New Mexico and the Question of Tax Competitiveness

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min readStay informed with quick and accessible analysis of today's top tax policy topics. Read Tax Foundation's Tax Policy Blog for insight from our experts on tax policies across the U.S. and abroad.

To find our most recent research papers and data, click the links below.

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

As Missouri legislators head into a special session, they should consider making a pro-growth change that the state is already so close to achieving: creating a flat income tax.

4 min read

The Inflation Reduction Act focused more on enforcement and hiring more auditors rather than programs that make it easier for taxpayers to comply with the code and the IRS to administer it.

6 min read

In a pattern that has become all too common in recent decades, the newly enacted Inflation Reduction Act (IRA) added yet another layer of complexity to an already complex and burdensome federal tax code.

9 min read

In response to high oil prices, Sen. Wyden has proposed raising taxes on oil and gas companies in three ways. His “Taxing Big Oil Profiteers Act” would create an additional 21 percent tax on so-called excess profits earned over 10 percent of revenues of oil companies with annual revenues over $1 billion; levy a tax on stock buybacks; and remove last-in, first-out (LIFO) tax treatment of inventory accounting.

7 min read

Arkansas recently became the 13th state to authorize an individual income tax rate reduction this year. This round of tax cuts accelerated reforms enacted eight months ago.

7 min read

The Inflation Reduction Act increases the IRS’s budget by roughly $80 billion over 10 years. The money is broken into four main categories—enforcement, operations support, business system modernization, and taxpayer services—as well as a few other small items such as an exploratory study on the potential of a free-file system.

6 min read

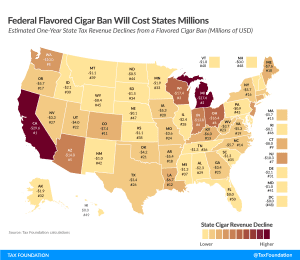

The FDA’s proposal to ban flavored cigars would carry significant revenue implications for many state governments.

7 min read

The Japanese tax and benefit system comes with trade-offs that policymakers must keep in mind when planning to reform the tax policy.

7 min read

The Inflation Reduction Act calls for a new 1 percent excise tax on stock buybacks, the argument being it would be better for the economy if firms invested their surplus cash in the business, rather than returning this value to shareholders.

3 min read

In dollar terms, the industries that would account for the largest book minimum tax liabilities are manufacturing, at $73.2 billion, followed by finance, insurance, and management at $46.9 billion.

6 min read

While exempting accelerated depreciation from the book minimum tax would reduce some of the economic harm of the tax, there remain many unresolved problems within the design and structure of the tax that make it a poorly chosen revenue option.

3 min read

In the rush to pass the Inflation Reduction Act, which features an ill-conceived tax on the book income of U.S. corporations, it is worth reminding policymakers of a well-established finding in the economic literature.

3 min read

The Inflation Reduction Act may be smaller than the proposed Build Back Better legislation from 2021, but both sets of legislation propose a reintroduced corporate alternative minimum tax (AMT). The 30-year experience with a corporate AMT shows it is not a good solution.

4 min read

While the tax and benefit system can be successful in keeping low-income working households out of poverty and encouraging workforce participation, high marginal tax rates like the one observed in the case of this Australian working parent act as barriers to upward mobility.

6 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. tax rules for large companies. However, as proposals have been debated in recent months, there are have been clear divides between U.S. proposals and the global minimum tax rules.

6 min read

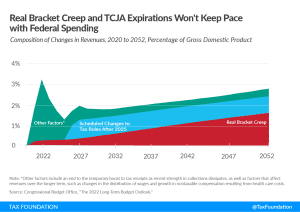

The latest CBO long-term budget outlook paints a troubling picture of fiscal irresponsibility. Rather than halt this rampant spending, Congress is actively adding programs that will exacerbate these long-term trends.

7 min read

Expediting income tax rate reductions and indexing major income tax provisions for inflation are two of the most important tax policy changes policymakers could make to provide meaningful tax relief to Hoosiers both now and in the years to come.

4 min read

Canadian workers could face up to two important marginal tax rate spikes and lose 60 percent of additional earnings to the provincial health-care premium.

4 min read

Some 40 years ago, the U.S. dealt with high inflation and slow economic growth. Then as now, the solution is a long-term focus on stronger economic growth and sustainable federal budgets.

5 min read