Corporate income taxes get all the attention, but if you’re in the warehousing or distribution business, what you really care about is property taxes—rates and, often more significantly, breadth.

According to our Location Matters study, which provides an apples-to-apples comparison of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. costs for seven model firms across all fifty states, property taxes are far and away the most significant tax type for both new and mature distribution centers, frequently responsible for more than two-thirds of a firm’s overall tax burden. At the extreme, property taxes account for an astonishing 94 percent of the state and local tax burden experienced by the new distribution center in South Carolina. This phenomenon is largely the result of job tax credits and withholding tax rebates that essentially wipe out the firm’s income tax burden and much of its sales tax burden.

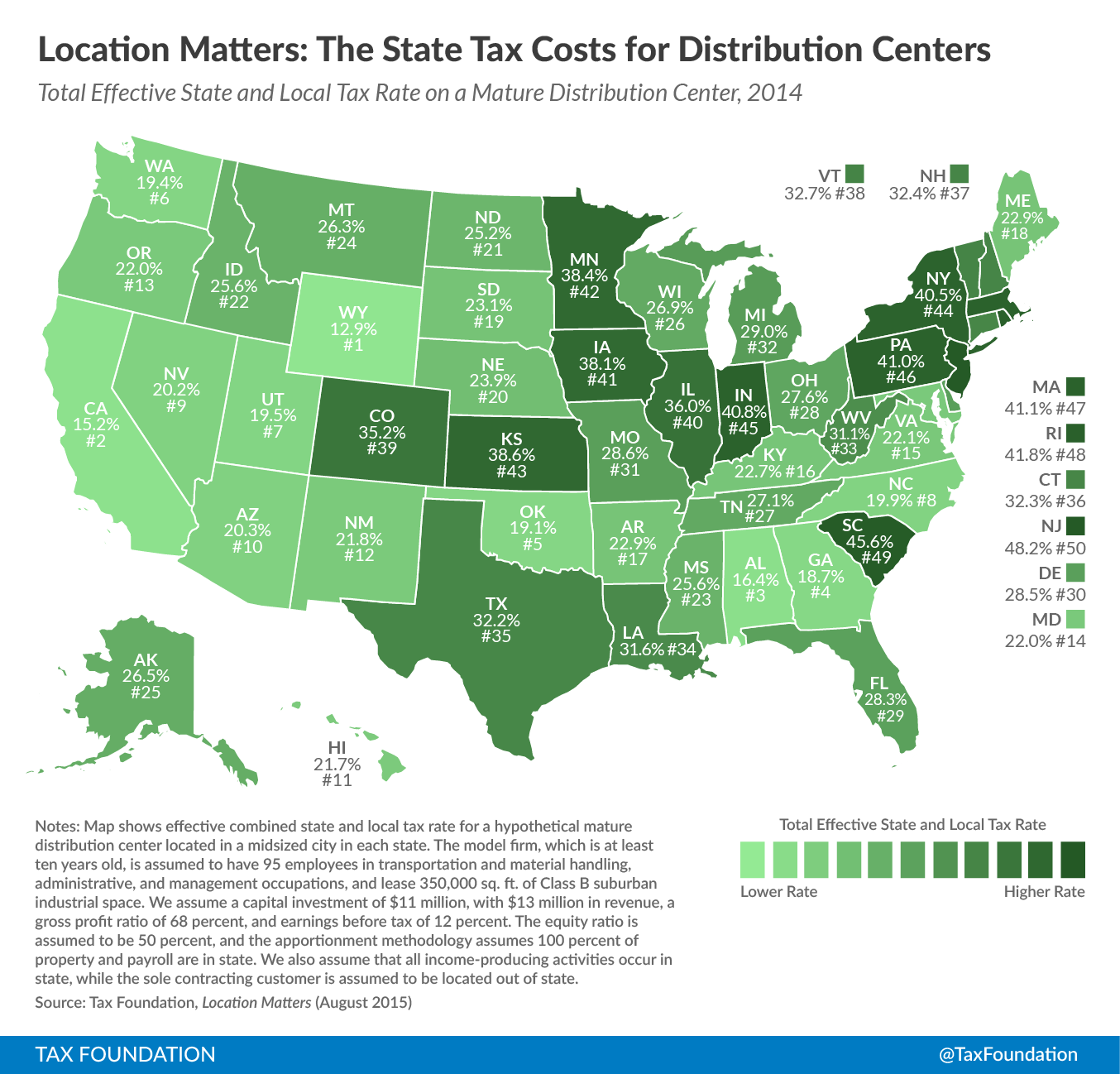

Click on map to enlarge. (See our reposting policy here.)

For these firms, property taxes are about more than just millages. Equally, if not more important, is whether a state’s property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. burden extends to inventory, business equipment, or both. For instance, states like Indiana, Massachusetts, Rhode Island, and South Carolina impose unusually high property tax burdens on mature operations in significant part because their property taxes extend beyond land and buildings.

It goes without saying that some states are naturally more attractive to distribution centers independent of tax burden. States with (or proximate to) a large manufacturing hub, or along a major transportation corridor, have clear advantages in attracting distribution centers. This is doubly the case for states boasting major ports, though there is of course significant competition among those ports, of which tax burdens are an important component. It is notable, in this context, that some states tax inventory but offer a “freeport exemption” for inventory with a final destination out of state.

Twenty-six states offer property tax abatements to new distribution centers, which substantially lower these firms’ effective tax rates. In many cases, though, these benefits may be short-lived, exposing firms to heavy tax burdens once the abatements expire. Corporate income taxes can also be a significant component of distribution centers’ effective tax rates, albeit not on par with property taxes. Consequently, many new distribution centers benefit from investment tax credits which reduce corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. liability.

The following table shows the highest and lowest tax cost states for mature distribution centers:

|

The Five Lowest Tax Cost States |

The Five Highest Tax Cost States |

|---|---|

| 1. Wyoming (12.9%) | 46. Pennsylvania (41.0%) |

| 2. California (15.2%) | 47. Massachusetts (41.1%) |

| 3. Alabama (16.4%) | 48. Rhode Island (41.8%) |

| 4. Georgia (18.7%) | 49. South Carolina (45.6%) |

| 5. Oklahoma (19.1%) | 50. New Jersey (48.2%) |

To read the full report, click here.

For the rest of the maps in this series, click the following links: Corporate Headquarters, Capital and Labor-Intensive Manufacturing, Research and Development Facilities, Call Centers, Retail Stores

(note: links will be updated throughout the week as new maps are posted)

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe