American Rescue Plan Act of 2021 (ARPA)

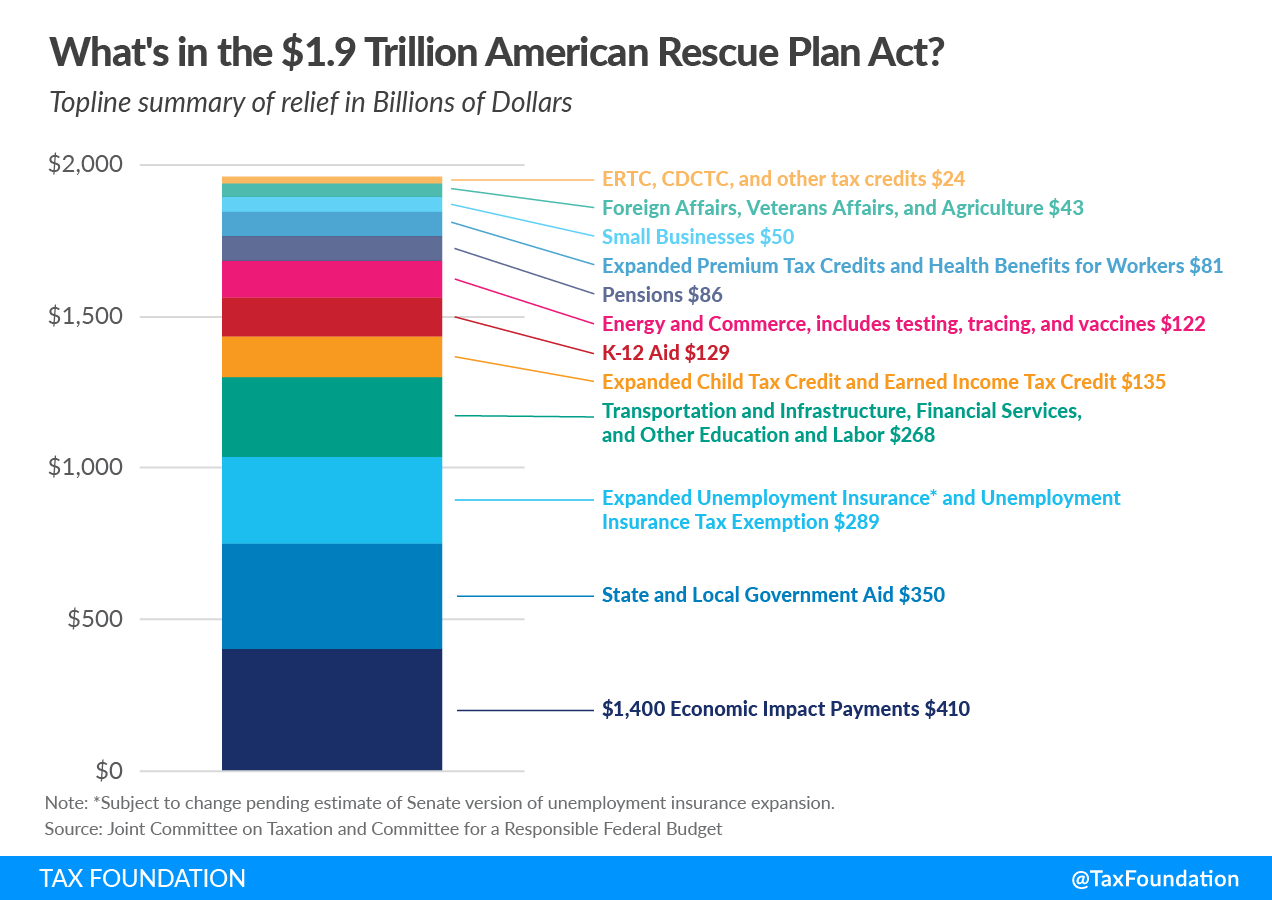

The United States has provided about $6 trillion in total economic relief to the American people during the coronavirus pandemic, including the $1.9 trillion that was approved when President Biden signed the American Rescue Plan Act (ARPA) into law on Thursday, amounting to about 27 percent of gross domestic product (GDP). Much of the economic relief in the American Rescue Plan is administered through the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code in the form of direct payments (stimulus checks) and expanded Child Tax Credit (CTC) in 2021. The size and method of relief will revive debates over the proper role of spending in the tax code and whether the temporary benefits should become permanent after the economy has recovered.

Policymakers will need to determine if the tax code is the proper vehicle to disburse such cash benefits and if the IRS can handle the additional responsibilities. Over the course of many years, the IRS has been tasked with an ever-growing list of administrative duties that go well beyond simple revenue collection—everything from poverty alleviation to education, housing, and health-care benefits. The American Rescue Plan, in addition to other pandemic response measures, would now require the IRS to administer additional benefits on a recurring monthly basis, much as a traditional spending agency, all while processing upwards of 160 million tax returns.

While several of the provisions in the American Rescue Plan are targeted toward the pandemic, like the extended unemployment insurance benefits, other aspects, like the expanded Child Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. , are unrelated and not well targeted toward the pandemic. Overall, about $850 billion is directed to individuals while about $65 billion is directed to businesses.

Most of the provisions are temporary expansions for 2021 to combat the pandemic. However, some policymakers are already considering making permanent several of the newly expanded benefits like the Child Tax Credit later this year, which would have a budgetary cost of well over $1 trillion over the next 10 years.

Below we provide more detail on the three major tax-related benefits in the American Rescue Plan: a third round of direct payments, extended unemployment insurance (UI) benefits and a $10,200 unemployment insurance income exemption for 2020, and an expansion of the Child Tax Credit.

$1,400 Stimulus Payments (Economic Impact Payments)

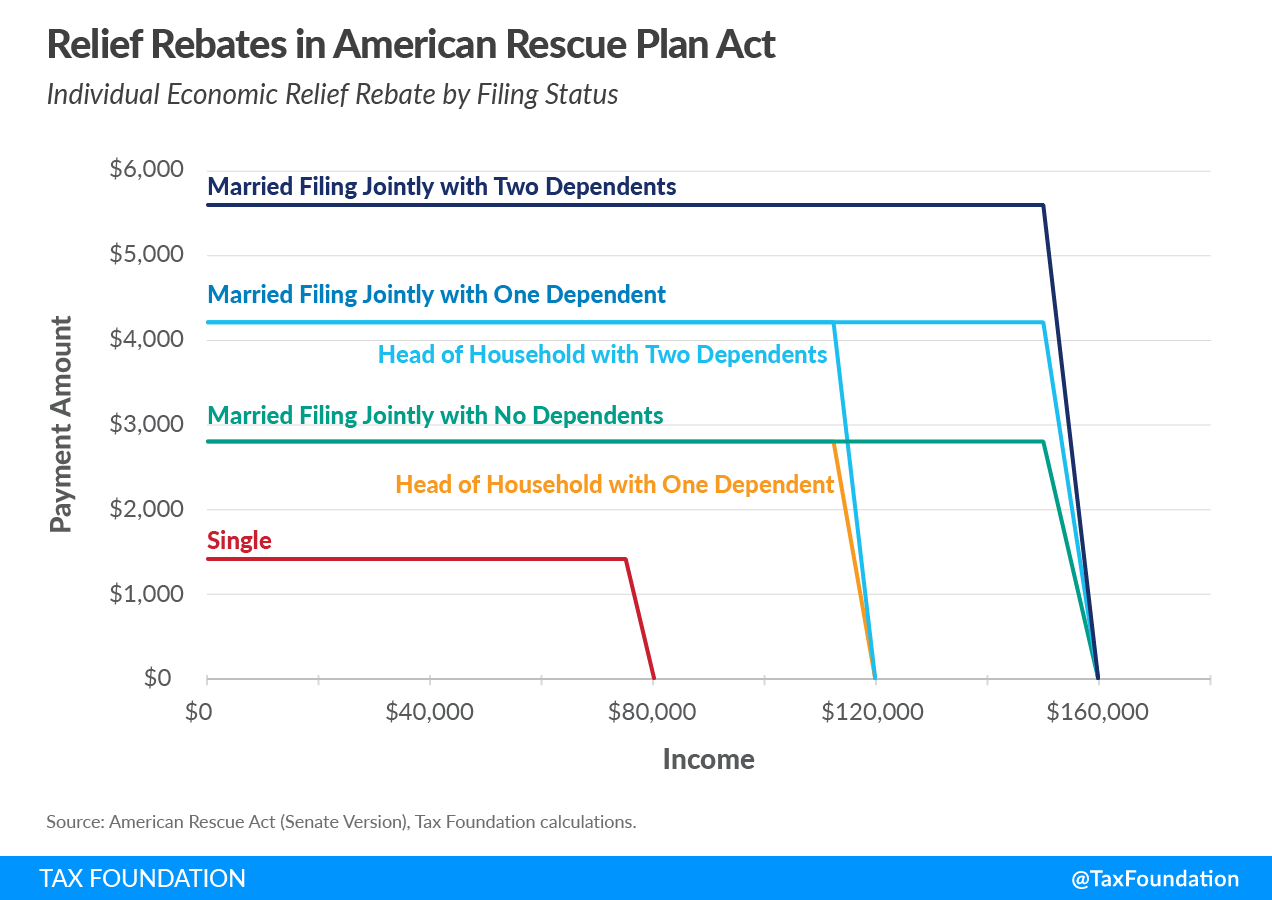

The American Rescue Plan Act provides a third round of stimulus payments up to $1,400 for adults and any dependent. Households with earnings of more than $80,000 for single filers, $120,000 for Head of Household filers, and $160,000 for married filing jointly will not receive any payment. The payments begin to phase out at $75,000 for single filers, $112,500 for Head of Household filers, and $150,000 for joint filers—meaning about 89 percent of filers will receive a payment (see Table 1).

The payment design creates steep phaseout rates for higher earners, which means they face high marginal tax rates and disincentives to work and could encourage filers to increase traditional retirement contributions in 2021 to reduce their AGI and receive an additional payment.

| Income level | Percent Change in After-Tax Income | Share of Filers with a Rebate | Average Rebate Amount |

|---|---|---|---|

| 0% to 20% | 24.70% | 100% | $2,172 |

| 20% to 40% | 10.81% | 100% | $2,537 |

| 40% to 60% | 6.41% | 100% | $2,431 |

| 60% to 80% | 4.21% | 99.5% | $2,611 |

| 80% to 90% | 1.97% | 74.5% | $1,792 |

| 90% to 95% | 0.40% | 25.0% | $509 |

| 95% to 99% | 0.01% | 1.6% | $17 |

| 99% to 100% | 0.00% | 0% | $0 |

| Total | 3.7% | 89.0% | $2,157 |

|

Source: Tax Foundation General Equilibrium Model, January 2021. |

|||

Unemployment Benefits

The American Rescue Plan also extends the three federal unemployment insurance expansions first created by the CARES Act through September 6, 2021. The American Rescue Plan increases the total number of weeks of benefits available to individuals who cannot return to work safely from 50 to 79, matching the expiration of the broader UI benefits.

The law maintains the federal supplement at its current level of $300 a week for weeks beginning after March 14 and before September 6, 2021. The American Rescue Plan provides 53 weeks of federal UI benefits after the state benefits end, up from 24 weeks.

The American Rescue Plan contains a new provision to exempt $10,200 of unemployment benefits received in 2020 from income taxes. The exclusion is retroactive, applying to unemployment insurance benefits received last year, largely to reduce the issue of surprise tax bills. It only applies to individuals with incomes below $150,000. The Joint Committee on Taxation (JCT) estimates the exemption will reduce federal revenue by $24.9 billion.

More than 45 million tax returns have already been filed with the IRS in the ongoing tax season, which is currently set to end on April 15. The last-minute exemption is bound to create confusion for taxpayers and puts additional pressure on the IRS to quickly provide instructions and guidance for those who have already filed their returns. Ideally, the exemption would have been made prior to the tax season’s commencement in mid-February to ensure a smoother tax season for the agency and taxpayers.

Expanded Child Tax Credit

Finally, the American Rescue Plan greatly expands the Child Tax Credit by allowing households with children to claim up to $3,600 for younger children or $3,000 for children age 6 or older regardless of earned income. While the CTC currently phases in with income and only $1,400 can be refunded to low-income households, the American Rescue Plan allows the full credit for low-income households, which raises marginal tax rates on these filers as they are no longer provided the credit as income rises. As such, it introduces a new disincentive to work for low-income earners, though the magnitude of the disincentive is disputed.

The expanded CTC would also be paid out monthly, which will be a major administrative challenge for the IRS. The agency must obtain projected incomes, filing statuses, and number of qualifying dependents for each eligible household to accurately advance the payments. While the Biden administration hopes to have this process ready by July, that may be an unrealistic timeline; it took the IRS two years to establish advance payments of the Affordable Care Act’s premium tax credits.

As the public health situation and the economy hopefully improve this spring and summer, policymakers will have an opportunity to evaluate the effectiveness and the costs of the expanded benefits in the American Rescue Plan and determine whether they should be allowed to expire or otherwise be reformed.

Related Resources

- COVID-19 Tax Resource Center

- American Rescue Plan Act Allocates $2 Billion to Nonexistent County Governments

- U.S. COVID-19 Relief Provided More Than $60,000 in Benefits to Many Unemployed Families

- American Rescue Plan Direct Payment Design and Marginal Tax Rates

- Making the Expanded Child Tax Credit Permanent Would Cost Nearly $1.6 Trillion

- Expanding Child Tax Credit as Monthly Payment for Pandemic Relief

- State & Local Aid Allocation in the American Rescue Plan

- Does the American Rescue Plan Ban State Tax Cuts?

- Which States Are Taxing Forgiven PPP Loans?

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe