Key Findings:

- Excessive taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates on cigarettes approach de facto prohibition in some states, inducing black and gray market movement of tobacco products into high tax states from low tax states or foreign sources.

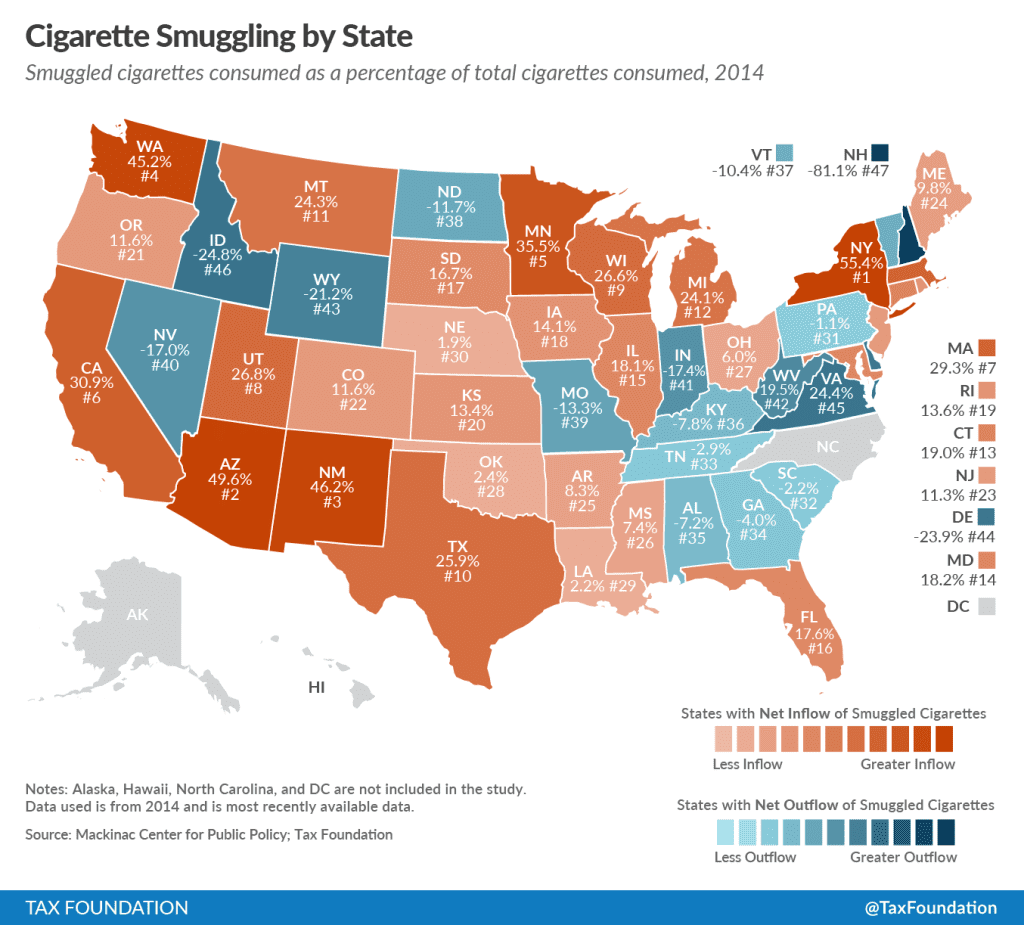

- New York has the highest inbound smuggling activity, with an estimated 55.4 percent of cigarettes consumed in the state deriving from smuggled sources in 2014. New York is followed by Arizona (49.6 percent of consumption smuggled), New Mexico (46.2 percent), Washington (45.2 percent), and Minnesota (35.5 percent).

- New Hampshire has the highest level of outbound smuggling at 81.1 percent of consumption, likely due to its relatively low tax rates and close proximity to high tax states in the northeastern United States. Following New Hampshire is Idaho (24.8 percent outbound smuggling), Virginia (24.4 percent), Delaware (23.9 percent), and Wyoming (21.2 percent).

- Following a cigarette tax increase from $2.51 to $3.51 in midyear of 2013, Massachusetts has seen a substantial increase in cigarette smuggling. Since the last year’s edition of this report, the state has jumped from 12 percent inbound smuggling to 29.3 percent inbound smuggling, the seventh highest in the country.

- Cigarette tax rates increased in 31 states and the District of Columbia between 2006 and 2014.

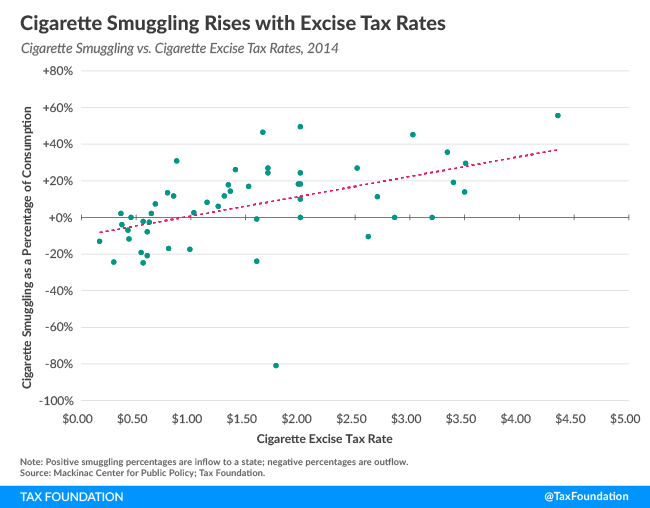

Public policies often have unintended consequences that outweigh their benefits. One consequence of high state cigarette tax rates has been increased smuggling as people procure discounted packs from low-tax states to sell in high-tax states. Growing cigarette tax differentials have made cigarette smuggling both a national problem and in some cases, a lucrative criminal enterprise.

Each year, scholars at the Mackinac Center for Public Policy, a Michigan think tank, use a statistical analysis of available data to estimate smuggling rates for each state.[1] Their most recent report uses 2014 data and finds that smuggling rates generally rise in states after they adopt cigarette tax increases. Smuggling rates have dropped in some states, however, often where neighboring states have higher cigarette tax rates. Table 1 shows the data for each state, comparing 2014 and 2006 smuggling rates and tax changes.

New York is the highest net importer of smuggled cigarettes, totaling 55.4 percent of total cigarette consumption in the state. New York also has the highest state cigarette tax ($4.35 per pack), not counting the additional local New York City cigarette tax (an additional $1.50 per pack). Smuggling in New York has risen sharply since 2006 (+62 percent), as has the tax rate (+190 percent).

Smuggling in Massachusetts has notably increased since the last data release. The state implemented a tax increase from $2.51 to $3.51 per pack in midyear 2013, and smuggling rates increased from 12 percent to 29.3 percent between the 2013 data and 2014 data. Over the same period, outbound smuggling increased in nearby low-tax New Hampshire, from -28.6 percent to -81.1 percent, suggesting that many cartons of cigarettes are crossing the border from one state to the other.

Other peer-reviewed studies provide support for these findings.[2] Recently, a study in Tobacco Control examined littered packs of cigarettes in five Northeast cities, finding that 58.7 percent of packs did not have proper local stamps. The authors estimated 30.5 to 42.1 percent of packs were trafficked.[3]

The study’s authors, LaFaive and Nesbit, note that smuggling comes in different forms: “casual” smuggling, where smaller quantities of cigarettes are purchased in one area and then transported for personal consumption, and “commercial” smuggling, which is large-scale criminal activity that can involve counterfeit state tax stamps, counterfeit versions of legitimate brands, hijacked trucks, or officials turning a blind eye.[4]

The Mackinac Center has cited numerous examples over the many editions of this report, including stories of a Maryland police officer running illicit cigarettes while on duty, a Virginia man hiring a contract killer over a cigarette smuggling dispute, and prison guards caught smuggling cigarettes into prisons.

Policy responses in recent years have included banning common carrier delivery of cigarettes,[5] greater law enforcement activity on interstate roads,[6] differential tax rates near low-tax jurisdictions,[7] and cracking down on tribal reservations that sell tax-free cigarettes.[8] However, the underlying problem remains: high cigarette taxes amount to a “price prohibition” of the product in many U.S. states.[9]

| State | 2014 Tax Rate (per pack) | 2014 Consumption Smuggled (positive is inflow, negative is outflow) | 2006 Consumption Smuggled (positive is inflow, negative is outflow) | 2014 Smuggling Ranking (1 is most smuggling, 50 least) | Smuggling Rank Change Since 2006 (e.g., NY changed from #5 to #1, so rank changed +4) | Cigarette Tax Rate Change, 2006-2014 |

|---|---|---|---|---|---|---|

| Note: Alaska, Hawaii, North Carolina, and the District of Columbia are not included in the study. Cigarette tax rates have changed for some states since 2014. | ||||||

| Source: Mackinac Center for Public Policy; Tax Foundation. | ||||||

| Alabama |

$0.425 |

-7.2% | +0.5% | 35 | -1 | No Change |

| Alaska |

$2.00 |

N/A | N/A | N/A | N/A | +25% |

| Arizona |

$2.00 |

+49.6% | +32.1% | 2 | +5 | +69% |

| Arkansas |

$1.15 |

+8.3% | +3.9% | 25 | +6 | +95% |

| California |

$0.87 |

+30.9% | +34.6% | 6 | +0 | No Change |

| Colorado |

$0.84 |

+11.6% | +16.6% | 22 | -8 | No Change |

| Connecticut |

$3.40 |

+19.0% | +12.3% | 13 | +9 | +125% |

| Delaware |

$1.60 |

-23.9% | -61.5% | 44 | +3 | +191% |

| District of Columbia |

$2.86 |

N/A | N/A | N/A | N/A | +186% |

| Florida |

$1.339 |

+17.6% | +6.9% | 16 | +10 | +294% |

| Georgia |

$0.37 |

-4.0% | -0.3% | 34 | +1 | No Change |

| Hawaii |

$3.20 |

N/A | N/A | N/A | N/A | +129% |

| Idaho |

$0.57 |

-24.8% | -6.0% | 46 | -7 | No Change |

| Illinois |

$1.98 |

+18.1% | +13.7% | 15 | +2 | +102% |

| Indiana |

$0.995 |

-17.4% | -10.8% | 41 | +2 | +79% |

| Iowa |

$1.36 |

+14.1% | +2.4% | 18 | +15 | +278% |

| Kansas |

$0.79 |

+13.4% | +18.4% | 20 | -8 | No Change |

| Kentucky |

$0.60 |

-7.8% | -6.4% | 36 | +4 | +100% |

| Louisiana |

$0.36 |

+2.2% | +6.4% | 29 | -2 | No Change |

| Maine |

$2.00 |

+9.8% | +16.6% | 24 | -9 | No Change |

| Maryland |

$2.00 |

+18.2% | +10.4% | 14 | +10 | +100% |

| Massachusetts |

$3.51 |

+29.3% | +17.5% | 7 | +6 | +132% |

| Michigan |

$2.00 |

+24.1% | +31.0% | 12 | -3 | No Change |

| Minnesota |

$3.34 |

+35.5% | +23.6% | 5 | +5 | +111% |

| Mississippi |

$0.68 |

+7.4% | -1.7% | 26 | +11 | +36% |

| Missouri |

$0.17 |

-13.3% | -11.3% | 39 | +5 | No Change |

| Montana |

$1.70 |

+24.3% | +31.2% | 11 | -3 | No Change |

| Nebraska |

$0.64 |

+1.9% | +12.0% | 30 | -7 | No Change |

| Nevada |

$0.80 |

-17.0% | +4.8% | 40 | -11 | No Change |

| New Hampshire |

$1.78 |

-81.1% | -29.7% | 47 | -1 | +123% |

| New Jersey |

$2.70 |

+11.3% | +38.4% | 23 | -20 | +13% |

| New Mexico |

$1.66 |

+46.2% | +39.9% | 3 | -1 | +82% |

| New York |

$4.35 |

+55.4% | +35.8% | 1 | +4 | +190% |

| North Carolina |

$0.45 |

N/A | N/A | N/A | N/A | +50% |

| North Dakota |

$0.44 |

-11.7% | +3.0% | 38 | -6 | No Change |

| Ohio |

$1.25 |

+6.0% | +13.1% | 27 | -8 | No Change |

| Oklahoma |

$1.03 |

+2.4% | +9.6% | 28 | -3 | No Change |

| Oregon |

$1.31 |

+11.6% | +21.1% | 21 | -10 | +11% |

| Pennsylvania |

$1.60 |

-1.1% | +12.9% | 31 | -10 | +19% |

| Rhode Island |

$3.50 |

+13.6% | +43.2% | 19 | -18 | +42% |

| South Carolina |

$0.57 |

-2.2% | -8.1% | 32 | +9 | +14% |

| South Dakota |

$1.53 |

+16.7% | +5.3% | 17 | +11 | +189% |

| Tennessee |

$0.62 |

-2.9% | -4.5% | 33 | +5 | +210% |

| Texas |

$1.41 |

+25.9% | +14.8% | 10 | +6 | +244% |

| Utah |

$1.70 |

+26.8% | +12.9% | 8 | +12 | +145% |

| Vermont |

$2.62 |

-10.4% | +4.5% | 37 | -7 | +46% |

| Virginia |

$0.30 |

-24.4% | -23.5% | 45 | +0 | No Change |

| Washington |

$3.025 |

+45.2% | +38.2% | 4 | +0 | +49% |

| West Virginia |

$0.55 |

-19.5% | -8.4% | 42 | +0 | No Change |

| Wisconsin |

$2.52 |

+26.6% | +13.1% | 9 | +9 | +227% |

| Wyoming |

$0.60 |

-21.2% | -0.6% | 43 | -7 | No Change |

Figure 1.

Figure 2.

[1] See, e.g., Mackinac Center for Public Policy, Michael LaFaive, Todd Nesbit, & Scott Drenkard, Cigarette Taxes and Smuggling: A 2016 Update (Dec. 2016), https://www.mackinac.org/s2016-09; Mackinac Center for Public Policy, Michael LaFaive, Todd Nesbit, & Scott Drenkard, Cigarette Smugglers Still Love New York and Michigan, but Illinois Closing In (Feb. 2015), http://www.mackinac.org/20900; Mackinac Center for Public Policy, Michael LaFaive, & Todd Nesbit, Cigarette Smuggling Still Rampant in Michigan, Nation (Feb. 2014), http://www.mackinac.org/19725; Mackinac Center for Public Policy, Michael LaFaive, & Todd Nesbit, Higher Cigarette Taxes Create Lucrative, Dangerous Black Market (Jan. 2013), http://www.mackinac.org/18128; Mackinac Center for Public Policy, Michael LaFaive, Cigarette Taxes and Smuggling 2010: An Update of Earlier Research (Dec. 2010), http://www.mackinac.org/14210; Mackinac Center for Public Policy, Michael LaFaive, Patrick Fleenor, & Todd Nesbit, Cigarette Taxes and Smuggling: A Statistical Analysis and Historical Review (Dec. 2008), http://www.mackinac.org/10005.

[2] See, e.g., Michael F. Lovenheim, “How Far to the Border?: The Extent and Impact of Cross-Border Casual Cigarette Smuggling,” National Tax Journal, Vol. LXI, No. 1, (March 2008). https://www.ntanet.org/NTJ/61/1/ntj-v61n01p7-33-how-far-border-extent.pdf?v=%CE%B1&r=04833355782549953; R. Morris Coats, “A Note on Estimating Cross Border Effects of State Cigarette Taxes,” National Tax Journal, Vol. 48, No. 4, (December 1995), pp. 573-84, https://www.ntanet.org/NTJ/48/4/ntj-v48n04p573-84-note-estimating-cross-border.pdf?v=%CE%B1&r=46492996768229045; Mark Stehr, “Cigarette Tax Avoidance and Evasion,” Journal of Health Economics, Vol. 24, (2005), pp. 277-97, http://www.sciencedirect.com/science/article/pii/S0167629604001225.

[3] Kevin C. Davis et. al., “Cigarette Trafficking in Five Northeastern US Cities,” Tobacco Control, December 2013, http://tobaccocontrol.bmj.com/content/early/2013/12/11/tobaccocontrol-2013-051244.

[4] See, e.g., Scott Drenkard, Tobacco Taxation and Unintended Consequences: U.S. Senate Hearing on Tobacco Taxes Owed, Avoided, and Evaded, Tax Foundation, July 29, 2014, https://taxfoundation.org/article/tobacco-taxation-and-unintended-consequences-us-senate-hearing-tobacco-taxes-owed-avoided-and-evaded.

[5] See, e.g., Curtis Dubay, UPS Decision Unlikely to Stop Cigarette Smuggling, Tax Foundation Tax Policy Blog, Oct. 25, 2005, https://taxfoundation.org/blog/ups-decision-unlikely-stop-cigarette-smuggling.

[6] See, e.g., Gary Fields, States Go to War on Cigarette Smuggling, Wall Street Journal, Jul. 20, 2009, http://www.wsj.com/articles/SB124804682785163691.

[7] See, e.g., Mark Robyn, Border Zone Cigarette Taxation: Arkansas’s Novel Solution to the Border Shopping Problem, Tax Foundation Fiscal Fact No. 168 (Apr. 9, 2009), https://taxfoundation.org/article/border-zone-cigarette-taxation-arkansass-novel-solution-border-shopping-problem.

[8] See, e.g., Joseph Henchman, New York Governor Signs Law to Tax Cigarettes Sold on Tribal Lands, Tax Foundation Tax Policy Blog, Dec. 16, 2008, https://taxfoundation.org/blog/new-york-governor-signs-law-tax-cigarettes-sold-tribal-lands.

[9] See Patrick Fleenor, Tax Differentials on the Interstate Smuggling and Cross-Border Sales of Cigarettes in the United States, Tax Foundation Background Paper No. 16 (Oct. 1, 1996), https://taxfoundation.org/article/tax-differentials-interstate-smuggling-and-cross-border-sales-cigarettes-united-states.