Three Questions on Pillar One

While the global minimum tax gets much attention in the media, there is another significant piece to the deal.

6 min readStay informed with quick and accessible analysis of today's top tax policy topics. Read Tax Foundation's Tax Policy Blog for insight from our experts on tax policies across the U.S. and abroad.

To find our most recent research papers and data, click the links below.

While the global minimum tax gets much attention in the media, there is another significant piece to the deal.

6 min read

Reshaping some of these policies to generate a smoother variation of marginal tax rates over different income levels would likely raise labor supply and encourage the upward mobility of workers and especially that of average-income workers.

5 min read

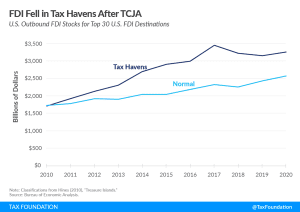

Academic research indicates foreign direct investment (FDI) is highly responsive to the corporate effective tax rate (ETRs); that is, the tax rate after accounting for all deduction and credits available to corporations.

3 min read

Policymakers from both parties in Harrisburg have proposed reducing Pennsylvania’s 9.99 percent corporate net income tax (CNIT) rate but could not agree on an approach—until now. With the enactment of HB 1342 lawmakers finally succeeded in cutting what had been the second highest state corporate tax rate in the nation.

7 min read

Idaho Ballot initiative would impose an incredibly high top marginal rate that would fall on many small businesses, not just high-income earners.

7 min read

High marginal tax rates can act as barriers to upward mobility, discouraging people from advancing in their careers.

5 min read

While the bulk of the proposed tax increases and spending programs remain under debate, Democratic lawmakers have reportedly agreed on prescription drug pricing provisions as a starting point for a revived Build Back Better package.

3 min read

As the Czech EU presidency considers a plan to manage various tax-related files, it would be wise to consider principled tax policy that broadens the tax base and reduces the tax wedge on strategic investment.

4 min read

Overall, the data shows outbound FDI shifted from low-tax to other jurisdictions, while inbound FDI remained largely unchanged.

3 min read

Gov. Stitt signed into law a pro-growth bill that will set the state apart from its peers. Other states should look to follow Oklahoma’s example and make full expensing permanent to maintain their competitiveness in an increasingly mobile economy.

3 min read

The proposals share a common goal of improving incentives for households to save during a time when inflation is impacting their finances.

3 min read

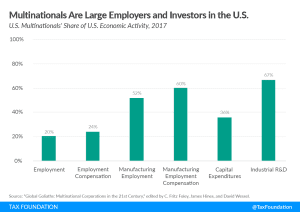

Although the dispersion of our supply chains throughout the world has been scrutinized in recent years, both inbound and outbound foreign direct investment are critical to sustaining supply chain resiliency and reducing economic risks for both firms and investors.

5 min read

As policymakers on both sides of the Atlantic debate the way forward on carbon border adjustment mechanisms, it is important to keep principles of good tax policy in mind.

7 min read

The French election results are paralyzing for French pro-growth tax reforms, pessimistic for EU own resources, and dire for overall economic certainty.

5 min read

The Biden administration has been supportive of the negotiations, but the changes should be reviewed in the context of recent policy changes in the U.S. and elsewhere, the general landscape of business taxation in the U.S., and potential challenges and risks arising from the global tax deal.

3 min read

Contrary to the Biden administration’s claims, raising taxes on cross-border investment would hurt U.S. economic growth and jobs. Research shows that FDI creates jobs in the U.S. and raises workers’ wages and productivity.

5 min read

Dr. Jorgenson’s work has been instrumental in convincing many in the tax policy community to take seriously the need to factor in the economic effects of taxation on capital formation, productivity, wages, and employment in forecasting the welfare and federal budget consequences of changes in tax policy.

4 min read

The United States needs to grow its way out of inflation and set the economy up for continued growth—the tax code provides tools for policymakers to do just that.

3 min read

President Biden’s budget proposes several new tax increases on high-income individuals and businesses, which combined with the Build Back Better plan would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

5 min read

The CBO projections show policymakers’ top priority over the next five years will need to be cleaning up our country’s fiscal situation while maintaining a pro-growth and competitive tax code.

5 min read