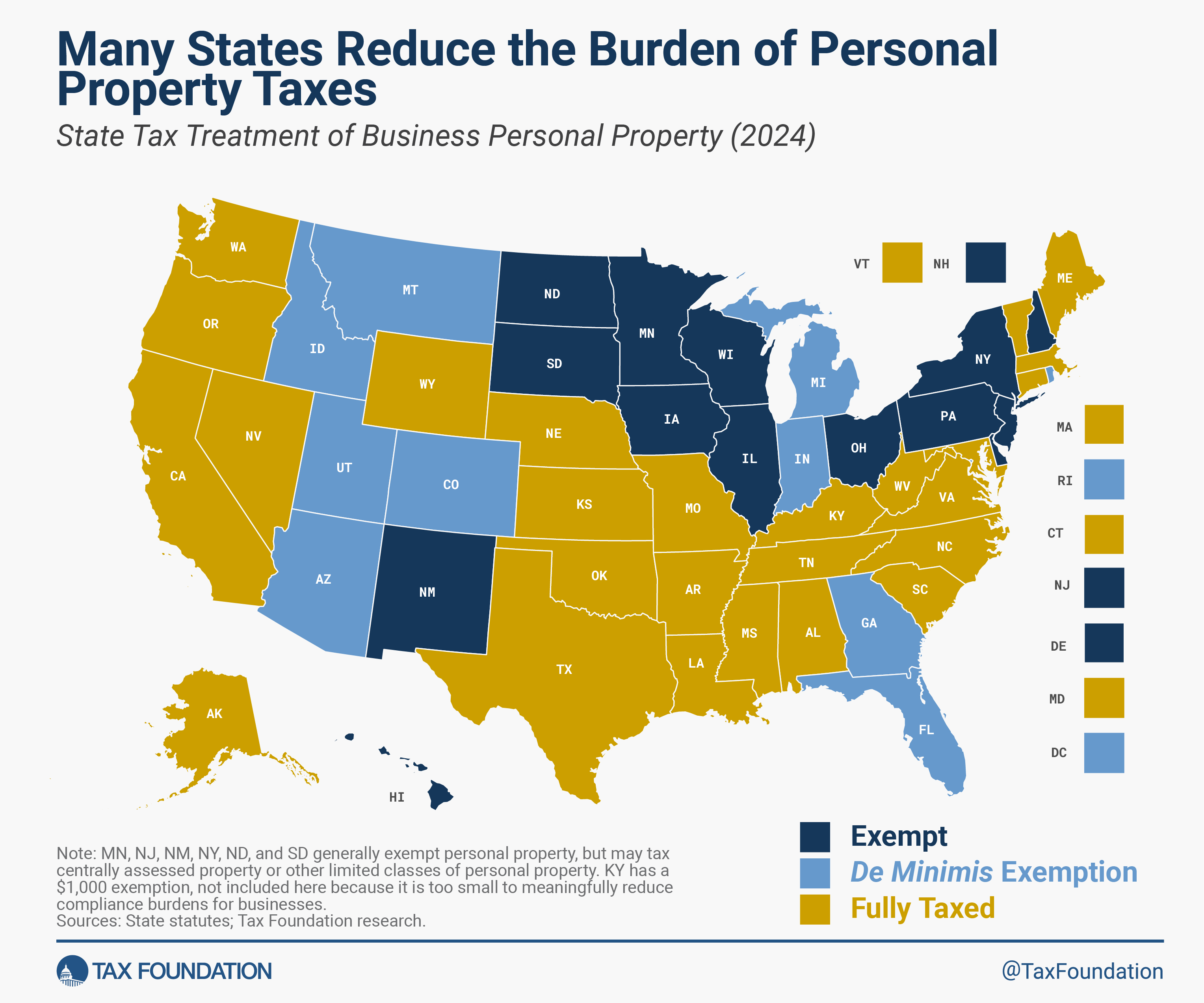

In most states, businesses not only pay taxes on their real property (land and structures), but also on their machinery, equipment, fixtures, and supplies, which are classified as tangible personal property (TPP). For many small businesses, the amount owed is negligible, but the compliance costs can be considerable. By allowing a de minimis exemption for businesses with only modest amounts of property, states can eliminate these compliance costs for a trivial loss of revenue. Fourteen states broadly exempt tangible personal property from taxation, while another 10 impose taxes on TPP but offer de minimis exemptions to avoid unduly burdening businesses with only a small amount of potentially taxable property.

Arizona, Colorado, Idaho, Indiana, Michigan, Montana, and Rhode Island have TPP taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. de minimis exemptions of $50,000 or more, while Florida, Georgia, Kentucky, and Utah have lower exemptions. (Kentucky, with an exemption of a mere $1,000, is so low as to be excluded from the map below.)

Unlike real property taxes, TPP taxes are taxpayer active, meaning that the taxpayer bears the responsibility of determining (subject to auditA tax audit is when the Internal Revenue Service (IRS) or a state or local revenue agency conducts a formal investigation of financial information to verify an individual or corporation has accurately reported and paid their taxes. Selection can be at random, or due to unusual deductions or income reported on a tax return. ) their tax liability, rather than receiving a tax bill from the government. Each business must itemize all personal property, with acquisition price and date, and depreciate it according to the appropriate schedule, to determine their taxable base.

We can see how this works by looking at the fairly typical case of the District of Columbia. In D.C., there are different schedules or sub-schedules for (1) reference materials; (2) furniture, fixtures, and machinery and equipment; (3) motor vehicles not registered in D.C.; (4) miscellaneous tangible personal property; and even (5) supplies. For tax purposes, businesses must report office supplies like stationary and envelopes, or the office kitchen’s cleaning supplies and cutlery. Outdoor holiday decorations are depreciated over five years, as are the business’s carpets, while paper products are reported at full cost, and desks, chairs, and cabinets depreciate at 10 percent per year.

For small businesses, this can be a lot of work—often wildly disproportionate to the amount actually owed. Meanwhile, the vast majority of TPP tax collections come from a small number of businesses. In an ideal world, they would not pay TPP taxes either, but imposing significant compliance costs on businesses with negligible exposure to the tax is particularly hard to justify.

Consequently, exempting the personal property of small businesses is a highly economical way of reducing taxpayer compliance burdens. Idaho recently exempted 90 percent of all businesses at a cost of about 1.1 percent of property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. collections. Indiana exempted at least 70 percent of businesses for less than 0.5 percent of property tax collections. The District of Columbia exempted 97 percent of businesses from TPP taxes by forgoing less than 1 percent of its property tax revenue. And Colorado recently raised its threshold from $7,900 to $50,000—exempting the majority of businesses—at a cost of less than one-sixth of one percent (0.15 percent) of property tax revenue.

Crucially, businesses only get the true benefit of the exemption if they are not required to file. If they must still itemize and depreciate all property, the compliance cost benefits are eliminated.

The time and resources spent itemizing office chairs and adding up the cost of paper towels is a deadweight loss that hurts businesses without helping local governments, and the revenue generated from this exercise is too trivial to justify its imposition on businesses with minimal tax liability.

For an extended analysis of the case for de minimis exemptions, click here.

Does Your State Have a Small Business Exemption for Machinery and Equipment?

| State | Exempt | De Minimis Exemption | Fully Taxed |

|---|---|---|---|

| Alabama | ✓ | ||

| Alaska | ✓ | ||

| Arizona | ✓ | ||

| Arkansas | ✓ | ||

| California (a) | ✓ | ||

| Colorado | ✓ | ||

| Connecticut | ✓ | ||

| Delaware | ✓ | ||

| Florida | ✓ | ||

| Georgia | ✓ | ||

| Hawaii (b) | ✓ | ||

| Idaho | ✓ | ||

| Illinois | ✓ | ||

| Indiana | ✓ | ||

| Iowa | ✓ | ||

| Kansas | ✓ | ||

| Kentucky | ✓ | ||

| Louisiana | ✓ | ||

| Maine | ✓ | ||

| Maryland | ✓ | ||

| Massachusetts | ✓ | ||

| Michigan | ✓ | ||

| Minnesota | ✓ | ||

| Mississippi | ✓ | ||

| Missouri | ✓ | ||

| Montana (c) | ✓ | ||

| Nebraska | ✓ | ||

| Nevada | ✓ | ||

| New Hampshire | ✓ | ||

| New Jersey (d) | ✓ | ||

| New Mexico (b) | ✓ | ||

| New York | ✓ | ||

| North Carolina | ✓ | ||

| North Dakota | ✓ | ||

| Ohio | ✓ | ||

| Oklahoma | ✓ | ||

| Oregon | ✓ | ||

| Pennsylvania | ✓ | ||

| Rhode Island | ✓ | ||

| South Carolina | ✓ | ||

| South Dakota (b) | ✓ | ||

| Tennessee | ✓ | ||

| Texas | ✓ | ||

| Utah (a) | ✓ | ||

| Vermont | ✓ | ||

| Virginia (a) | ✓ | ||

| Washington | ✓ | ||

| West Virginia | ✓ | ||

| Wisconsin | ✓ | ||

| Wyoming | ✓ | ||

| District of Columbia | ✓ |

Sources: State statutes; Tax Foundation research. Share this article