The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

EU: The Next Generation

The European Commission announced new budget plans including loans, grants, and some revenue offsets. The proposals follow other support mechanisms for workers and businesses that were designed in response to the Covid-19 pandemic and economic shutdown.

5 min read

Lessons from Alberto Alesina for U.S. Lawmakers

Alesina’s work suggests that raising taxes to reduce the federal deficit and national debt would be an economic mistake. The less economically damaging path is to cut spending, what some have called austerity policies.

3 min read

Net Operating Loss Carrybacks Are a Vital Source of Tax Relief for Struggling Firms in the Coronavirus Crisis

Rather than find ways to restrict net operating loss (NOL) carrybacks, lawmakers should focus on ways to improve liquidity by cashing out accrued NOLs, which would benefit startups and new small businesses without taxable income to offset in prior years.

3 min read

In Some States, 2020 Estimated Tax Payments Are Due Before 2019 Tax Returns

To prevent confusion and to ensure taxpayers receive the full benefit of the extended federal deadline, states should consider extending first- and second-quarter estimated tax payment due dates to July 15 or later.

9 min read

Tax Changes in California Governor’s Budget Could Stand in the Way of Economic Recovery

While other states are starting to think about the recovery, California is contemplating tax policies that would stand in the way of economic expansion once the health crisis abates. California’s shortfall is all too real, but tax policies which impede recovery are a hindrance, not a help.

5 min readHEROES Act Dependent Expansions Come with Major Drawbacks

The HEROES Act adds to the confusion and instability already inherent in the tax code with multiple expiring provisions and reduced filing guidelines.

4 min read

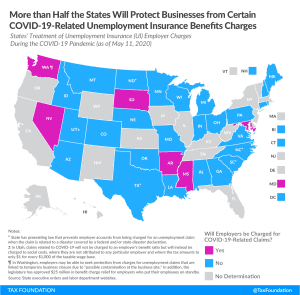

More Than Half the States Will Protect Businesses from Certain COVID-19-Related Unemployment Insurance Tax Hikes

Lawmakers can help expedite their state’s economic recovery by protecting employers from facing higher unemployment insurance tax rates at a time when they can least afford to pay them.

8 min read

HEROES Act Temporarily Increases Dependent Credit Generosity

The HEROES Act would make notable expansions to all three dependent-related credits, increasing maximum credit amounts, refundability, and income eligibility phaseouts. Practically, this means that certain filers could expect to receive a larger refund for each additional hour of work, eligible dependent, and dependent care expenses if the bill became law.

5 min read

Breaking Down State and Local Aid under the SMART Act

The SMART Act, sponsored by Senators Bob Menendez and Bill Cassidy and Rep. Mikie Sherrill, would provide $500 billion in flexible funding to state and local governments.

6 min read

Neutral Cost Recovery Is Not a New Idea

As stated by Rep. Jack Kemp in 1985, “Neutral cost recovery is designed to provide the present value of investment expensing without some of its practical problems.”

5 min read