The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Florida Lawmakers Should Provide Certainty Around the State’s Corporate Income Tax Rate Reduction

Florida is now the ninth state to implement or adopt a corporate income tax cut in 2021, with the state’s new rate the nation’s second lowest—for now.

6 min read

Federal Plastics Tax Is Not a Good Revenue Raiser

One of the Senate’s proposals to pay for the Build Back Better Act is a federal excise tax on virgin plastics, which are plastics that are not reprocessed or recovered.

4 min read

How Heavily Taxed Are U.S. Multinationals?

In general, the effective tax rates on the foreign profits of U.S. multinationals are not that low relative to the U.S. tax rate, contrary to popular rhetoric.

7 min read

Carbon Tax: Weighing the Options for Financing Reconciliation

A carbon tax would be a less economically harmful pay-for than either personal or corporate income tax hikes and a more efficient way to reduce carbon emissions than green energy tax credits, but would come with other trade-offs.

4 min read

History of Attempted Changes to Step-Up in Basis Shows Perilous Road Ahead

As Congress considers President Biden’s proposal to tax unrealized capital gains at death, the history of previous efforts suggests it faces a perilous road ahead. Lawmakers must resolve tricky design and implementation details that derailed past attempts to change how capital gains are treated when assets are passed from one generation to the next.

4 min read

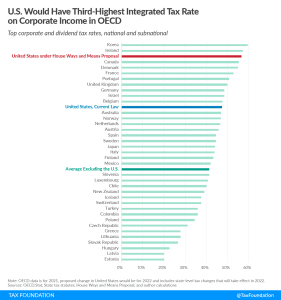

U.S. Corporate Income Faces Third-Highest Integrated Tax Rate in OECD Under Ways and Means Plan

Under the House Ways and Means tax plan, the United States would tax corporate income at the third-highest integrated tax rate among rich nations, averaging 56.6 percent.

3 min read

Federal Judge Rules Against ARPA’s Tax Mandate

Kentucky and Tennessee won an important legal victory Friday when a federal court ruled that the American Rescue Plan Act (ARPA)’s restrictions on state fiscal autonomy were unconstitutional and enjoined (blocked) the enforcement of those provisions against both states.

7 min read

Choose Your Own Adventure: Global Minimum Tax Edition

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have surfaced in recent weeks, there are clear divides among various proposals.

5 min read

Latest White House Report Tells Incomplete Story on Average Tax Rates for Wealthy

The White House Council of Economic Advisors (CEA)’s recent report estimates the average federal individual income tax rate for the top 400 wealthiest households in the U.S to be 8.2 percent, lower than typically estimated for top earners.

4 min read

2021 Spanish Regional Tax Competitiveness Index

The Spanish Regional Tax Competitiveness Index allows policymakers, businesses, and taxpayers to evaluate and measure how their regions’ tax systems compare and serves as a road map for policymakers to reform their tax systems and make their regions more competitive and attractive for entrepreneurs and residents.

7 min read