Economic cycles can have significant impacts on state revenue, but states can prepare for the inevitable downturns during good times by putting away money in a revenue stabilization fund—or rainy day funds, as they’re often known. Funding levels and the actual names of these funds may vary from state to state, but rainy day funds have increasingly emerged as a standard component of states’ budgeting toolkits.

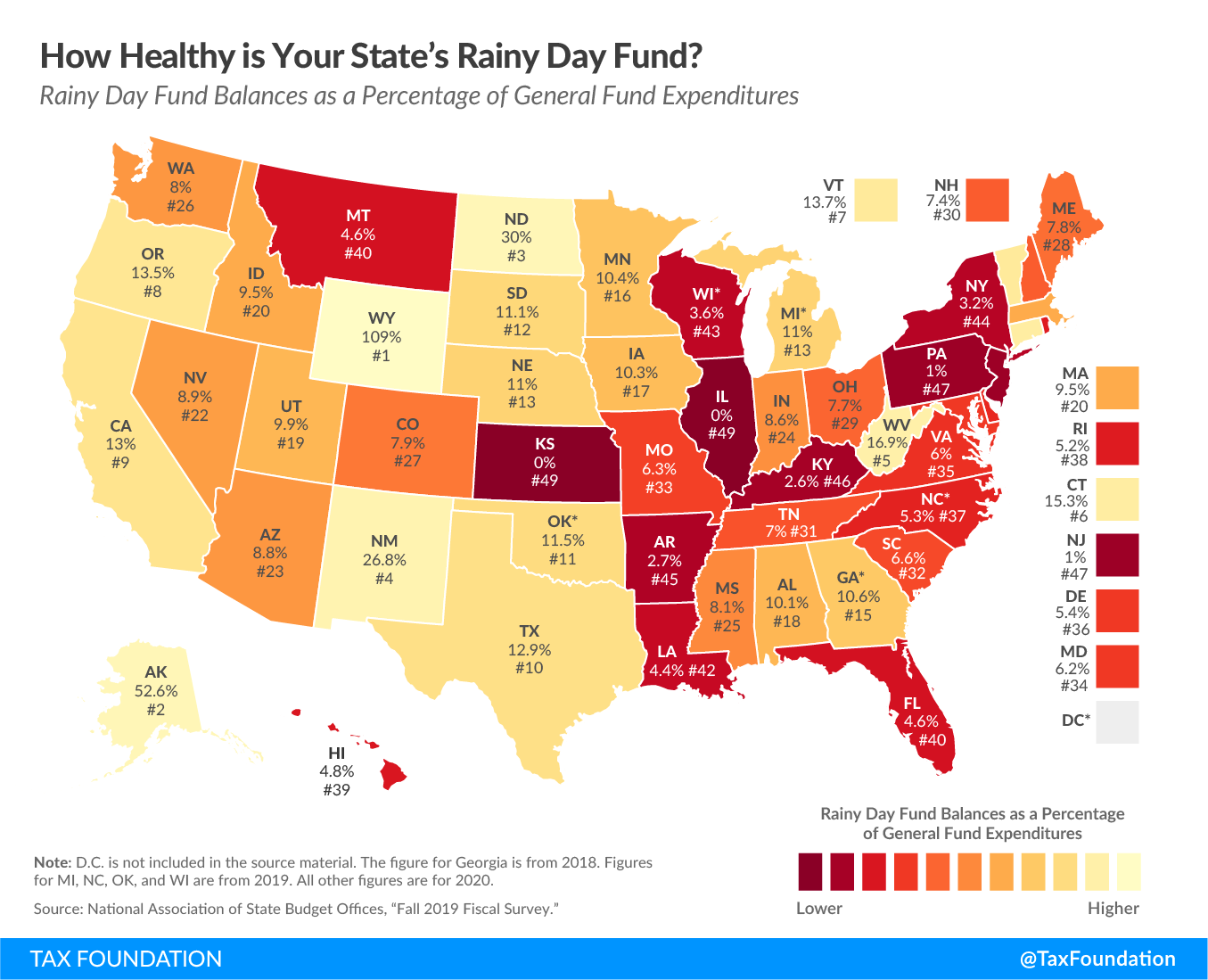

This week’s map looks at what percentage of a state’s general fund expenditures could be covered by the money in its rainy day fund (or funds). Because state revenues and budgets vary widely, looking at this percentage instead of dollar amounts alone allows us to compare how much a state has been saving, and exactly what those savings mean.

Of the 50 states, Wyoming has the most robust rainy day account, covering 109 percent of its annual general fund expenditures with $1.6 billion. Alaska comes in second with 52.6 percent of its annual expenditures ($2.3 billion). North Dakota (30 percent and $727 million) and New Mexico (26.8 percent and $2 billion) follow behind. Notably, each of these states relies heavily on revenue from oil and gas production and other resource extraction. Because of the revenue volatility associated with these industries, which were struggling predating the COVID-19 pandemic-related economic contraction, such states often deposit a substantial amount of excess revenue from severance and related taxes into rainy day funds in years when prices and production are high.

Kansas and Illinois have the least in their rainy day funds—Illinois with very little (only $4 million), and Kansas with nothing at all. Kansas implemented its rainy day fund (the Budget Stabilization Fund) only recently, in 2016, one of the last states to do so. While the plan was to establish the fund in 2017, deposits were not scheduled to begin until fiscal year 2020, after the state would accrue some revenue from the 2017 taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. increases. As such, the fund still stands empty. Pennsylvania and New Jersey are only slightly above this level, each with savings to cover 1 percent of their annual expenditures.

Due to data availability, Michigan, North Carolina, Oklahoma, and Wisconsin numbers are from 2019, and numbers for Georgia are from 2018. All other info is from 2020.

Share this article