The taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. treatment of charitable giving over the past few years has been influenced by two major tax events: the 2017 Tax Cuts and Jobs Act (TCJA) and the 2020 Coronavirus Aid, Relief, and Economic Security (CARES) Act. These changes provide a case study of how changes in tax policy can influence taxpayer behavior in the short term, but also how these policies have turned the charitable deduction into a province of the rich.

Despite these wild fluctuations in tax policy, history shows that giving is tied more to higher after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. s and a growing economy than tax incentives for charitable giving.

How the TCJA Affected Charitable Giving

The TCJA made three significant changes to the tax code that influenced charitable giving:

- Lowered marginal tax rates

- Nearly doubled the size of the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

- Increased the limit from which charitable gifts could be deducted from adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” (AGI)

Let’s look at the ramifications of each of these changes.

Rate Reductions Caused Timing Shifts

As lawmakers crafted the TCJA, they were very clear that one of the goals was to reduce marginal income tax rates. In 2017, the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. had seven brackets ranging from 10 percent to a top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. of 39.6 percent. Indeed, TCJA lowered most tax rates—including the top rate to 37 percent.

Many taxpayers took advantage of these prospective changes by increasing their charitable gifts in 2017 to deduct them at the higher tax rates. This was especially the case among high-income taxpayers.

As Table 1 illustrates, overall charitable tax deductionA tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state and local taxes paid, mortgage interest, and charitable contributions. s jumped 9 percent in 2017 compared to 2016, from roughly $234 billion to $256 billion. However, charitable tax deductions for taxpayers earning between $200,000 and $500,000 jumped 14 percent while deductions for those earning $500,000 to $1 million increased by 18 percent.

Meanwhile, charitable tax deductions for those earning $1 million to $10 million rose by a staggering 72 percent, or $22.5 billion. As we will see, charitable tax deductions for these wealthy taxpayers dropped off considerably in 2018, indicating that they brought forward deductions into the year with the higher tax rates.

| 2017 Deductions (in Billions) | 2017 Deductions (in Billions) | Increase in Deductions 2016 to 2017 (in Billions) | Percent change 2016 to 2017 | |

|---|---|---|---|---|

| Total Charitable Deductions | $233.9 | $256.1 | $22.2 | 9% |

| $0 to $100,000 | $56.3 | $58.0 | $1.8 | 3% |

| $100,000 to $200,000 | $53.3 | $57.1 | $3.8 | 7% |

| $200,000 to $500,000 | $35.2 | $40.1 | $4.9 | 14% |

| $500,000 to $1 million | $15.0 | $17.7 | $2.6 | 18% |

| $1 to $10 million | $31.3 | $53.8 | $22.5 | 72% |

| $10 million or more | $42.8 | $47.1 | $4.3 | 10% |

| Source: IRS. | ||||

Raising the Standard Deduction Removed 46 Million Itemizers

For taxpayers who itemize, the charitable tax deduction is one of the top deductions they claim, along with the mortgage interest deductionThe mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households’ taxable incomes and, consequently, their total taxes paid. The Tax Cuts and Jobs Act (TCJA) reduced the amount of principal and limited the types of loans that qualify for the deduction. and the state and local tax deduction. One of the TCJA’s other major changes to the individual tax code was to nearly double the standard deduction for all taxpayers—from $6,500 to $12,000 for individual filers and from $13,000 to $24,000 for married couples—thus reducing the need of many to itemize.

As Table 2 illustrates, the number of itemizers who claimed the charitable deduction dropped significantly from roughly 38 million in 2017 to nearly 15 million in 2018, a 60 percent decline. As a result, IRS data shows that the overall value of itemized charitable deductions fell from $256 billion in 2017 to $196 billion in 2018.

However, the biggest changes were at the lower end of the income scale. The number of taxpayers who earned less than $100,000 and claimed the charitable deduction dropped from over 18 million in 2017 to 5.7 million in 2018. The value of their deductions also fell from $58 billion in 2017 to $26.7 billion in 2018, a decline of 54 percent.

Similarly, the taxpayers earning between $100,000 and $200,000 who claimed the charitable deduction fell from about 13 million in 2017 to about 5 million in 2018. The value of their deductions fell by nearly 40 percent, from $57 billion to $35 billion.

| 2017 | 2018 | |||

|---|---|---|---|---|

| Itemizers | Charitable Deductions Claimed | Itemizers | Charitable Deductions Claimed | |

| Total Charitable Deductions | 37,979,015 | $256.0 | 14,844,596 | $196.9 |

| $0 to $100,000 | 18,442,686 | $58.0 | 5,733,170 | $26.7 |

| $100,000 to $200,000 | 12,971,310 | $57.1 | 4,995,604 | $35.3 |

| $200,000 to $500,000 | 5,250,599 | $40.1 | 3,027,162 | $33.0 |

| $500,000 to $1 million | 881,904 | $17.7 | 686,437 | $17.2 |

| $1 to $10 million | 413,377 | $53.8 | 382,211 | $36.8 |

| $10 million or more | 19,142 | $47.1 | 20,014 | $48.0 |

Fewer Itemizers Does Not Mean Fewer Overall Donations

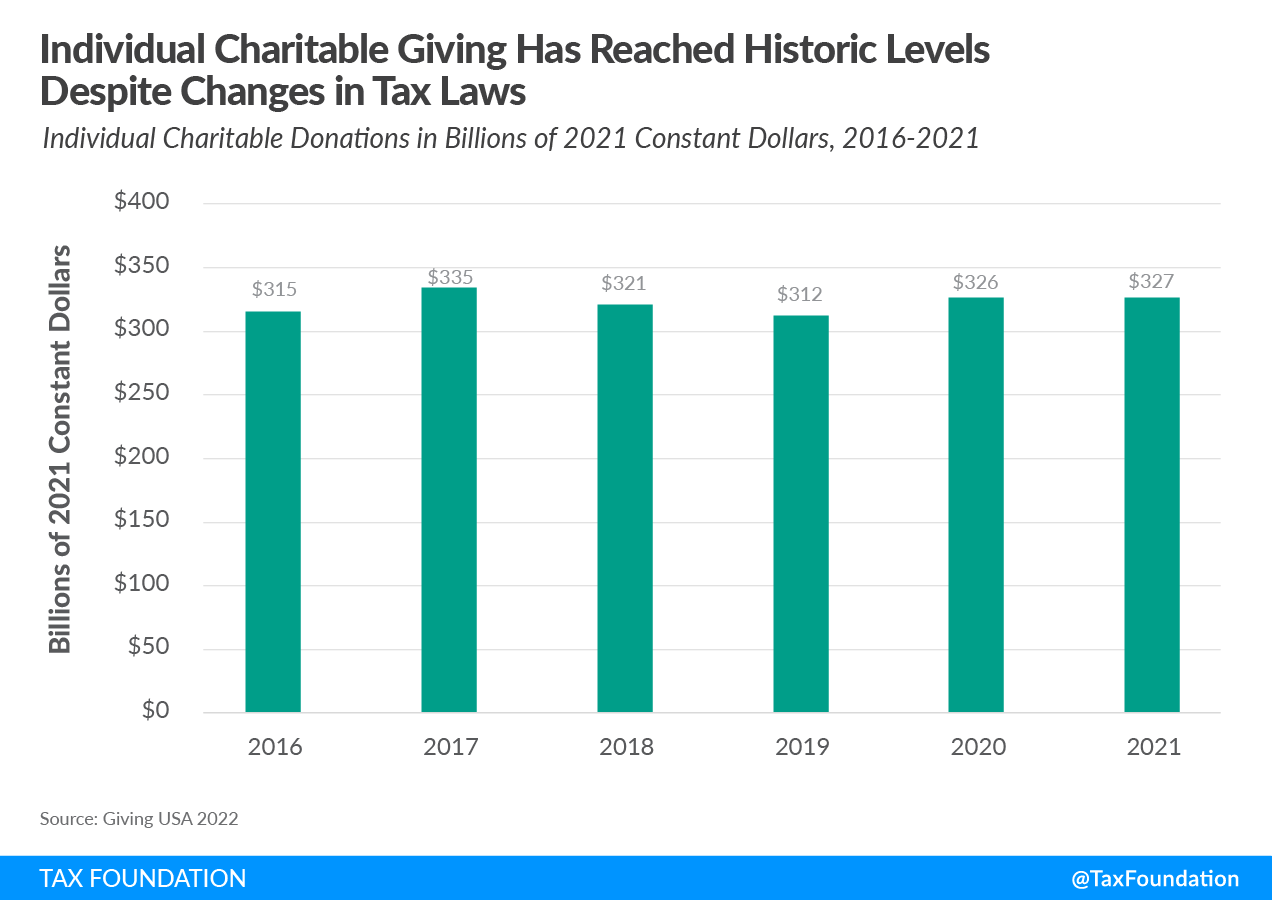

Many non-profit advocates feared that contributions would decline if there were fewer taxpayers able to deduct their charitable donations. However, according to Giving USA data, total individual giving did not drop off much following the TCJA, in both nominal or real terms. Indeed, in real terms, individual giving in 2018 was higher than 2016 levels (pre-TCJA).

Charitable donations dropped only slightly in 2019, after adjusting for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. , and were still roughly in line with 2016 levels even though there were dramatically fewer taxpayers itemizing deductions.

TCJA Increased the Value of Charitable Giving for the Wealthy

Before the TCJA, taxpayers were limited in how much of their charitable gifts they could claim against their income—50 percent of AGI. The TJCA increased that limit to 60 percent.

As a very simple example, let’s say a taxpayer has $100,000 in income. The old rules said they could claim $50,000 in charitable donations against their AGI. The new rules increased that amount to $60,000. Assuming they had no other deductions, their taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. would be reduced from $100,000 to $40,000.

The ramifications of this change may have encouraged some wealthy itemizers to increase their giving, which may have offset some of the decline in itemized deductionItemized deductions allow individuals to subtract designated expenses from their taxable income and can be claimed in lieu of the standard deduction. Itemized deductions include those for state and local taxes, charitable contributions, and mortgage interest. An estimated 13.7 percent of filers itemized in 2019, most being high-income taxpayers. s.

However, looking at the post-TCJA trends in Table 3, it is difficult to see a clear pattern of how this provision influenced giving. More clear, however, is how taxpayers with incomes above $10 million responded to the CARES Act expansion of the deduction limitation.

| (figures in billions) | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|

| Total Charitable Deductions | $233.9 | $256.1 | $197.0 | $190.1 | $215.4 |

| $0 to $100,000 | $56.3 | $58.0 | $26.7 | $27.1 | $32.1 |

| $100,000 to $200,000 | $53.3 | $57.1 | $35.3 | $35.1 | $34.8 |

| $200,000 to $500,000 | $35.2 | $40.1 | $33.0 | $34.4 | $33.8 |

| $500,000 to $1 million | $15.0 | $17.7 | $17.2 | $17.5 | $17.6 |

| $1 to $10 million | $31.3 | $53.8 | $36.8 | $36.3 | $37.6 |

| $10 million+ | $42.8 | $47.1 | $48.0 | $39.8 | $59.5 |

|

Source: IRS. |

|||||

How the CARES Act Impacted Charitable Giving

The CARES Act made two major changes to charitable tax policies that appear to have had a short-term impact on giving:

- Created an above-the-line deduction for those taking the standard deduction of $300 for singles and $600 for married couples

- Increased the limit from which charitable deductions could be claimed against AGI

Let’s look at the ramifications of each of these changes as well.

More Itemizers but Limited Impact

IRS data for 2020 (the most recent available), indicates that 41.4 million taxpayers who took the standard deduction also claimed the above-the-line charitable deduction. Nearly 29 million of these taxpayers earned less than $100,000 and 38 million earned less than $200,000. It is likely that many of these taxpayers were exempted from itemizing by the TCJA.

The total value of their deducted donations was $10.7 billion. While not a trivial amount, it only increased the total amount of charitable deductions in 2020 by 5 percent, from $204.6 billion to $215.4 billion. The average deduction claimed was $258.

How the Charitable Deduction Became the Province of the Rich

The CARES Act increased the deduction limit of charitable gifts from 60 percent of AGI to 100 percent. As Table 3 illustrates, the charitable tax deductions claimed by taxpayers earning over $10 million jumped by 50 percent, from $39.7 billion in 2019 to $59.5 billion in 2020. Giving by those earning $1 to $10 million increased by $1.3 billion.

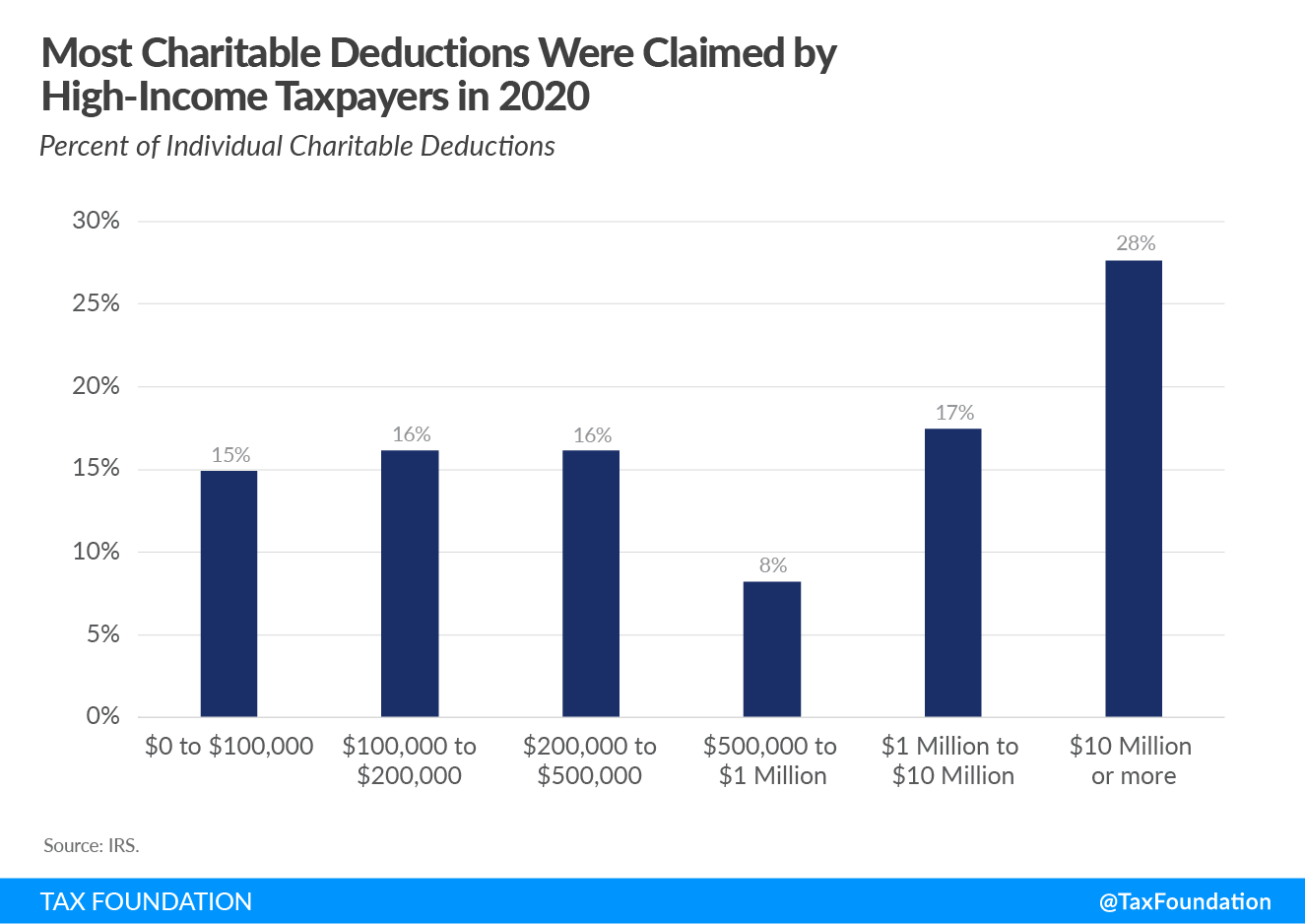

This change greatly tilted the giving playing field to the rich. As Figure 3 shows dramatically, taxpayers earning over $10 million claimed 28 percent of all charitable deductions in 2020, while taxpayers earning over $1 million claimed 45 percent of charitable tax deductions.

Even considering the added above-the-line contributions of taxpayers taking the standard deduction, taxpayers earning less than $100,000 claimed just 15 percent of all charitable tax deductions in 2020.

The Lesson: Low Tax Rates Matter More to Charity in the Long Run

This case study illustrates that changes in charitable tax policy can change taxpayer behavior in the short term but also cause big fluctuations in giving patterns and compliance headaches for taxpayers. It cries out for stability and predictability.

History tends to show that that charitable giving increases as tax burdens decline, incomes rise, and the economy grows.

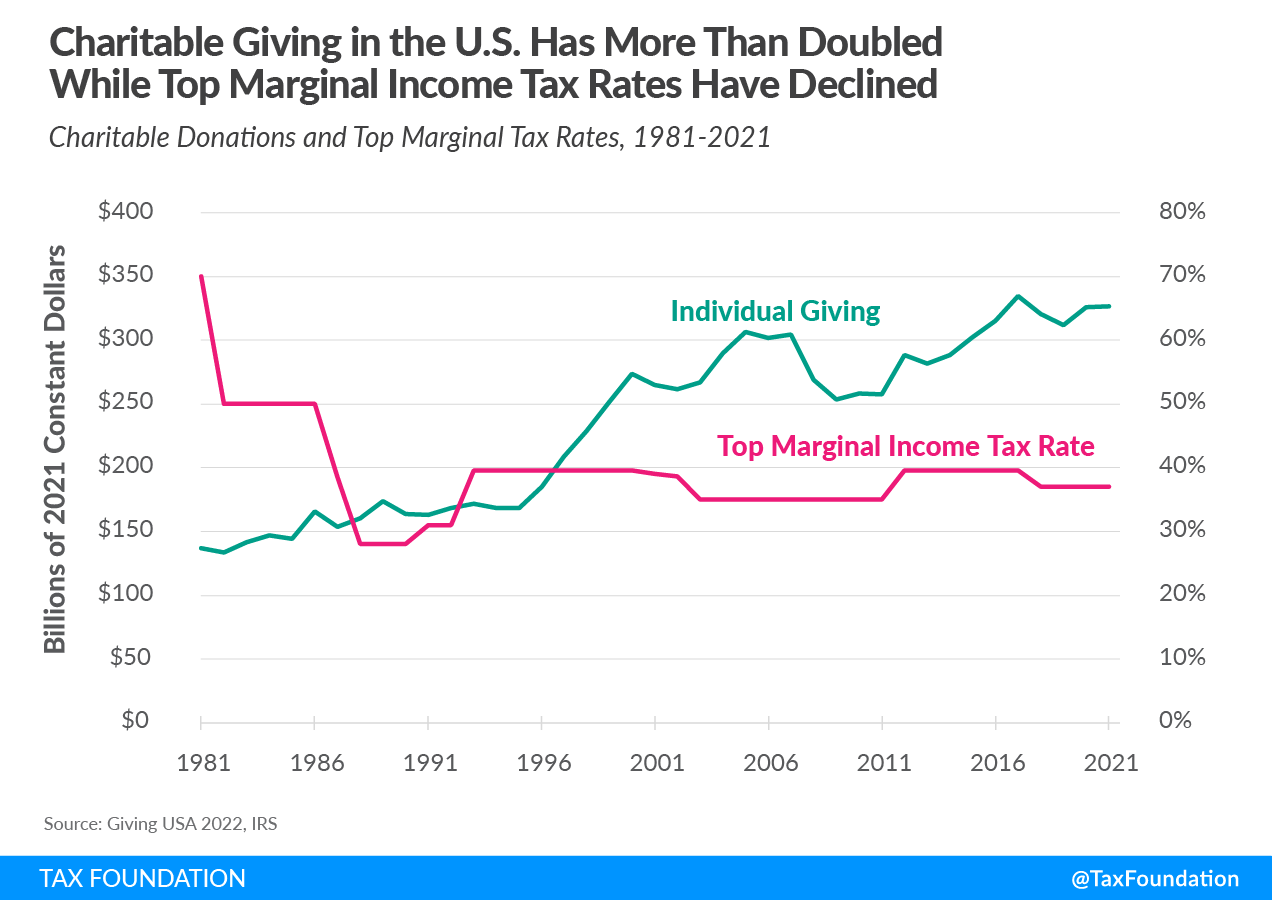

Figure 3 shows the changes to the top marginal tax rates for married couples since 1981 contrasted with the growth in charitable giving adjusted to today’s dollars. After a dramatic drop during the 1980s from 70 percent to 28 percent, the top individual tax rate has averaged 37 percent for the past four decades.

While tax rates have declined and stabilized, charitable giving has more than doubled in real terms since 1981, from $137 billion to $327 billion today. There would seem to be an inverse correlation between tax rates and giving, as lower rates are associated with increased giving, likely due to higher after-tax incomes.

Indeed, between 1981 and 2021, total individual giving grew by 138 percent after adjusting for inflation. By contrast, total disposable personal income grew by 177 percent in real terms, which means that individual charitable giving grew slightly slower than after-tax incomes over the past 40 years. The difference could result from the fact that charitable giving is more sensitive to business cycles than incomes.

Over the long run, tax policies that grow after-tax incomes and the economy do more to boost charitable giving than policies that try to incentivize people to be charitable.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe