Whether 2020 has felt like a blur or a slog—whether it feels like December or as if it’s still March—we are finally reaching the end of a hard year. Traditional New Year’s Eve parties may be out this year, but if your festivities still include popping a bottle of bubbly, the champagne you toast with will be taxed.

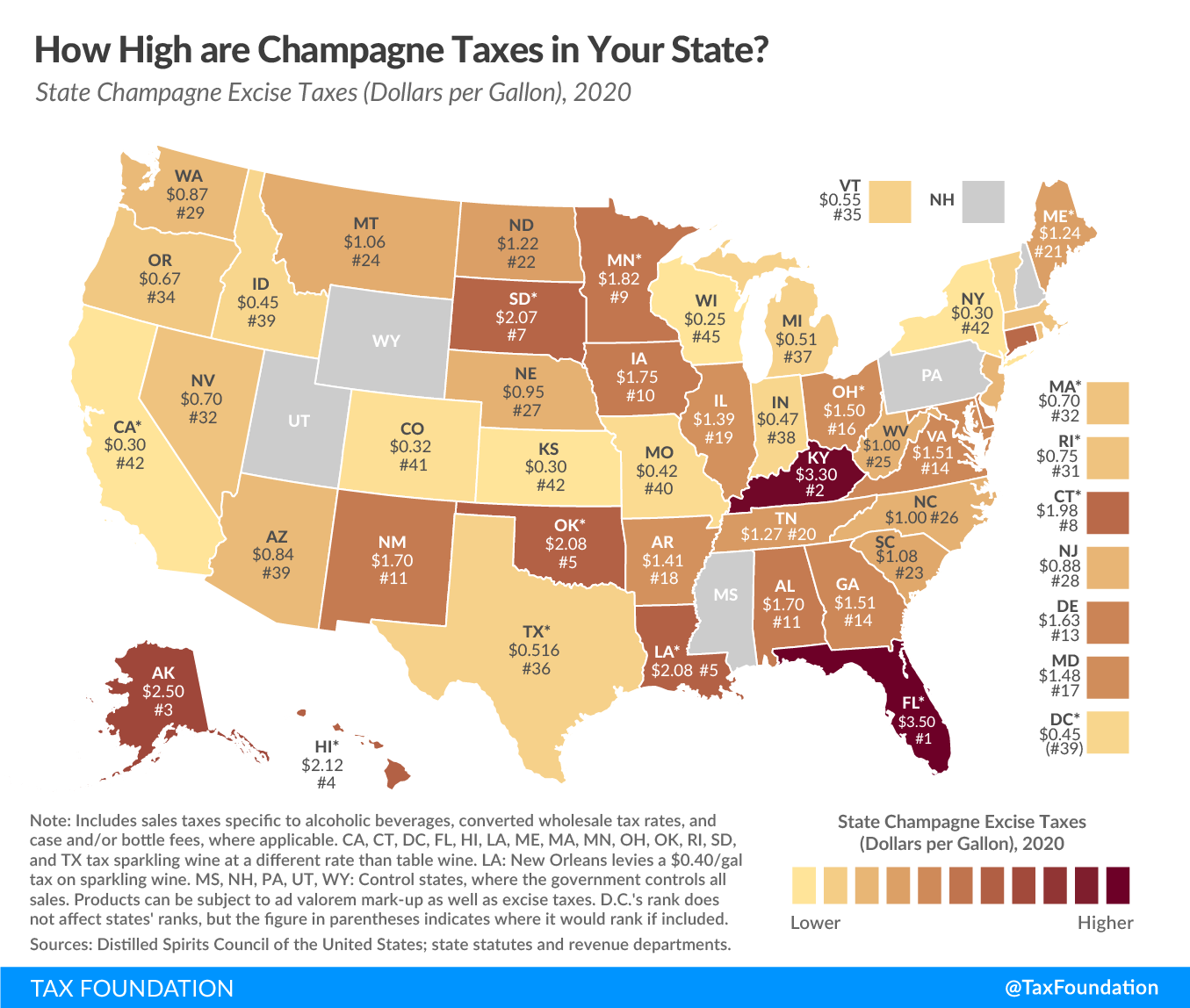

According to data compiled from the Distilled Spirits Council of the United States and state revenue departments, Florida comes in with the highest state champagne taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate at $3.50 per gallon. Next are Kentucky ($3.30 a gallon) and Alaska ($2.50 a gallon). Wisconsin ($0.25) is at the other end of the spectrum, with New York, Kansas, and California tied for second lowest at $0.30 a gallon. A typical bottle of champagne is 760 ml, with “magnum” bottles at 1.5 liters, representing just under 0.2 and 0.4 gallons, respectively.

Most states use the same excise tax rates for champagne and table wine, but 14 have alternate rates for sparkling wine.

Even though states can levy taxes at the production, wholesale, or retail level, vendors ultimately pass along those taxes to consumers in the form of higher prices. On the other hand, four states (Arkansas, Maryland, Minnesota, and South Dakota) and the District of Columbia levy sales taxes specific to alcoholic beverages that consumers pay directly.

As you pop open your bottle of bubbly to toast to better times ahead, take a look at how your state compares on these excise taxes. And here’s wishing you and yours a happier, and healthier, 2021.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe