The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

“Taxing Big Oil Profiteers Act” Risks Disincentivizing Production, Inventory

In response to high oil prices, Sen. Wyden has proposed raising taxes on oil and gas companies in three ways. His “Taxing Big Oil Profiteers Act” would create an additional 21 percent tax on so-called excess profits earned over 10 percent of revenues of oil companies with annual revenues over $1 billion; levy a tax on stock buybacks; and remove last-in, first-out (LIFO) tax treatment of inventory accounting.

7 min read

Arkansas’s Rate Reduction Acceleration

Arkansas recently became the 13th state to authorize an individual income tax rate reduction this year. This round of tax cuts accelerated reforms enacted eight months ago.

7 min read

How to Think About IRS Tax Enforcement Provisions in the Inflation Reduction Act

The Inflation Reduction Act increases the IRS’s budget by roughly $80 billion over 10 years. The money is broken into four main categories—enforcement, operations support, business system modernization, and taxpayer services—as well as a few other small items such as an exploratory study on the potential of a free-file system.

6 min read

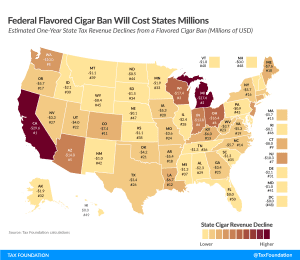

FDA Ban on Flavored Cigars Could Cost $836 Million in Annual Excise Tax Revenue

The FDA’s proposal to ban flavored cigars would carry significant revenue implications for many state governments.

7 min read

Japan’s Tax and Benefit System for Working Parents Isn’t Working

The Japanese tax and benefit system comes with trade-offs that policymakers must keep in mind when planning to reform the tax policy.

7 min read

Stock Buyback Tax Would Hurt Investment and Innovation

The Inflation Reduction Act calls for a new 1 percent excise tax on stock buybacks, the argument being it would be better for the economy if firms invested their surplus cash in the business, rather than returning this value to shareholders.

3 min read

Who Gets Hit by the Inflation Reduction Act Book Minimum Tax?

In dollar terms, the industries that would account for the largest book minimum tax liabilities are manufacturing, at $73.2 billion, followed by finance, insurance, and management at $46.9 billion.

6 min read

Minimum Book Tax: Flawed Revenue Source, Penalizes Pro-Growth Cost Recovery

While exempting accelerated depreciation from the book minimum tax would reduce some of the economic harm of the tax, there remain many unresolved problems within the design and structure of the tax that make it a poorly chosen revenue option.

3 min read

Reminder that Corporate Taxes Are the Most Economically Damaging Way to Raise Revenue

In the rush to pass the Inflation Reduction Act, which features an ill-conceived tax on the book income of U.S. corporations, it is worth reminding policymakers of a well-established finding in the economic literature.

3 min read

It Would Be a Mistake to Resurrect Corporate Alternative Minimum Tax

The Inflation Reduction Act may be smaller than the proposed Build Back Better legislation from 2021, but both sets of legislation propose a reintroduced corporate alternative minimum tax (AMT). The 30-year experience with a corporate AMT shows it is not a good solution.

4 min read