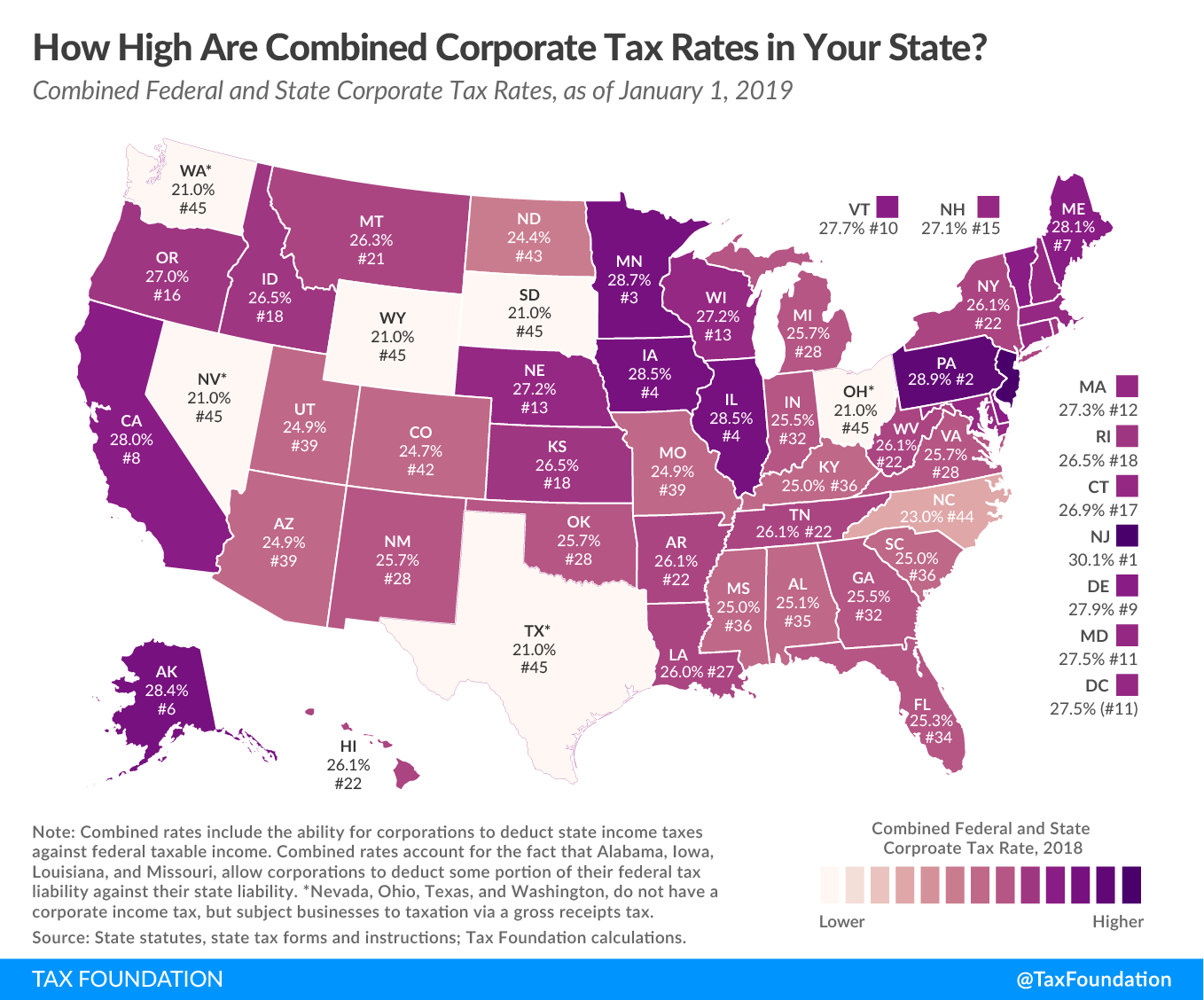

The Tax Cuts and Jobs Act (TCJA) reduced the U.S. federal corporate income tax rate from 35 percent to 21 percent. However, most U.S. states also tax corporate income. These state-level taxes mean the average statutory corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate in the U.S., which combines the average of state corporate income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates with the federal corporate income tax rate, is 25.8 percent in 2019.

State-level corporate income tax rates vary across the country. Six states (Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming) levy no corporate income tax, while the other 44 states and the District of Columbia do tax corporate profits. State-level rates range from a low of 2.5 percent in North Carolina to a high of 12 percent in Iowa. While the majority of states levy a flat rate on corporate profits, 14 states have progressively structured corporate income taxes.

Several states—Nevada, Ohio, Texas, and Washington—tax businesses via a gross receipts tax. So while they do not have corporate income taxes, businesses in those states are still subject to taxation.

The state with the highest corporate income tax rate is New Jersey, with a top combined rate of more than 30 percent. Corporations in six other states—Alaska, Illinois, Iowa, Maine, Minnesota, and Pennsylvania—face a combined rate over 28 percent. Businesses in the six states that levy no tax on corporate profits still face the federal rate of 21 percent.

Currently, corporations can fully deduct state and local income taxes, which pushes effective statutory tax rates below the statutory “headline” tax rate. Additionally, four states (Alabama, Iowa, Louisiana, and Missouri) allow corporations to deduct some portion of their federal tax liability against their state liability, further reducing effective statutory tax rates. The effective statutory tax rate represents the average of state and federal rates after accounting for this deductibility.

The TCJA significantly reduced the federal corporate income tax rate, making the U.S. more competitive with other developed nations. However, it’s important for policymakers to remember that corporate income taxes at the state level also contribute to the overall tax burden on corporate profits.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeNote: This is part of our “Business in America” blog series

- The Lowered Corporate Income Tax Rate Makes the U.S. More Competitive Abroad

- Corporate and Pass-through Business Income and Returns Since 1980

- Firm Variation by Employment and Taxes

- 2017 GDP and Employment by Industry

- Pass-Through Businesses Q&A

- Marginal Tax Rates for Pass-through Businesses Vary by State

- Taxes on Capital Income Are More Than Just the Corporate Income Tax

- Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

- Not All Tax Expenditures Are Equal