totaling nearly $570 million.

These revenue losses come with other challenges to governments. Bans, prohibitions, and exceedingly high tax rates fuel black markets and smuggling. The illicit cigarette market is a multibillion-dollar industry.

When Massachusetts banned the sale of menthol in cigarettes in 2020, illicit trade and cross-border shopping for cigarettes skyrocketed. Despite the ban, aggregate sales of cigarettes across the New England region showed no significant decline compared to other regions. Obviously, a nationwide ban would make cigarette smuggling and cross-border shopping more difficult, but the incentives for participation in the black market also grow.

Policymakers and regulators should not ignore the law of unintended consequences as they set tax rates and regulatory regimes for nicotine products. History is full of costly lessons from unforeseen reactions to prohibitions.

If the goal is to reduce smoking, high taxes and product bans are a costly and relatively ineffective means for reaching that goal. Consumers who still demand prohibited products may simply shift consumption to other (potentially more harmful) products, or they may find illegal means of acquiring what they want. The result is a narrowing a tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , leaving fewer taxpayers to cover the costs of the externalities associated with smoking.

| Tax Rate | Percent of Sales that are Flavored | |||||

|---|---|---|---|---|---|---|

| State | Little Cigars | Large Cigars | Little Cigars | Large Cigars | Reduction in Annual State Tax Collections | Rank of Revenue Loss |

| Alabama | $0.004 | $0.04 | 38.9 | 42.1 | $2,312,558 | 29 |

| Alaska | 75% of wholesale | 75% of wholesale | 42.3 | 42.3 | $1,948,360 | 32 |

| Arizona | $0.021 | $0.22 | 50 | 52.2 | $14,021,174 | 5 |

| Arkansas | 68% of wholesale | 68% of wholesale | 41.1 | 26.6 | $5,400,099 | 18 |

| California | 63.49% of wholesale | 63.49% of wholesale | 31.4 | 40.8 | $29,626,816 | 1 |

| Colorado | 50% of wholesale | 50% of wholesale | 60 | 48.1 | $7,436,442 | 11 |

| Connecticut | 50% of wholesale (not to exceed $0.50/cigar) | 50% of wholesale (not to exceed $0.50/cigar) | 23.4 | 46.6 | $8,039,031 | 9 |

| Delaware | 30% of wholesale | 30% of wholesale | 32.8 | 50.6 | $2,141,852 | 31 |

| District of Columbia | $0.251 | 91% of wholesale | 19.9 | 19.9 | $27,492 | 48 |

| Florida | no tax | no tax | 14.8 | 40.1 | $0 | 51 |

| Georgia | $0.003 | 23% of wholesale | 34.3 | 34.3 | $3,454,900 | 25 |

| Hawaii | $0.16 | 50% of wholesale | 0.07 | 0.07 | $203 | 50 |

| Idaho | 40% of wholesale | 40% of wholesale | 56.3 | 32.4 | $2,177,037 | 30 |

| Illinois | $0.149 / cigar | 36% of wholesale | 26 | 38.2 | $2,482,928 | 28 |

| Indiana | 24% of wholesale | 24% of wholesale | 41.1 | 58.5 | $13,877,148 | 6 |

| Iowa | $0.07 | 50% of wholesale (not to exceed $0.50/cigar) | 34.2 | 44 | $5,302,069 | 20 |

| Kansas | 10% of wholesale | 10% of wholesale | 40.1 | 40.9 | $1,182,904 | 38 |

| Kentucky | 15% of wholesale | 15% of wholesale | 37.7 | 40 | $6,045,644 | 13 |

| Louisiana | 8% of wholesale | 20% of wholesale | 29.4 | 42.8 | $6,747,200 | 12 |

| Maine | 43% of wholesale | 43% of wholesale | 10.5 | 63.2 | $7,645,778 | 10 |

| Maryland | 70% of wholesale | 15% of wholesale | 30.9 | 33.1 | $1,056,515 | 41 |

| Massachusetts | 40% of wholesale | 40% of wholesale | 0.1 | 46.5 | $5,749,249 | 15 |

| Michigan | 32% of wholesale | 32% of wholesale (not to exceed $0.50/cigar) | 23.8 | 46.9 | $27,607,037 | 2 |

| Minnesota | $0.152 | 95% of wholesale (not to exceed $0.50/cigar) | 30.6 | 38.7 | $1,913,550 | 33 |

| Mississippi | 15% of wholesale | 15% of wholesale | 33.7 | 37.7 | $1,341,715 | 37 |

| Missouri | 10% of wholesale | 10% of wholesale | 44.3 | 49.7 | $3,688,780 | 24 |

| Montana | 50% of wholesale | 50% of wholesale | 48.3 | 46.9 | $1,165,264 | 39 |

| Nebraska | 20% of wholesale | 20% of wholesale | 40.9 | 49.2 | $142,265 | 47 |

| Nevada | 30% of wholesale | 30% of wholesale | 36.7 | 50.3 | $3,302,833 | 27 |

| New Hampshire | $0.089 | no tax | 24.1 | 47.4 | $23,878 | 49 |

| New Jersey | 30% of wholesale | 30% of wholesale | 17.8 | 48.7 | $10,329,639 | 7 |

| New Mexico | $0.100 | 25% of wholesale (not to exceed $0.50/cigar) | 48 | 52.7 | $1,028,345 | 42 |

| New York | $0.218 | 75% of wholesale | 56.3 | 44.9 | $5,727,692 | 16 |

| North Carolina | 12.8% of wholesale | 12.8% of wholesale (not to exceed $0.30/cigar) | 41.5 | 39.9 | $5,751,932 | 14 |

| North Dakota | 28% of wholesale | 28% of wholesale | 44 | 42.7 | $523,842 | 44 |

| Ohio | 37% of wholesale | 17% of wholesale (not to exceed $0.58/cigar) | 33.8 | 55.7 | $16,401,846 | 4 |

| Oklahoma | $0.102 | $0.12 | 43.8 | 53.2 | $4,199,370 | 21 |

| Oregon | $0.167 | 65% of wholesale (not to exceed $1.00/cigar) | 39.1 | 37.8 | $5,699,882 | 17 |

| Pennsylvania | $0.130 | no tax | 42.1 | 47.7 | $938,298 | 43 |

| Rhode Island | $0.213 | 80% of wholesale (not to exceed $0.50/cigar) | 20.2 | 51.7 | $160,876 | 46 |

| South Carolina | 5% of wholesale | 5% of wholesale | 37.2 | 54.2 | $1,352,636 | 35 |

| South Dakota | 35% of wholesale | 35% of wholesale | 35 | 43.2 | $1,519,861 | 34 |

| Tennessee | $0.031 | 6.6% of wholesale | 40.7 | 52 | $1,348,485 | 36 |

| Texas | $0.001 | $0.01 | 27.9 | 30.9 | $3,427,323 | 26 |

| Utah | $0.085 | 86% of wholesale | 78.9 | 60.2 | $3,998,979 | 22 |

| Vermont | $0.154 | 92% of wholesale or $2.00 – $4.00 / cigar | 23 | 51.9 | $1,058,890 | 40 |

| Virginia | 20% of wholesale | 20% of wholesale | 39.9 | 42.3 | $5,354,201 | 19 |

| Washington | $0.151 | 95% of wholesale (not to exceed $0.65/cigar) | 33.5 | 50.5 | $10,021,525 | 8 |

| West Virginia | 12% of wholesale | 12% of wholesale | 49.1 | 55 | $3,782,685 | 23 |

| Wisconsin | 71% of wholesale (not to exceed $0.50/cigar) | 71% of wholesale (not to exceed $0.50/cigar) | 40.1 | 49.3 | $17,399,478 | 3 |

| Wyoming | 20% of wholesale | 20% of wholesale | 52.9 | 46.2 | $469,624 | 45 |

| Total All States | 33.3 | 47.8 | $266,356,134 | |||

| Sources: United States Department of Treasury, “The Tax Burden on Tobacco,” 2022; states’ departments of revenue; Kuiper et al (2018) and Wang et al (2022), which both aggregate Nielsen sales product scanner data; the Cigar Association of America; and author calculations. | ||||||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe