The country’s manufacturing sector is in decline. In 1979, about 19.6 million Americans were employed in manufacturing. Today the number stands at 12.3 million. Despite—or perhaps because of—this economic shift, manufacturing firms tend to be the recipients of substantial state incentives. That’s one takeaway from our new Location Matters study, which calculates the tax bills of seven model firms. We calculate their taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. liability in all fifty states, first as mature firms and then again as new firms more likely to be eligible for state incentives, allowing for an apples-to-apples comparison of how state taxes fall on distinct business types.

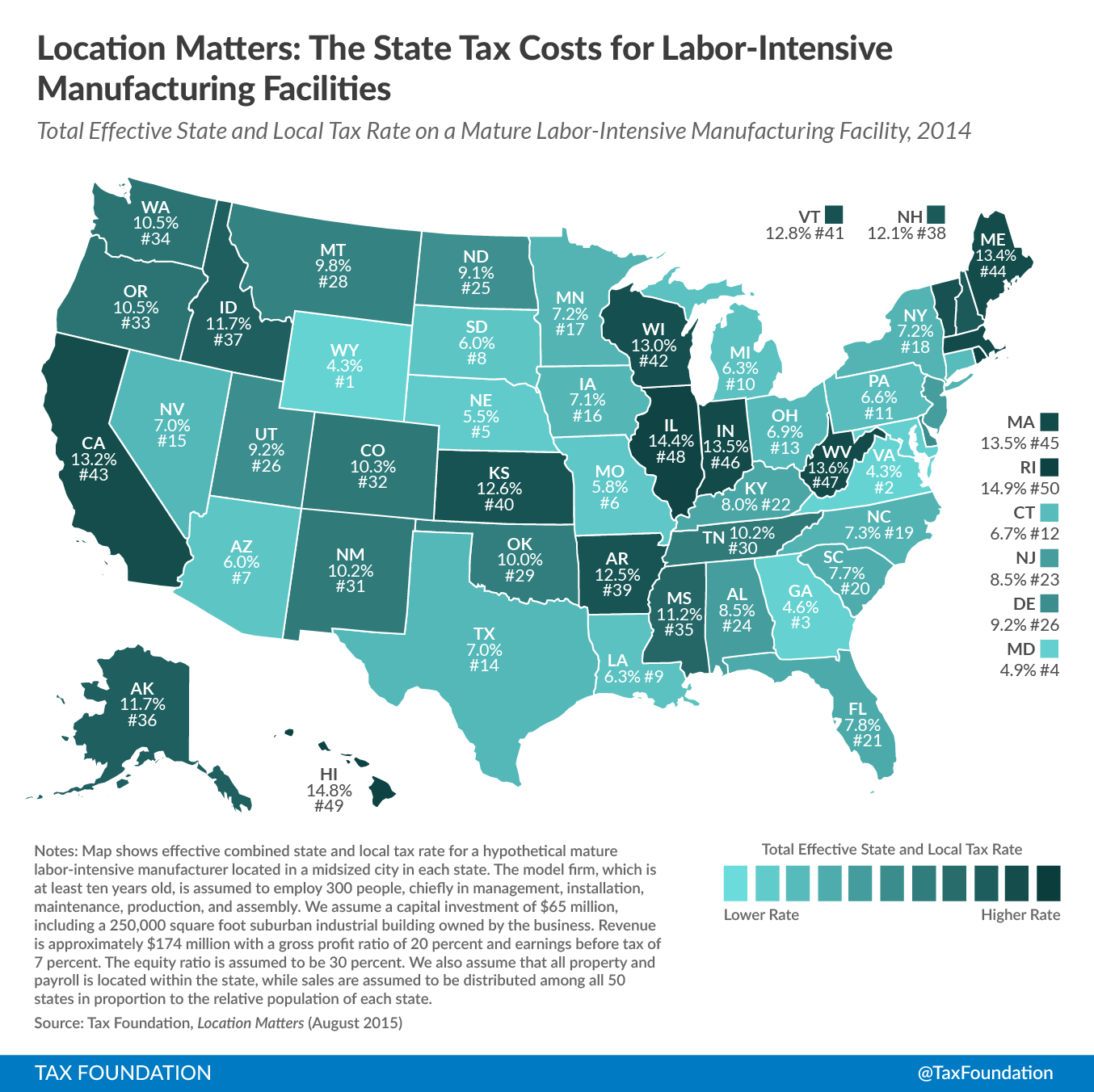

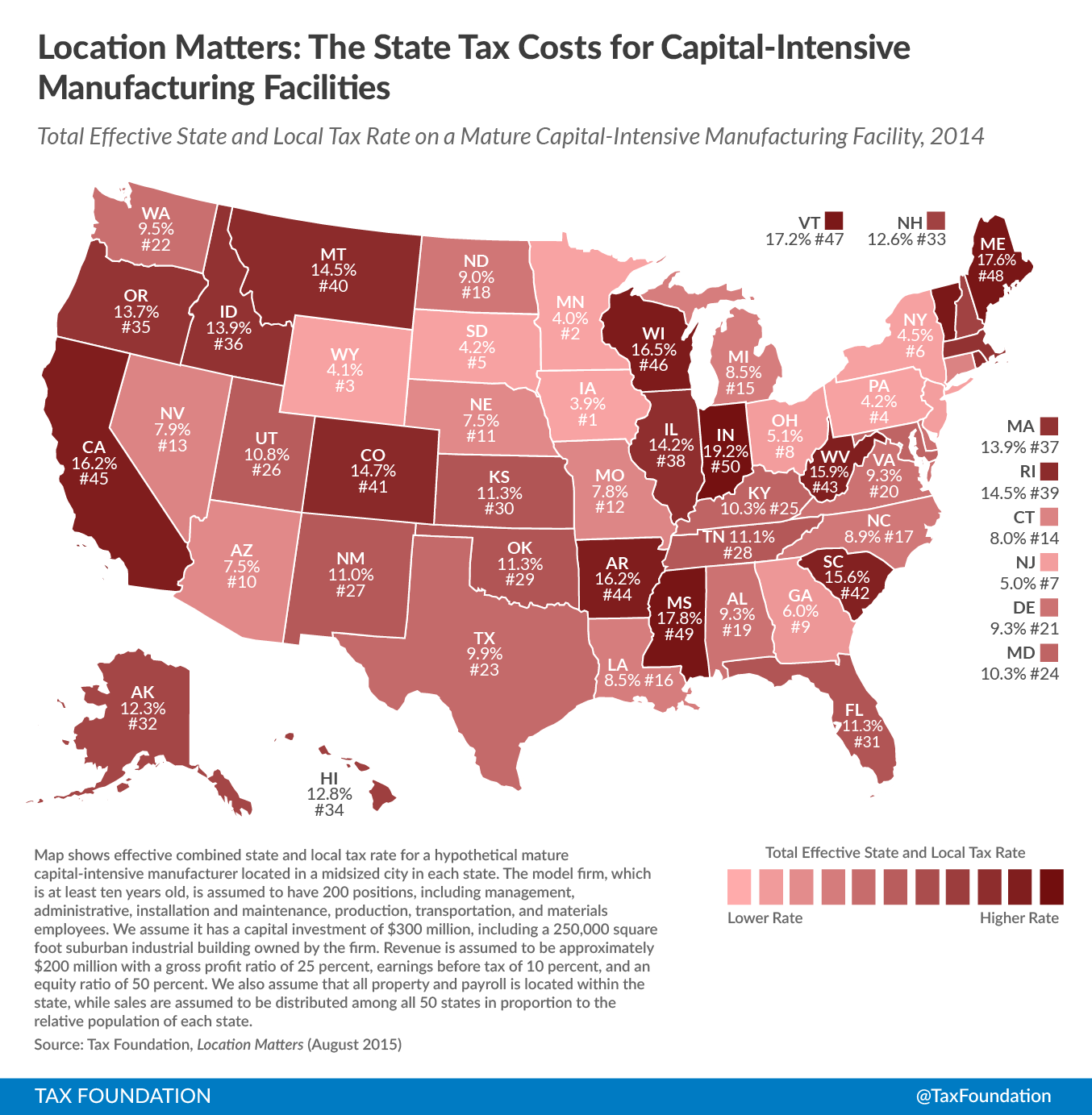

Two of our seven model firms were manufacturers: a capital-intensive manufacturing facility and a labor-intensive manufacturing facility, given their distinct tax exposure. Predictably, unemployment insurance tax burdens tend to be more significant to labor-intensive manufacturing, but the impact of other taxes varies across the two firm types as well.

Click on map to enlarge. (See our reposting policy here.)

Corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. burdens can be quite substantial, particularly for labor-intensive firms. In many cases, however, the actual corporate income tax rate is a poor predictor of actual burden, especially for new firms. Sixteen states offer withholding tax rebates, 24 states offer investment tax credits, and 24 states offer job tax credits to new labor-intensive manufacturers, all holding down—and in some cases eliminating—income tax burdens, at least for the first few years of operations.

New manufacturing operations in states with high income taxes, unfavorable apportionmentApportionment is the determination of the percentage of a business’s profits subject to a given jurisdiction’s corporate income tax or other business tax. US states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders. rules, and limited incentives tend to experience the highest aggregate tax costs. Conversely, favorable apportionment factors and the absence of a throwback rule can often do more for a firm than a lower corporate income tax rate.

Property taxes are more important to capital-intensive manufacturing operations than they are to labor-intensive operations, as the latter have less equipment potentially subject to tax. Still, states which limit their property tax base to land and buildings (rather than also taxing equipment and inventory) offer a lower tax environment for manufacturing firms of all types, all else being equal. Property tax abatements are also significant for manufacturing firms. Thirty-nine states offer some degree of property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. abatement for new capital-intensive manufacturers, a few of which all but wipe out overall tax liability for that firm type.

Because many states offer such substantial incentives for manufacturers, states with low tax costs for these firms are an intriguing mix of generally low tax states and relatively high tax states which make special dispensation for manufacturers. Such non-neutral treatment, of course, must be made up somewhere else in the system, meaning that other companies must pay more in taxes to cover the tax expenditure for manufacturing incentives.

The following table shows the five lowest and five highest tax cost states, expressed in terms of total effective tax rate for mature capital- and labor-intensive manufacturing operations:

| Capital-Intensive | Labor-Intensive |

|---|---|

| 1. Iowa (3.9%) | 1. Wyoming (4.3%) |

| 2. Minnesota (4.0%) | 2. Virginia (4.3%) |

| 3. Wyoming (4.1%) | 3. Georgia (4.6%) |

| 4. Pennsylvania (4.2%) | 4. Maryland (4.9%) |

| 5. South Dakota (4.2%) | 5. Nebraska (5.5%) |

| … | … |

| 46. Wisconsin (16.5%) | 46. Indiana (13.5%) |

| 47. Vermont (17.2%) | 47. West Virginia (13.6%) |

| 48. Maine (17.6%) | 48. Illinois (14.4%) |

| 49. Mississippi (17.8%) | 49. Hawaii (14.8%) |

| 50. Indiana (19.2%) | 50. Rhode Island (14.9%) |

To read the full report, click here.

For the rest of the maps in this series, click the following links: Corporate Headquarters, Call Centers, Research and Development Facilities, Distribution Centers, Retail Stores

(note: links will be updated throughout the week as new maps are posted)

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe