See our latest analysis of the corporate rates under the House Democrats’ proposal.

President Joe Biden’s proposal to raise taxes on corporations has renewed arguments about how much the U.S. should collect from corporations in tax revenue compared to other advanced countries. Advocates of raising corporate taxes argue that the U.S. collects less from corporations compared to its peers and that the U.S. has an unusually low effective taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate on corporate income. These claims tend to understate U.S. corporate tax collections compared to peer countries in the Organisation for Economic Co-operation and Development (OECD) and the effective tax rates faced by U.S. corporations.

There are several ways to measure U.S. tax collections and the tax burden. One way is to look at revenue collected from the corporate tax as a portion of U.S. GDP. Treasury Deputy Assistant Secretary Kimberly Clausing argues that corporate tax revenue relative to GDP fell from about 2 percent prior to the Tax Cuts and Jobs Act (TCJA) to 1 percent after enactment, which is below the OECD average of 3.1 percent in 2018 and 2019.

However, is it important to remember that the U.S. also has a large pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. sector, where tax collections show up in individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. revenue. Non-corporate business tax revenue made up about 10 percent of total taxes on income and capital gains in 2014, higher than the OECD average of 6.5 percent. This means that total U.S. business tax collections as a portion of GDP are higher than looking at U.S. corporate tax revenue in isolation.

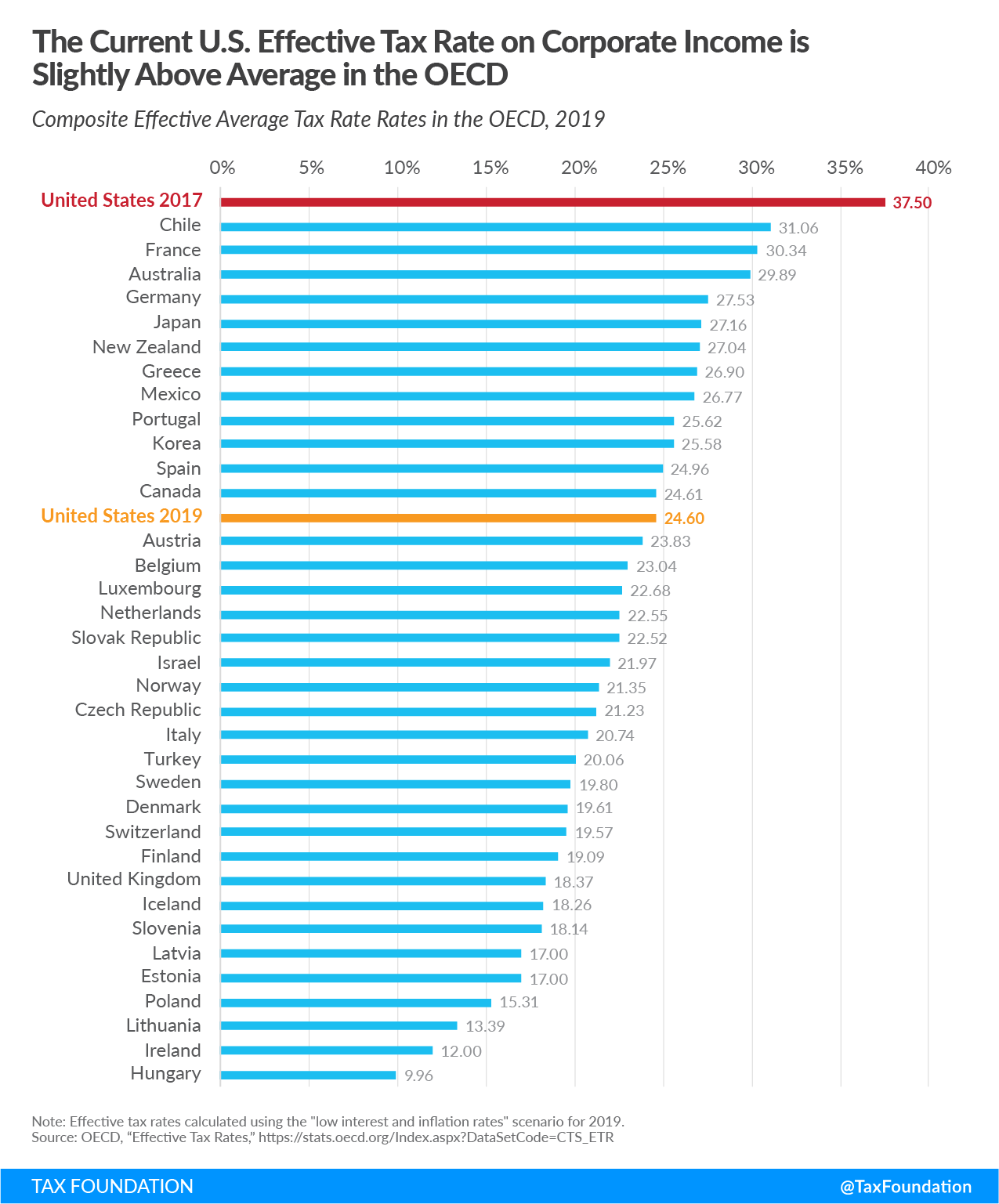

Another way of comparing the tax burden faced by corporations is to look at the effective average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. (EATR), which is a forward-looking indicator of the tax burden on a prospective investment made by a corporation, accounting for tax rates, depreciation, and other tax provisions.

According to the OECD, U.S. corporations faced an EATR of 24.6 percent in 2019, which ranks above the non-U.S. average of 21.9 percent and 13th highest out of 37 countries in the OECD. In 2017, prior to the TCJA, the U.S. EATR for corporate investment was the highest in the OECD at 37.5 percent.

Instead of calculating a hypothetical EATR, you could also measure average effective tax rates using data from the Bureau of Economic Analysis (BEA) on corporate tax collections. However, that data would need to be adjusted for the fact that BEA includes S corporation profits in its broader definition of corporate profits, but does not include taxes that S corporations pay in its corporate tax data. This tends to understate the effective tax rate faced by C corporations in the U.S.

When adjusting for S corporationAn S corporation is a business entity which elects to pass business income and losses through to its shareholders. The shareholders are then responsible for paying individual income taxes on this income. Unlike subchapter C corporations, an S corporation (S corp) is not subject to the corporate income tax (CIT). tax revenue, the average effective tax rate using BEA data rises from 20.5 percent to 26 percent in 2017. In 2018, after the TCJA was enacted, the average effective tax rate fell to 19.4 percent according to BEA data.

A third way to compare the tax burden on corporate investment is the marginal effective tax rate (METR). This is also a forward-looking measure of the how taxation increases the cost of an investment that returns just enough profit to break even in real terms. This is a helpful measure because it shows how corporate taxes impact investment incentives.

In 2019, according to the OECD, the U.S. had a composite METR of about 11.2 percent, above the non-U.S. OECD average of 7.2 percent and ranked 17th highest out of 37 countries. In 2017, the U.S. METR was among the top 10 in the OECD at 17.4 percent. Raising the corporate tax rate and imposing other taxes on corporate income would rank the U.S. as worse or greater than we stood in 2017, reducing investment incentives in the U.S.

Whether we use corporate tax collections as a portion of GDP, average effective tax rates, or marginal tax rates, each measure shows that the U.S. effective corporate tax burden is close to or above the average compared to its OECD peers. Raising corporate income taxes would put the U.S. at a competitive disadvantage, whether one looks at statutory tax rates or effective corporate tax rates.

Launch Resource Center: President Biden’s Tax Proposals

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe